The statistical forecasting model says:

Next 6 Months: +11% (Flavors of the model vary from 7% to +15%)

Probability of at least breaking even: 82% (Flavors vary from 59% to 97%)

Don’t fight the Fed.

My several stock market models are in basic agreement that the Federal Reserve and U.S. Treasury are controlling the path of the stock market. Massive deficit spending from the U.S. Treasury and never-before-seen liquidity and low interest rates from the Fed have been keeping the economy and the stock market alive and will keep doing so for the foreseeable future.

By analogy, the economy has been totally reliant on life support for the past covid-dominated year. Without all the stimulus the patient would have died. In the best case, the stimulus will gradually taper off and the patient will emerge from Intensive Care to hear cheers from all of us.

Continuing the Intensive Care analogy, only about 20% of covid patients on ventilators survived. Unfortunately, there will probably be areas of the economy that will have lingering damage — commercial real estate being a likely casualty. I remain concerned that a side effect of the stimulus and ‘seeing the end of the covid tunnel’ will be a major stock market bubble that eventually pops. But, for the moment, the market is likely to continue to increase. The odds of the market at least breaking even over the next six months is about average. I expect increasing volatility over the summer months.

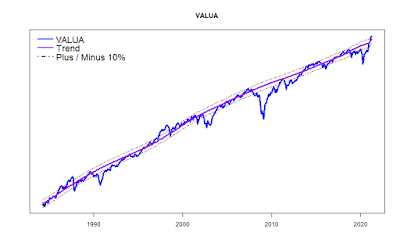

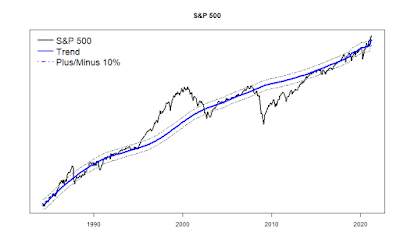

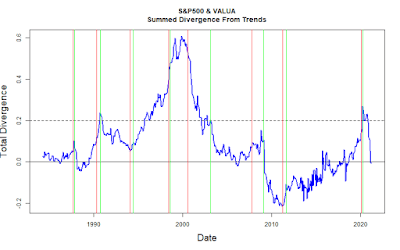

Tracking the Long Term Trend

Both the S&P 500 and the Value Line Arithmetic Average remain somewhat more than 10% above their long term trend lines. (Trend based on a model that factors in Real Potential GDP and interest rates.) Likewise the Morningstar.com Fair Market Value Graph estimates that stocks as a whole are about 10% above fair market value.

In normal markets this 10% overvalued level signals that the market is due for some sort of correction. Breaking much above this level will confirm a true market bubble. So far, we are seeing froth, but not yet a major bubble.

Something very unusual has been happening over the past few months: the boring mainstays of the economy have been leading the way. For most of the past year glamorous tech stocks (Apple, Google, Facebook, Netflix, Amazon, etc.) have been shooting up like rockets. Now, the rest of the market that is catching up.

Hi Tom, enjoy your monthly forecasts. Are you no longer submitting them any longer?Thanks, Dom

LikeLike

Any more models getting published to the blog in the future?

LikeLike

Going to continue posting in the future hopefully? 🙏

LikeLike