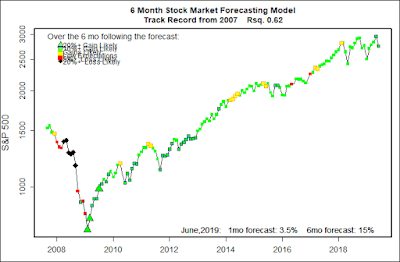

The statistical forecasting model says:

June, 2019: +3.5% (Outstanding.)

Next 6 Months: +15% (Very high!)

Probability of at least breaking even: (Excellent . 97% – 98%)

What am I doing? Fully invested since spring 2009.

I guess it’s put up or shut up time for my forecasting models. There is not much I can write to hedge or try to obscure what their calculations conclude.

Lots of scary financial / economic /political news. Not much positive sounding news. The models don’t seem to care. They look at other stuff, and still can’t read internet news stories.

There was a big stock market drop last month. Interest rates have inverted (short term interest rates are lower than long term rates). Usually that means a recession is in the cards sooner or later. The federal deficit (remember when that used to be big news?), well, it is growing faster than when the Obama stimulus plan kicked in to provide emergency economic relief. I can’t keep track of all the trade wars the President has started, or seems to want to start. Brexit seems more certain, whatever that means. Home sales are down — always a bad sign. The President seems to be sinking deeper and deeper into his swamp. The list of bad omens seems pretty long at the moment.

But, my forecasting models — all my current flavors — are incredibly optimistic. They appear to be shouting: Yippee! The one month predictive model points to a 3.5% gain, which for that model is very high. The models dealing with probability of at least breaking even see winning over the next 6 months as a near-sure thing (around 97%) The 6 month models are uniformly expecting gains of around 15% — again, that is very high for them.

So, the models aren’t hedging their forecasts.

All I know for sure is that for the past 11 years the models have a much better track record than my gut feelings. I am just staying fully invested to see how this plays out.

Time will tell.

Stocks June thru November, 2019: Really Great?

(Click on image to enlarge.)

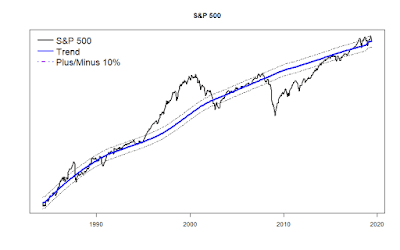

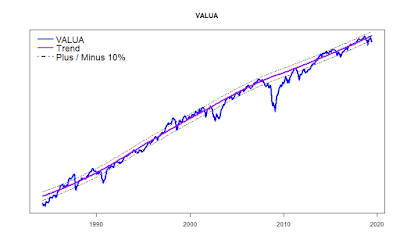

The Long Term Picture

The Value Line Arithmetic Average (VALUA) is slightly worse than 10% below its long term trend line. The S&P 500 is right at the long term trend line. Combined, these say to me that there is room for the market to jump back up 10%. The market could certainly fall or do whatever it wants. But, the net long term pressure to revert to the mean points upward.

(Click on image to enlarge.)

(Click on image to enlarge.)

Hi Tom,Thank you for sharing your posts over the years. Do you have some thoughts you would be willing to share on how you would react in the event your models forecast a large correction/downturn – would you move to cash or bonds and just look to preserve capital or would you try and profit off of the downturn? On the other side would you look for particularly beaten down or historically good areas to reinvest in once the models indicate close to bottom or would you simply go back in to the broader market?I assume you’ve got a strategy at least roughly in place but didn’t see any posts so was curious for anything you’d like to share. Kind regards,Tom

LikeLike

Hi TomW,Sorry for the slow reply — I don't check this email address very often.When the models eventually go negative, I expect a gradual process over several months. First, they will forecast 3%-8% six month losses, then, say, 5%-10% drops, then eventually 15% to 20% collapses. The market might well even keep going up for the first few warning months.Given the development of that sort of warning, I expect to react in kind — I will ignore the minor initial warnings. (So far the models have erred by warning too early rather than too late.) Then, as the warnings escalate, I'll start to head to safety. If the models really start to scream I may even do some shorting. That is my current hypothetical expectation.I think it is actually much safer to get aggressive AFTER a market crash. If stocks are down, say, 40% and the models have turned strongly positive, I expect to get forceful, perhaps with leveraged ETF's. But, this remains to be seen.I really don't know much about sectors or individual stocks — I'm having a hard enough time just trying to understand the overall market. :o)I am glad to say what I am doing for my own investing. But, I cannot give investing advice. I am not a qualified investment advisor, and I have no idea what will be your particular best course of action.Thanks for reading!TomT

LikeLike