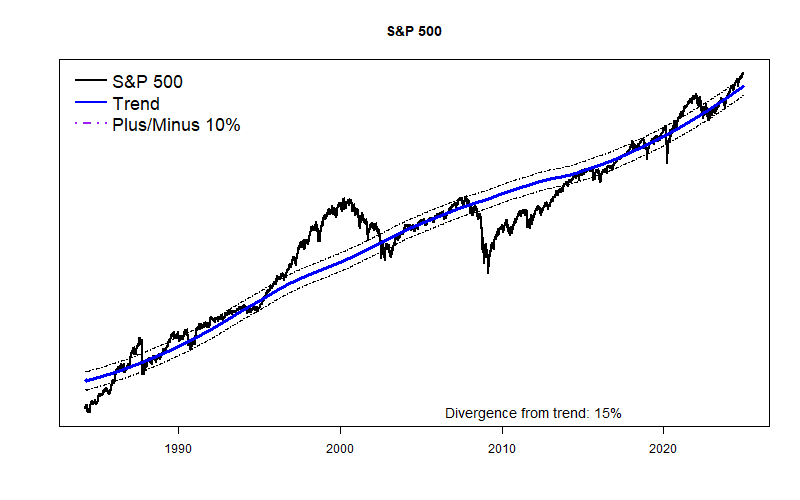

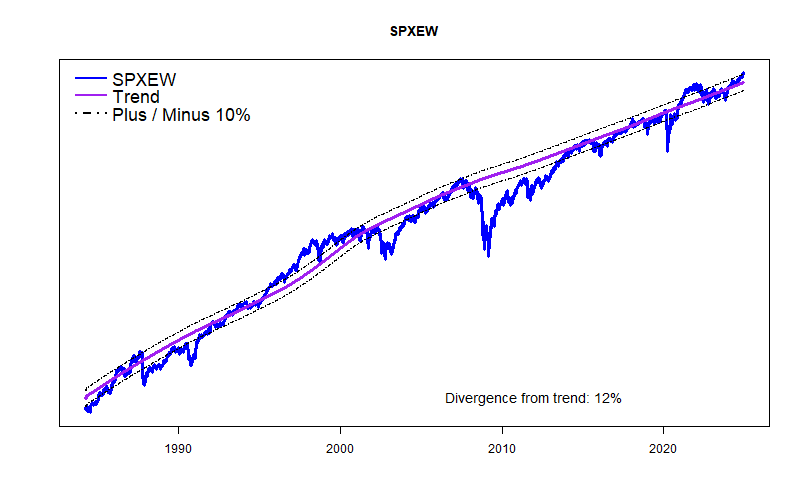

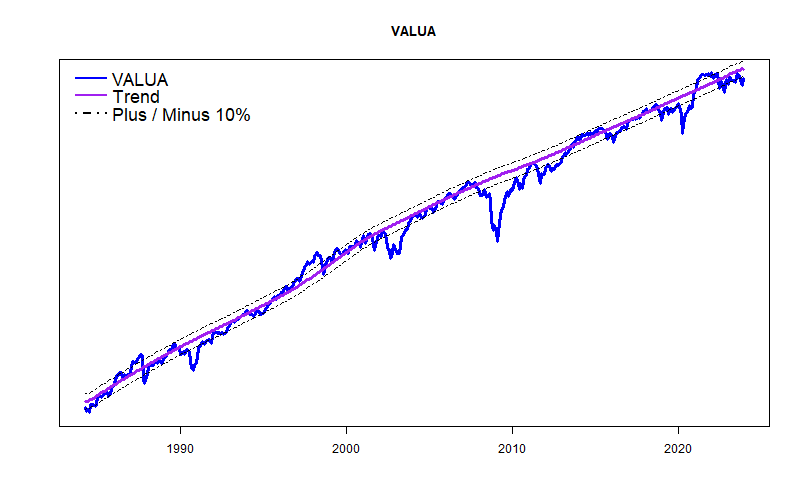

My forecasting models have started to twitch nervously, even though they still cannot read the newspaper. Overall, the models look at a significant array of economic data and conclude that the corporate economic environment is really pretty good. GDP is above trend. Profits are wonderful. The Federal Reserve is tightening less and less. Chances for a recession very soon are miniscule. All good. Unfortunately, stock prices generally are way above normal — historically above normal. Sooner or later something is going to break, with the question being: When? The exact “Why?” may be becoming clear.

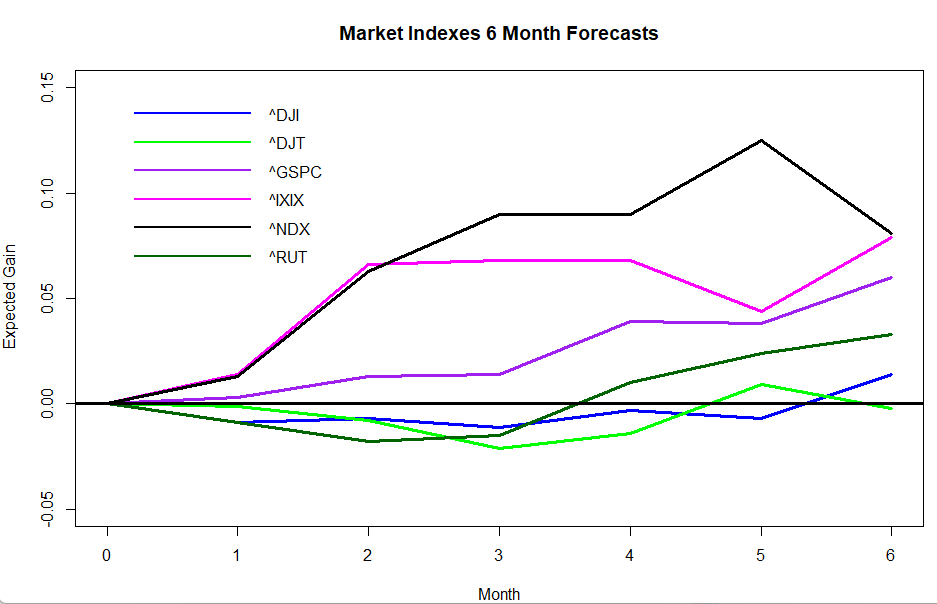

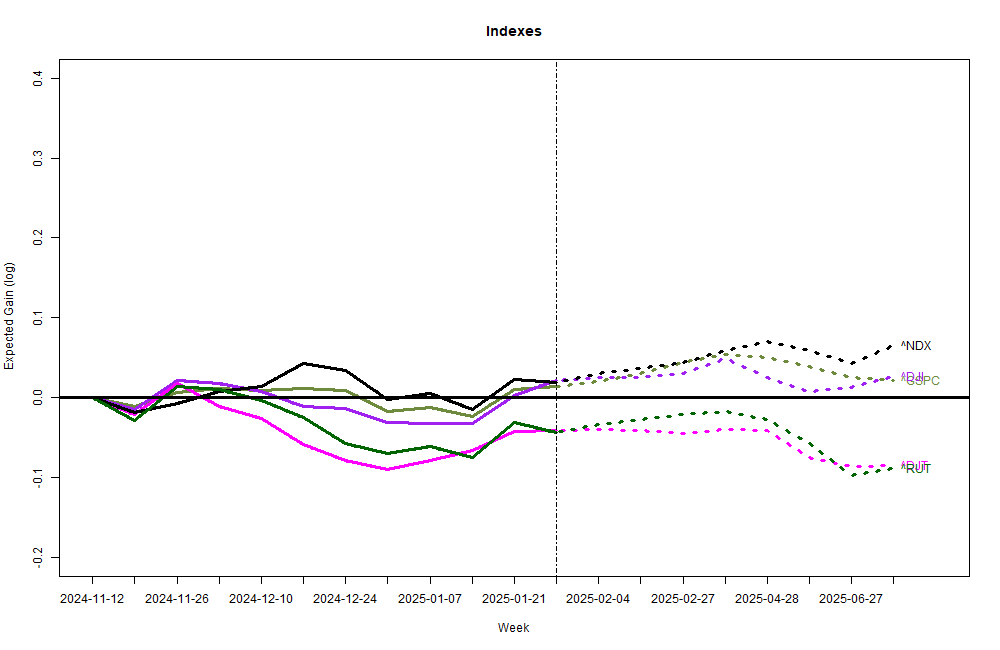

My older econometric forecast formulas (followed since 2007, R.sq ~ 0.5) are turning somewhat pessimistic for the coming half year with an expected SP500 loss of roughly 4%. The 6-month probability of loss is slightly higher than the probability of gain. The newer forecasts (graph above) are based on much more data and “should” be more accurate. Just like last month, the newer forecasting models are a bit more positive than my older models with the SP500 gaining a bit for the next two months, but then falling so that the index is essentially flat by the end of July. Both sets of models are starting to fret a bit about late spring.

In my view, the new Trump-2 administration is trying to avoid having the US economy crushed between a proverbial rock and a hard place. The clash is not easily avoidable.

The crushing “rock” in the analogy is the US Federal Deficit. At 6.3% of GDP the current federal deficit is at an unsustainable level characteristic of economic emergencies. Usually, this level of deficit occurs when GDP is down (recession) and Federal recovery spending is way up, and it corrects naturally and quickly when the economy recovers and emergency Federal spending runs out. That is not the case today; GDP is already unusually high and most Federal stimulus spending has already run out. The crushing deficit today is structural, not temporary, and stems from entitlement programs (Medicare, Social Security) and the Trump tax cuts of 2017 that are expiring this year. If the tax cuts are not renewed, the deficit will quickly move toward normal. But, that probably won’t happen.

The “hard place” stems from Mr. Trump promising to renew the tax cuts and even increase them, adding further reduction in corporate taxes, lower taxes on social security earnings, increased State and local tax deductions, no tax on tip income, etc. He also has promised to leave Medicare and Social Security programs untouched.

The President has made clear that he intends to escape the deficit bind through drastically reduced federal spending and massive tariff increases. As he has said of the tariffs: “It’ll be a tremendous amount of money for our country, tremendous amount.”, also: “Tariffs are going to make us very rich and very strong.” So far, he has presented only a general sketch of his plans.

Supposedly, 25% tariffs on Canada and Mexico begin today, as I write. On the federal spending side, last week, there was a pause in nearly all federal grant programs and roughly a million federal employees received an email encouraging them to resign with the bonus of 6 months of administrative leave (or face unpleasant working conditions). There appears to be no legal authorization for either initiatives.

As of last Friday, the stock and bond markets appears to have ignored all the fireworks. I have a strong feeling that is going to change. For this spring, I expect a period of high volatility as world markets try to understand what is actually happening.