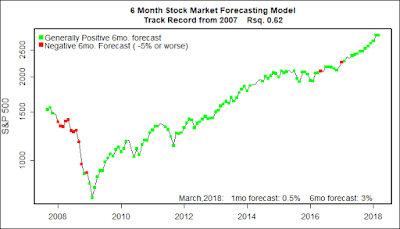

One Month Stock Market Forecast March, 2018: 0.5% gain ( near average)

6 Month Stock Market Forecast March thru August, 2018: 3% (a little below average)

Probability of at least Breaking Even: 0.43 to 0.92 (above average, but a wide range)

What am I doing? Staying fully invested, but realizing stock melt-ups end.

(Click on image to enlarge.)

January and February marked the return of volatility to the U.S. stock market. January was incredibly good, and February had a nasty market correction with a sharp recovery in the later part of the month — none the less resulting in a loss of about 4% for the month. Right now the stock market is pretty close to where it was as at the end of last December.

According to my models, the U.S. stock market has performed somewhat better than expected — exuberance and optimism have dominated action spurred on by real world expectations of high corporate profits stemming from huge cuts in tax rates, and massive increases planned for federal deficit spending. It is quite an economic party. Might as well enjoy it. My personal guess is that it will run another year or two, probably blooming into a true bubble.

(The rest of this post is boring. Feel free to ignore it. It is just rant and opinion rather than proven math. Have a nice month.)

We all know that eventually reality will settle in to stock market prices. This stock market party is going to end — abruptly. Most all widely accepted metrics say the market is over priced. The Federal Reserve will raise interest rates enough to bring the party to a close. (It usually takes about a 3% rise in interest rates. The increase has to be swift.)

As it is supposed to, the Federal Reserve, in time, will “take away the punch bowl” from the party. There will be a classic rush to the exits. All of the Greater Fools will end up in the drunk tank.

Currently, the Fed continues to raise interest rates very very slowly. Unusually slowly. It is a bit like the Fed Directors are saying: “Don’t worry. We are just raising the price of the punch a bit. This party is really great and we aren’t trying to shut it down.”

The big question for me is not whether a stock market crash is coming in the next couple of years. A crash WILL come. Crash is what stock markets have done for hundreds of years. Every time.

The big question for me (and, no doubt, all three of my loyal readers) is whether my econometric models will have any success in predicting when the party will end with a crash? Have the new factors of massive tax cuts and huge spending increases changed the rules? Are we in a truly new situation that defies forecasting?

I think the models will hold up pretty well.

The essence of any stock market crash is getting enough people really, really, scared of a market Armageddon — at the same time. It takes months and months for fear to accumulate to a terrifying level for enough people. Until then, smaller groups of investors will have bouts of temporary jitters. Particular market sectors will go through trauma resulting in increased overall volatility for the market.

Counter intuitively, each time the overall stock market survives a shot of volatility, it builds faith in the investing public that the stock market can survive the next round of volatility. Faith in “market momentum” is what ruins most investors during a market crash. First, they hold on for dear life during a downturn believing that the market will quickly recover. Then, after capitulating and selling all their stock, they believe that momentum will keep sending the market lower and lower. They are losers who buy high and sell low. Believing in market “momentum” is a very dangerous thing — and the bogus basis of the astrology-like art of “Technical Analysis.”

My models have nothing to do with so-called market momentum. They are all about a handful of economic statistics that have shown themselves for decades to lead the stock market by about 6 months. Looked at closely, most have a high degree of “emotionality” — the forces that drive these measures can change dramatically in a short period of time. They say a lot about the people who developed them and who compile and adjust them. In one way or another, the majority of the indicators I use are influenced by the emotions of a reasonably large number of people.

So, I think the models will be OK. We’ll all see in a year or two.

Thanks Tom,I, and I'm sure many others, enjoy and appreciate your monthly forecasts.

LikeLike

Thanks!

LikeLike