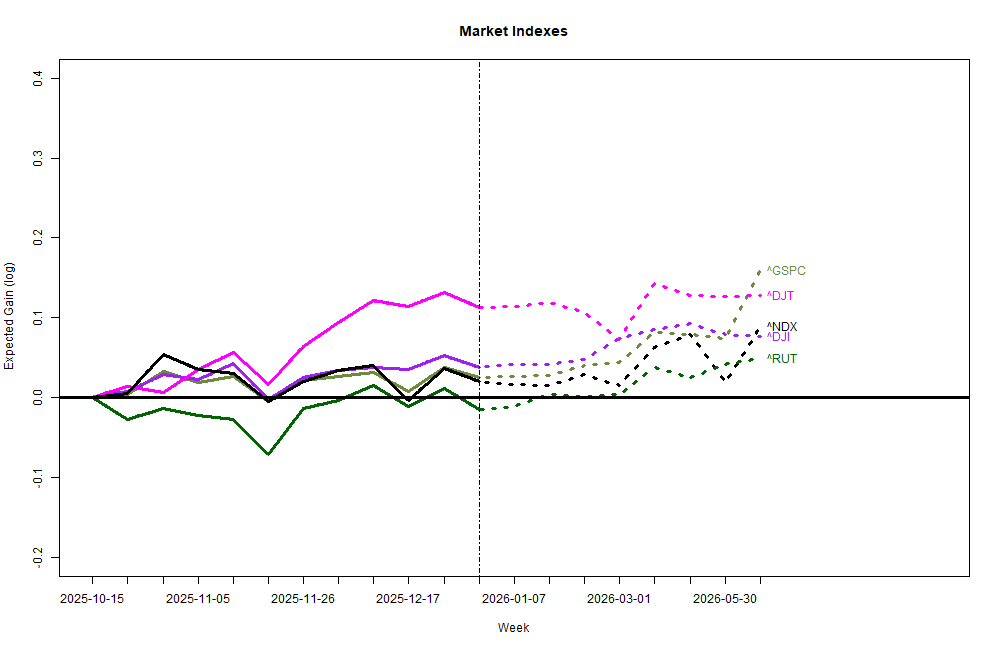

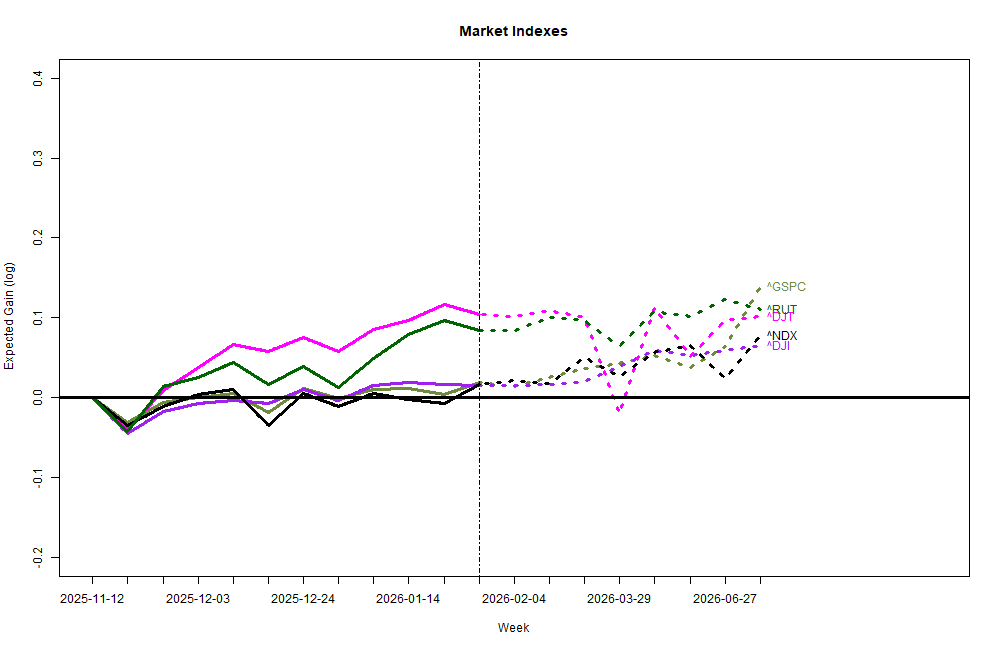

Both my long-running and more current data-intensive stock market models are positive, but unenthusiastic about the U.S. stock market for the coming 6 months. Last month the models expected the stock market to twitch around, but not rise much. And that is what happened. Sometimes these models actually are right.

Goling forward, the models expect flat behavior this month as well, followed by small gains over the next few months. For reasons I have not figured out, the current models see market jitters next month or in April.

Viewed from 30,000 feet, the market should be zooming up. Government deficit spending remains high, continuing to juice up GDP. The Trump tariffs have had a slight reduction in the federal deficit, but continuation of the Trump tax cuts and the addition of more give-aways have more than made up the difference. The AI infrastructure build out (software and hardware) continues as a historic spending stmulant.

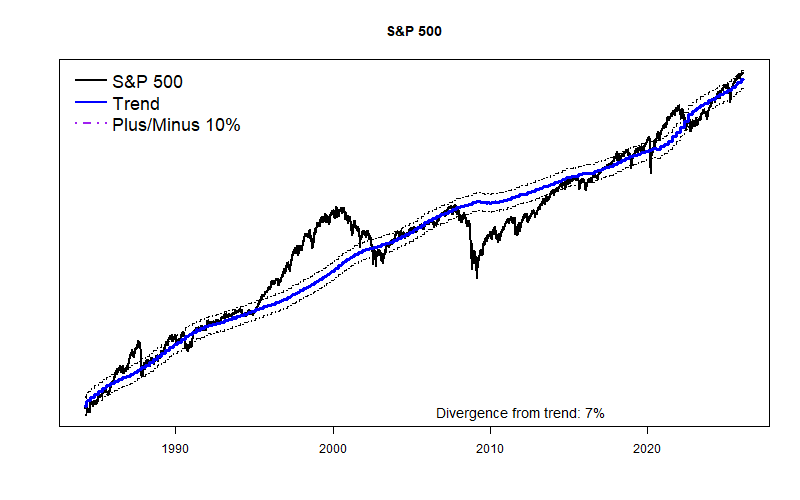

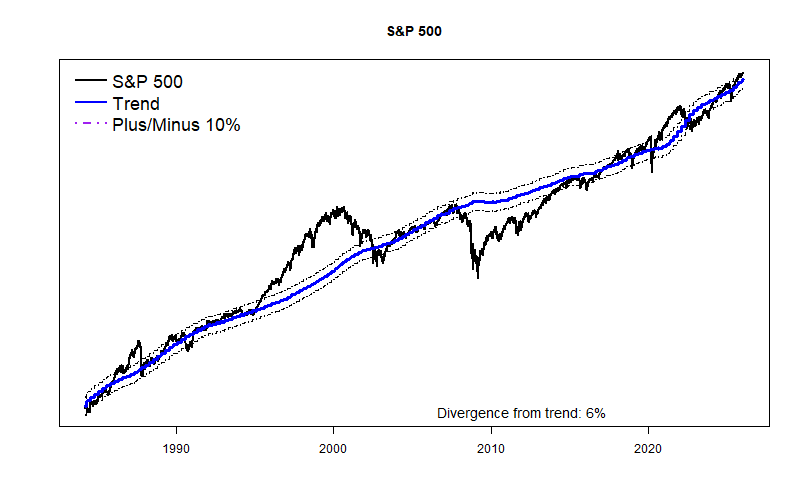

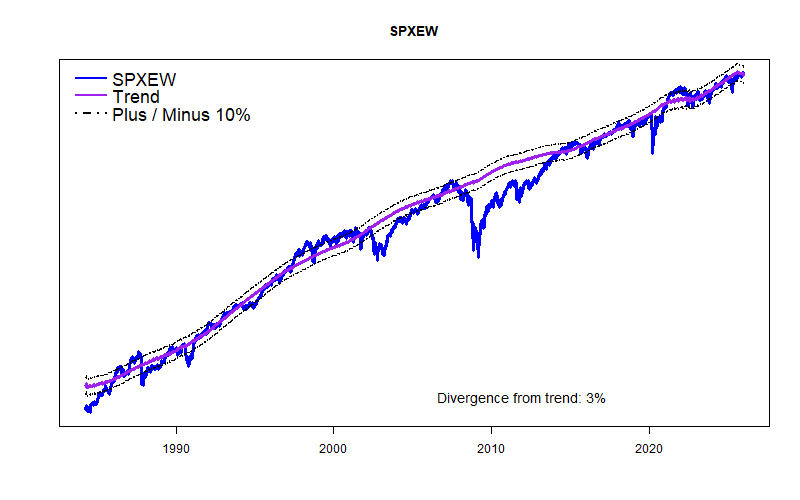

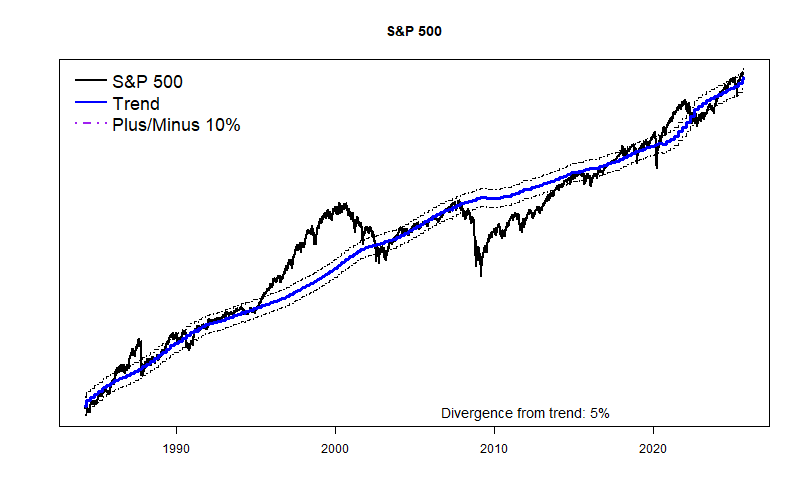

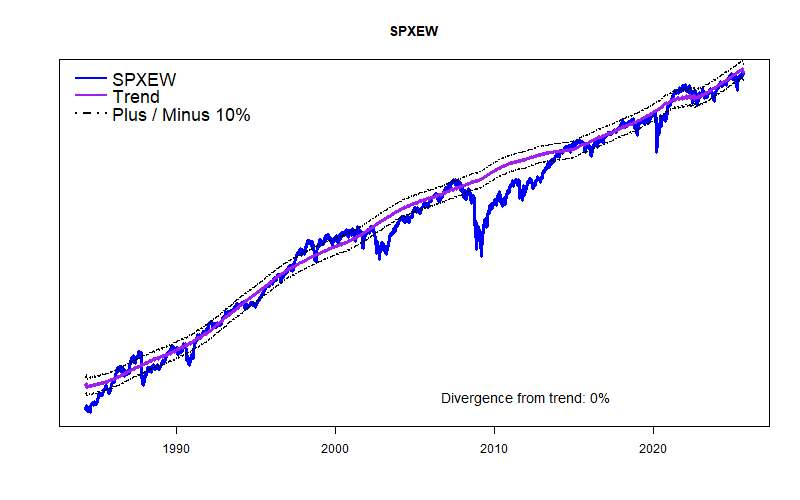

The stock market, however, seems to be discounting the spending bonanza. My graph of the long term GDP-based trend of the S&P 500 shows it to be about 7% above trend which is not a big deal. The equal-weight version of the S&P 500 is running an anemic 1% below trend. If the overall economy was really healthy we would have seen a true boom/bubble. This looks more like a hospital patient being kept alive with heroic medical care, and held in a coma by heavy drugs.

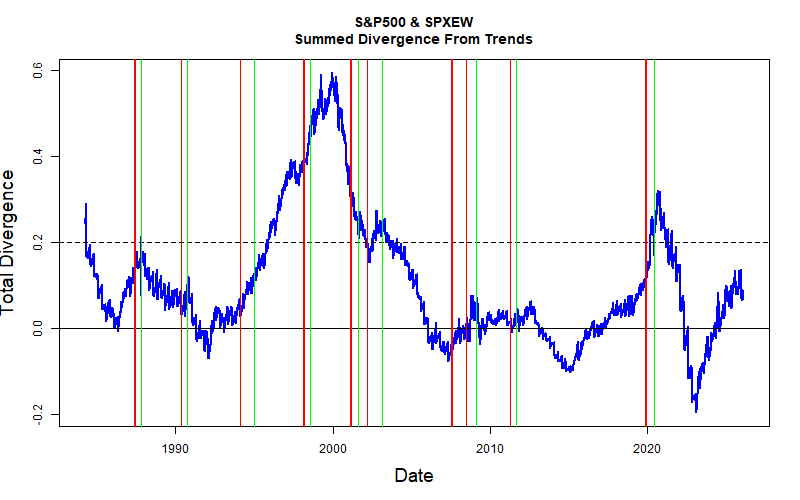

Consumer spending continues to climb — but, most spending growth has come from the very wealthy, not the broader population. Unemployment is not terribly high at 4.4%, but the graph has a concerning upward slope and most recent employment has come in the low-paid health care industry. Corporate profits remain acceptable. Money supply is increasing at a moderate pace. Last year’s surge of the Magnificent Seven appears to be waning. The high relative growth of the S&P 500 versus it’s equal-weight version appears to have slowed-down and may be topping.

Could be worse, I guess. Another queasy market month would be fine, I guess.