The U.S. economy is doing very well. Unfortunately, it is starting to do a bit TOO well. That has happened before, and these episodes of economic boom never end well. This one won’t end well either. My guess remains that the demise will occur in one to three years.

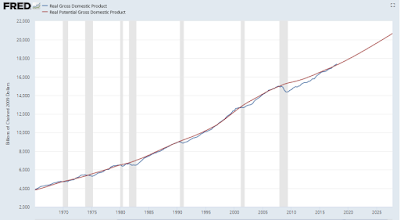

The Congressional Budget Office is well known for the ‘economic scores’ that it calculates for the impacts of proposed congressional legislation. In calculating those scores CBO relies on an economic model of the U.S. economy that it created many years ago and has been improving ever since. The CBO model estimates how large the U.S. Gross Domestic Product should be if the country were at full employment, giving the model the name of ‘Real Potential Gross Domestic Product’.

The CBO model gets tweaked every now and then, but not by much. The last adjustment I can remember was a small downgrade of future estimates to account for changes in how fast the baby boomer generation is retiring. That’s why current estimates for best case GDP growth are lower that previous decades.

The graph below was downloaded from the Federal Reserve public data site ‘FRED’. It shows CBO’s Real Potential GDP model and actual values for U.S. Real GDP. (‘Real’ meaning that inflation has removed from the data so that everything is shown in constant 2009 dollars.)

(Click on image to enlarge, Esc to return.)

The match between actual GDP and the CBO model are amazingly close nearly all of the time. The big exception of course is when actual GDP plummets several percent causing the country to suffer a recession. (The gap caused by the Great Recession was unusually large — that’s why it was the ‘Great’ recession.) As a general rule, the stock market suffers a collapse as investors realize a recession is nigh, and the market rebounds sharply when it appears that the economy is likely to recover.

It is worthwhile to click on the graph above to look closely. Prior of most recessions the economy tends to perform better than the Real Potential GDP. That exceptional performance can last for as long as several years — until the Fed decides the economy has become overheated.

GDP now is better than expected by the long term model. In part that is due to the normal turn of the business cycle. We are at the boom part of the cycle. This time, however, normal cyclic economic expansion has the incredible financial stimulus heaped on the economy by the deficit spending of the Trump tax cuts. The stimulus is twice as large as the stimulus provided by the Government at the depths of the Great Recession. That load of cash is just starting to hit the real economy. A major boom is underway. That is wonderful!

But, the boom, inherently, will not be sustainable.

For years the Federal Reserve Bank has been raising interest rates very very slowly, trying to move them from the historically low rates necessary to break the country out of the Great Recession.

If, or rather, when the Fed determines the economy is becoming frothy, the Fed will increase interest rates faster until the economy cools down. That will bring the next stock market crash. Like any tragedy unfolding, the only questions are: Exactly how? and Exactly when?