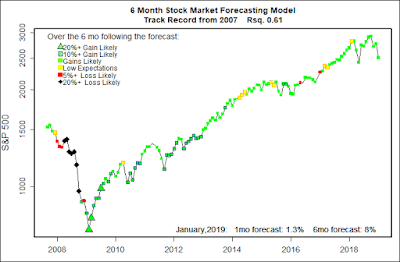

The statistical forecasting model says:

January, 2019: +1.3% (Above average)

Next 6 Months: 8% (Significantly above average)

Probability of at least breaking even: Well above average

Investors around the world are scared going into 2019. The market declines over the third quarter of 2018 were fast, prolonged, and sharp. The great big negative facing the stock market is obvious: the Federal Reserve moves to raise interest rates are starting to slow the economy. The real economy will probably get somewhat worse before it gets better. The spread in long term versus short term interest rates has become miniscule. If short term rates rise above long term rates a significant recession is almost guaranteed. There is good reason to be worried.

My forecasting model sees things differently. The model polls a group of economic indicators that have track records of a half century or more of pointing to the moves of U.S. stock markets in the coming half year. Together they estimate what the market is most likely to do based upon what the market has done in similar situations over the last several decades.

After a sharp decline such as we have experienced, the model expects the market to recover some. Whether it goes on to set new records is another question, but the model says the market is probably not in the midst of a major market crash. However, other than some degree of rebound, the statistical model does not spy the makings of a major new bull market.

A boring 2019 would be wonderful, but more likely we will experience a lot of volatility.

Happy New Year to both of my readers :o)

This comment has been removed by a blog administrator.

LikeLike