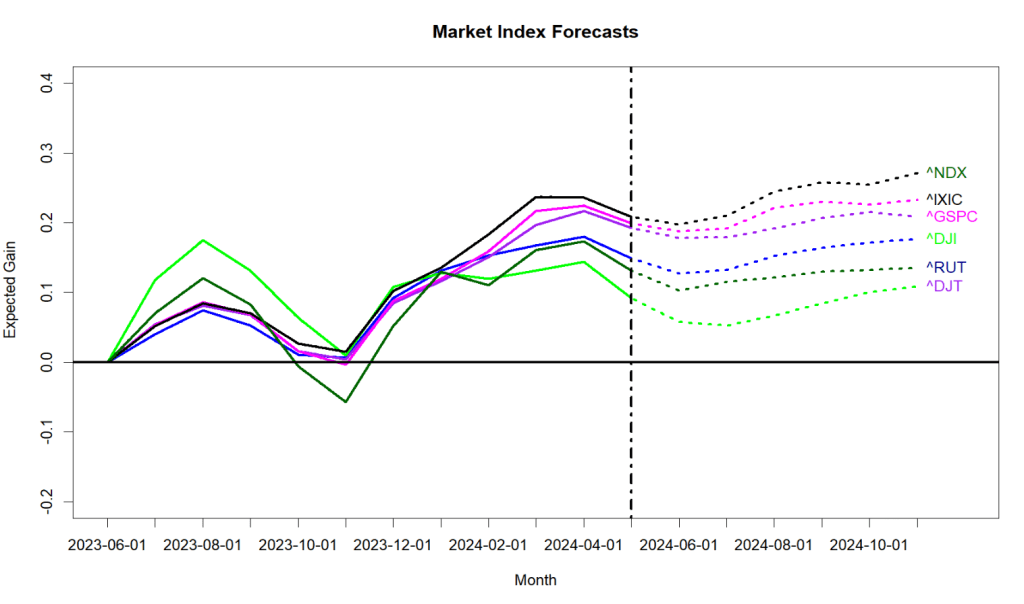

My models for various US stock market indexes are surprisingly positive for the first half of 2025: flat to negative for January, but then generally rising over the next 6 months. The forecast for the NASDAQ 100 ( ^NDX) is strong. My older monthly-based models for the S&P 500 and the ValueLine Arithmetic Average are not as encouraging, just flat for the coming half year.

The models reflect a strong macroeconomic picture. Gross Domestic Product is robust, running about 2% above the Real Potential GDP model maintained by the Congressional Budget Office. Inflation for consumers and industrial commodities is down, so the Federal Reserve has shifted from trying to restrain the economy to a more neutral stance. Interest rates are high-ish compared to the past half-decade, but rates are modest compared to the past half-century. Crucially, long-term interest rates have finally climbed above short-term rates; that is a good thing as it gives the financial sector room to breathe. Money supply if easing a bit; that’s always nice. Corporate profits remain strong. Several indicators say prospects for a near-term recession are minimal. Unemployment at 4.1% has crept up slightly, but is historically good. We are on the leading edge of major technological change through Artificial Intelligence, and already there are huge new capital investments underway with prospects for more to come. The stock market has scored up the best two-year returns since 1998! What’s not to like?

Unfortunately there are three problems that eventually will slam the stock market. The only real question is: When?

First, the US economy is only glowing brightly because of huge and unsustainable federal government budget deficits, not mainly through real intrinsic growth. Second, even if the economy was not propped up unrealistically, the market is still way over-priced by nearly all traditional valuation measures. Third, all other industrialized countries are going through the same process of cutting covid-related government deficits. Already, the parliaments of Germany, France and South Korea have fallen because there were no agreements on budgets going forward. Bond markets are starting to worry.

And, it is totally unclear what the U.S. Congress is going to do about the budget this spring. Will the deficit shrink or will it explode in size? Unknown. Aside from that, everything is great, and it doesn’t seem like the world is ready to explode this month.

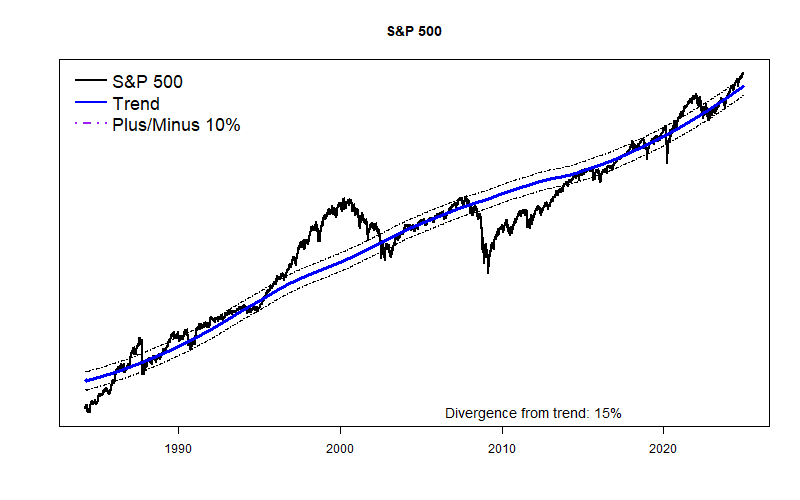

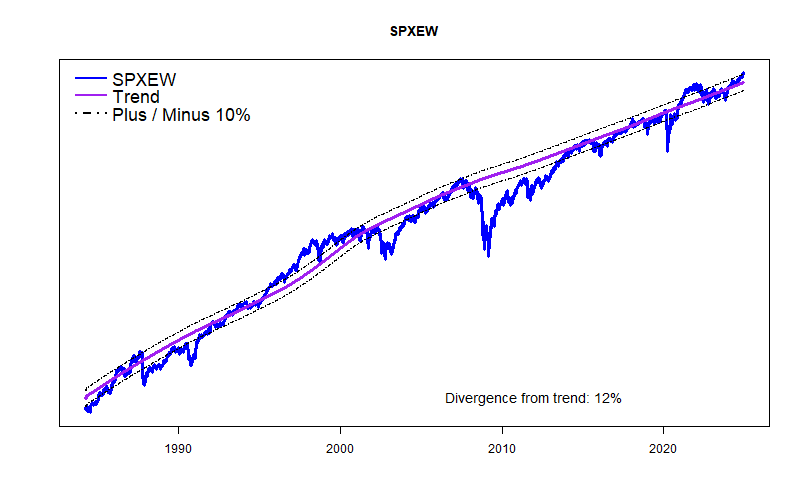

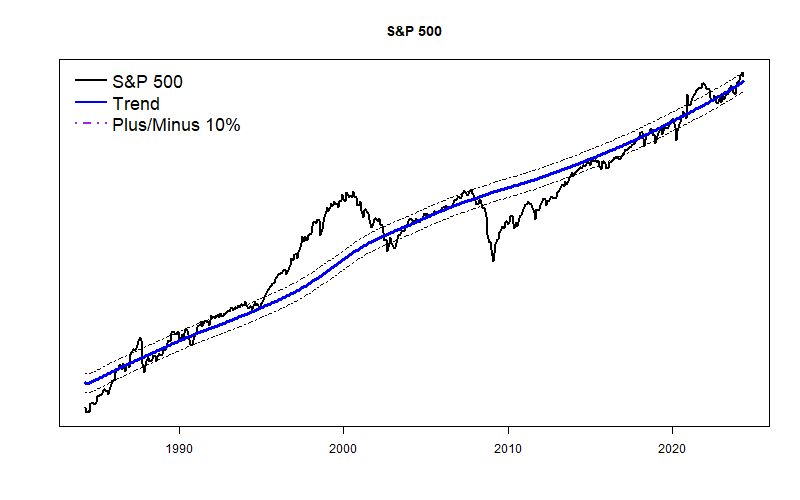

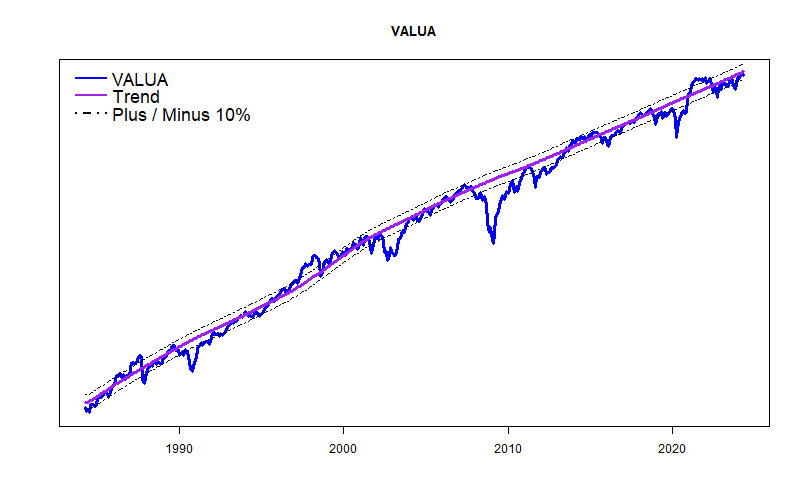

I recalibrated my long-term trendlines for the S&P 500 and the Equal Weight S&P 500. The recalibration better recognizes the impacts of inflation on the market. The modified trendlines have a slightly better fit with the past 4 decades of market behavior. The good news is that according to the new trend lines the S&P 500 is somewhat nearer to trend and the Equal Weight S&P 500 is actually slightly below trend.

Happy New Year!