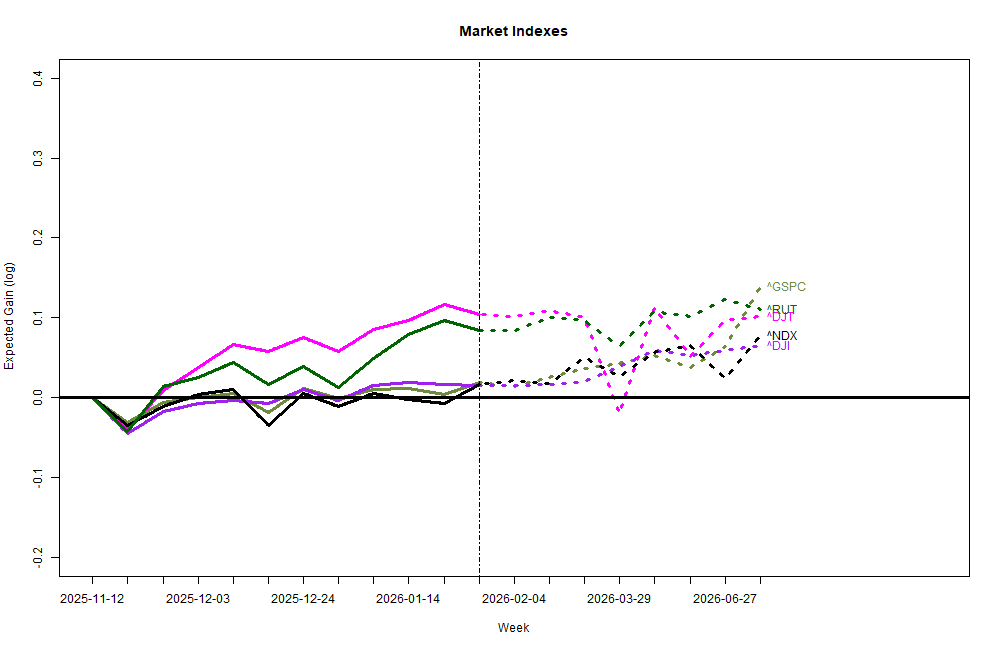

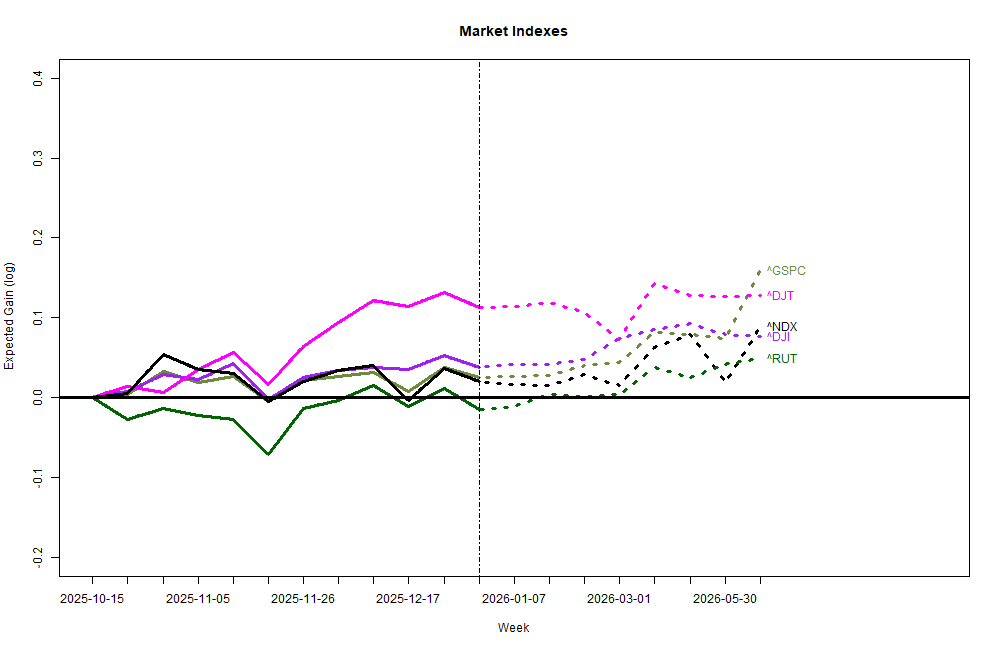

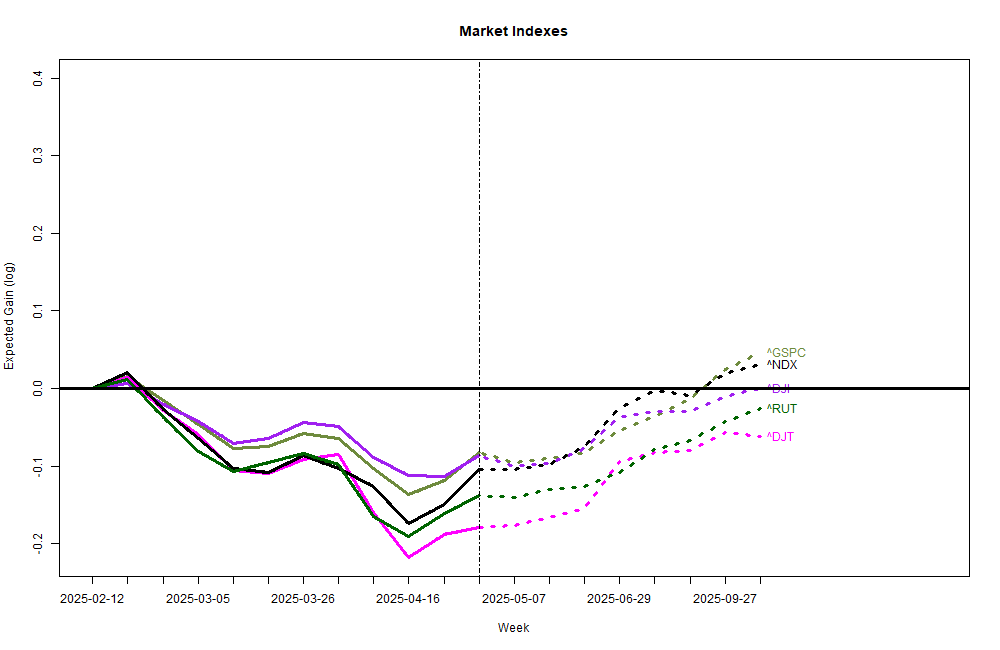

The stock forecasting models behind this blog continuously crunch and re-crunch numbers for a vast array of economic and business data, most of it going back decades. The data pays greatest attention to factors like GDP fluctuation, and severe financial market stress that have direct statistical correlation to stock market shifts (95% confidence as minimum). As I wrote the other day, the models have some worries, but overall they are not not highly concerned about US stock market performance for the coming half year.

Just because the models are not flashing dire warnings does not mean that the models are going to be correct. This time may, indeed, be different as it is not the usual assets that appear to be shedding value faster then a melting snow cone in July. The MAGA bubble may be is imploding. “Sell America” is a very real factor. This smells like a wiff of fear. It might be time to consider shelter. (Or maybe this is just a false alarm. After all, I am just a crazy prophet.)

I am less concerned by the early movie reviews of the Melania film than by the price charts of the Official Melania Meme Coin and the companion Trump MAGA Meme Coin . Melania debuted at nearly $8 but is now valued at $0.12, a collapse of about 98%. The MAGA coin has fared worse, fetching $15.56 on Memorial Day, 2024, and now selling for slightly under 4 cents. (-99%). Trump’s flagship enterprise, Trump Media (DJT), has lost 88% of its value from a high of $97.54 in 2022. It is now becoming a leader in nuclear fusion? Really? I mean, REALLY?

This just might fit a pattern. Like the numerous bankrupt Trump Atlantic City casino’s. (I remember when they would offer free bus rides and spending cash to geezers in Washington, DC just so they could maintain the fiction of high casino attendance.) And Trump University. Trump Vodka; he is a non-drinker. Trump Steaks. Those super gold leaf sport shoes! Trump Airlines; forgot that one. Trump Mortgage closed after 18 months. Go Trump, an online booking service, also failed after 18 months. Tour de Trump flopped in 2 years. And, of course, there was Trump Magazine a luxury lifestyle publication that died in 2009 after less than 2 years. The newly renamed Donald J. Trump, John F. Kennedy Center had attendance plummet instantly by approximately 50% as he made himself Chairman. Possibly to save face, the Center is scheduled to close for at least 2 years (the remainder of his second term in office). Ironically, the Kennedy Center closure begins on July 4, commemorating the 250th anniversary of the Republic.

To be fair, Trump certainly has had successes in real estate, golf courses, and with the TV show “The Apprentice”. He is a true Confidance Man, a promoter first-class. Even navigating his many failures, Donald Trump personally usually made money. It was his investors, creditors, and suppliers who went broke.

Today, the primary investors and creditors of Donald Trump are the citizens of the United States. To a real extent the rest of the world is stuck in the deal as well. With high spending deficits he is destroying the financial status of the Country. That is fact not opinion. He didn’t start it, but he did make it worse. With tariffs and provocations he has made if hard for many businesses to plan with any degree of certainty. Again, just fact. The overall economic numbers appear to show that a toll is being levied on the economy. (OK, that is still in the realm of opinion.)

One of the largest economic bubbles that may be ready to pop is cryptocurrency. Something that is only of value to criminals wanting to hide their booty. As of early February 2026, the total cryptocurrency market capitalization is approximately $2.24 trillion to $2.35 trillion. That is big enough to matter if it suddenly vanishes in smoke. Within this, Bitcoin constitutes about half of the market. Bitcoin rose gloriously as the “Crypto President” came into office, but now has lost nearly half of its value since last summer. The falling price chart looks like a falling knife. This is big enough to hurt the real economy.

Gold and silver have been rising exponentially in price. And may have peaked. Silver is a useful and wonderful metal, but it does not normally double in price in just half a year like it just did. The last time that happened was in the early 1980’s when a speculative fraud tried to capture the entire silver market. It didn’t end well.

Exploding commodity prices usually start with fearful investors looking for a safe haven, but then greedy investors pile on to catch the mojo. When fear and greed lead to flying prices, crashing prices often follow at some point. With little warning.

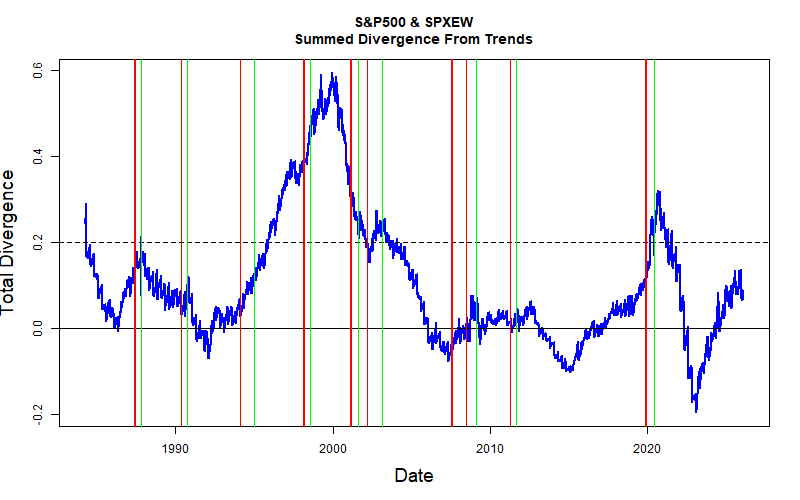

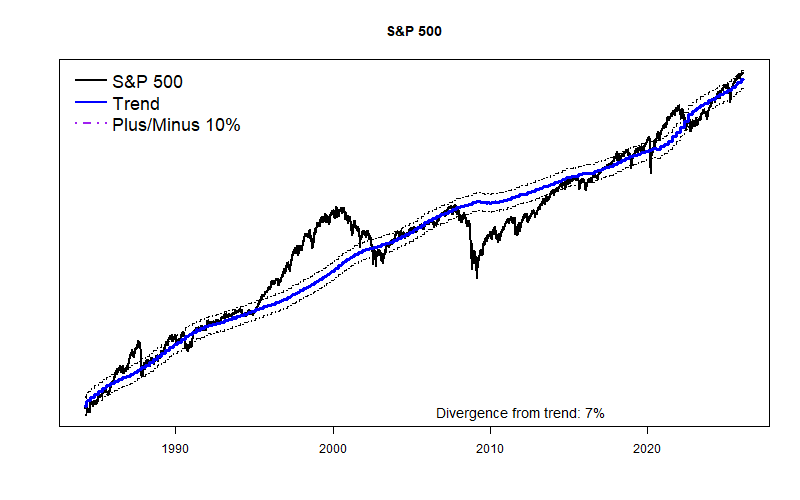

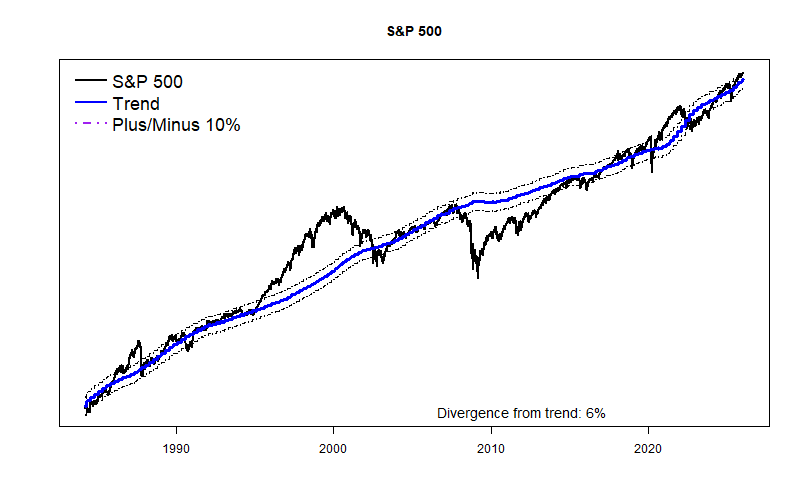

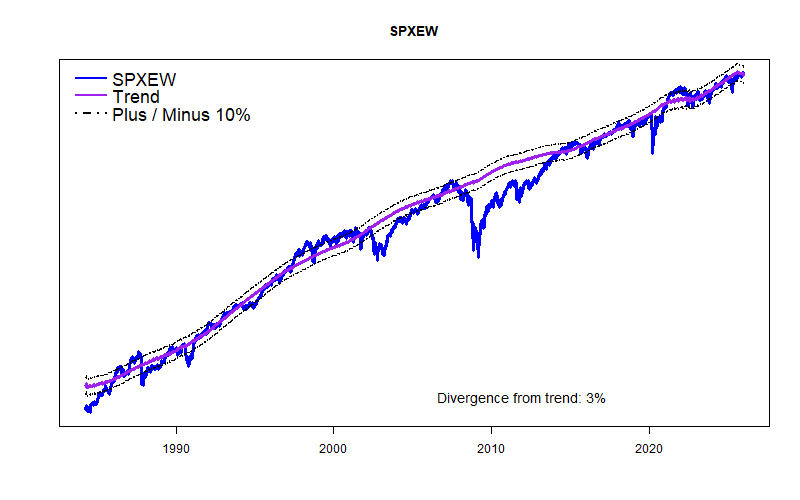

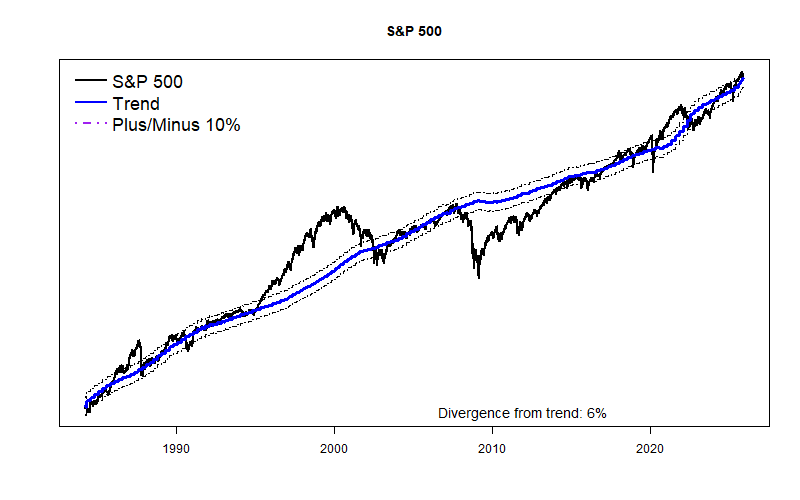

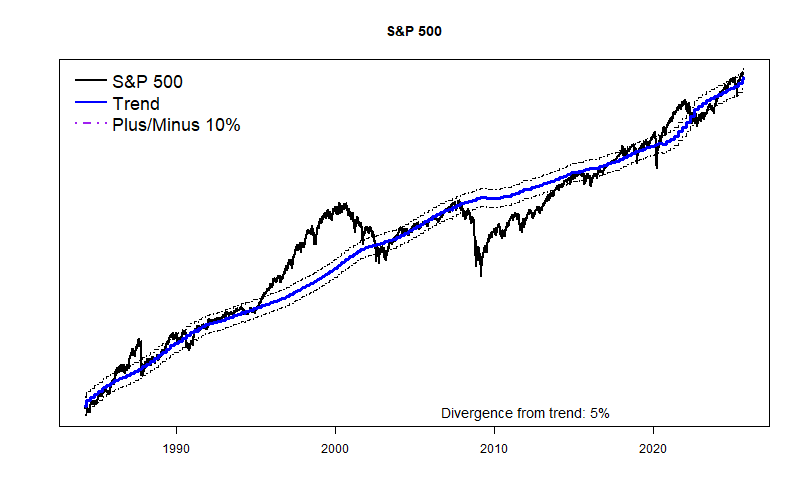

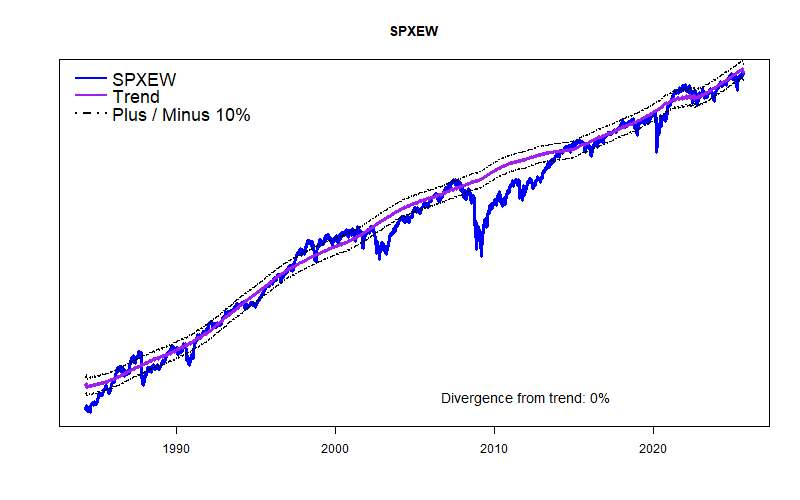

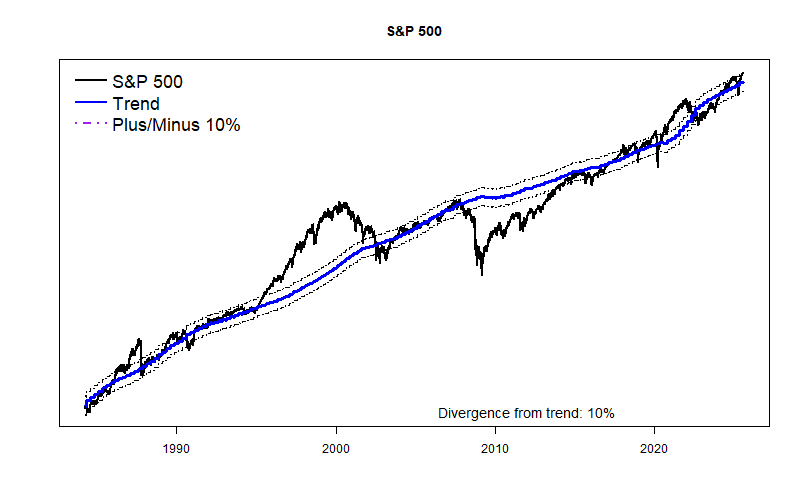

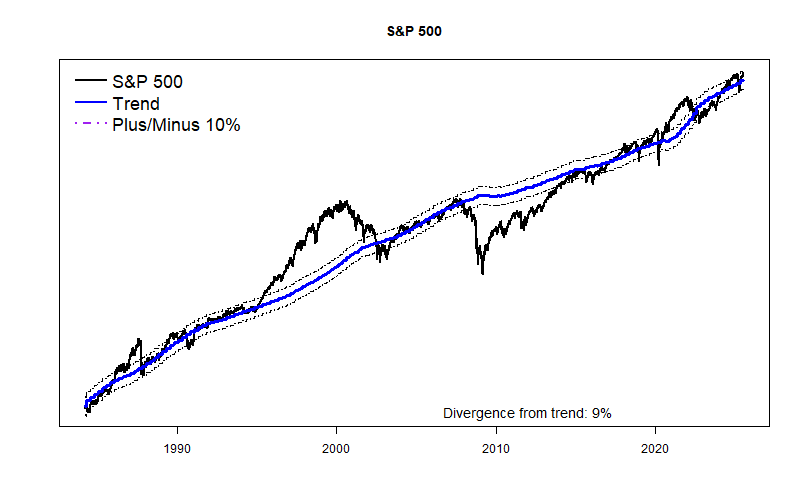

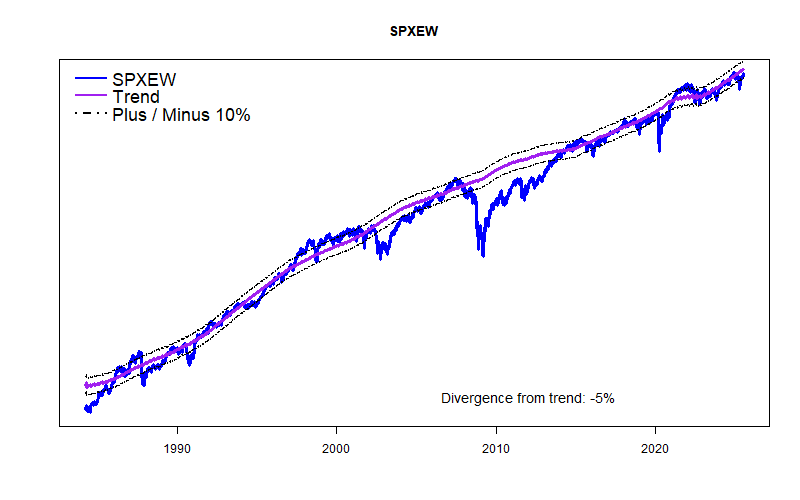

Stock market valuations are extremely high, perhaps dangerously high. Columnist Mark Hulbert regularly tracks various market valuation measures. His most recent post tracking 10 long-standing valuation measures points to a possible -5.4% yearly loss for the US market for the next decade. My own long-term trend line for the market (see last post) is much less dire, but it is clear that short term stock prices have much more room to fall than to rise.

A greater concern may be the overall “Sell America” sentiment. It makes the market ripe for panic. Foreign investment does not dominate Treasury Bonds, the stock market, private equity, or real estate. But, foreign ownership is critical in each market. If foreign owners suddenly walk away, panic is guaranteed. Donald Trump has clearly communicated to the rest of the world that: “WE DON’T LIKE YOU!” This is not the way most business owners work to entice new customers. There is just a chance that a few might take offense at the continuing stream of insults and threats.

It is hard to generate a stock market crash. It only happens once a decade or so. A huge number of hardened “buy and hold for ever” investors need to be convinced and get scared enough to actually panic and sell. As long as high deficit spending and massive AI infrastructure creation remain intact the overall U.S. economy will plod on. The key ‘tell’ of a coming recession is unemployment, the sole indicator the makes up the now-famous Sahm Rule . Current unemployment indicates that a near-term recession is unlikely.

But, new hiring, a major leading indicator is way down. The most recent new hires number from November was the lowest since 2011 as part of the Great Recession. Since most of Trump’s business ventures failed at about 18 months, it might be sensible to observe that the current presidential term is in month 13.

The situation appears primed for a sudden shock to cause an instant crash akin to the 1987 or 1998 panic attacks. I have no idea if or when that will actually happen. My number crunching still finds that improbable. Some small market tremors would be a blessing, a mildly painful but helpful inoculation of sorts.

It may be worthwhile to start to pay attention.