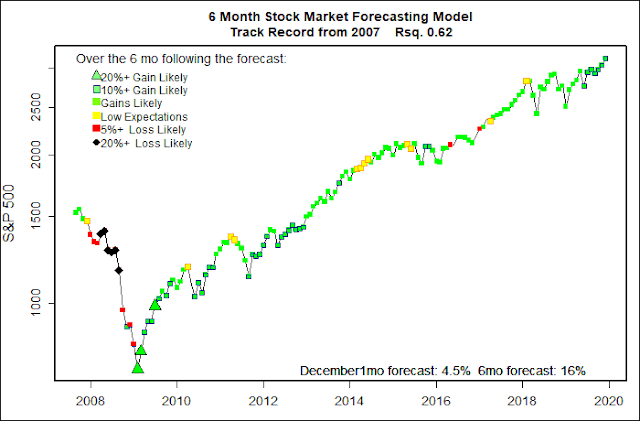

Please ignore my forecasts for at least the next several months. Feel free to also ignore my personal opinions below. They are not intended as stock market advice. I certainly do not know what is going to happen.

Apparently many people believe that fears of the novel coronavirus are grossly inflated. I sure hope they are right, but I don’t think they are.

The human and economic changes brought on by the coronavirus pandemic have only just started to hit worldwide. About 3 months ago the virus did not even exist! So far less than 0.0001% of the world population has been infected. Before this is over some epidemiologists fear that roughly half of the world population may have contacted the disease. This is nearly impossible to comprehend. There are more unknowns about the pandemic than things we know.

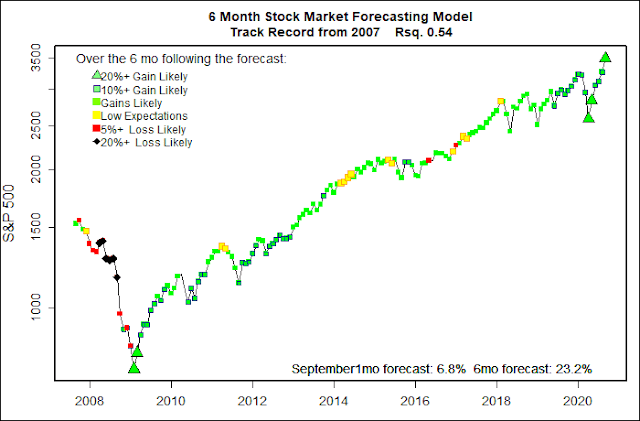

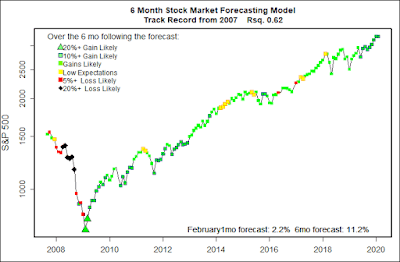

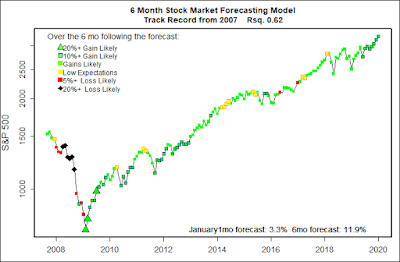

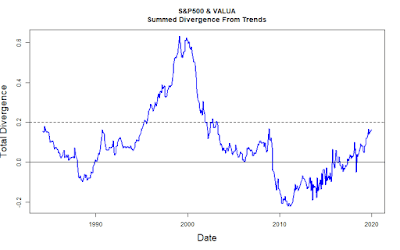

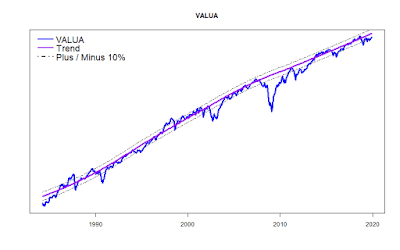

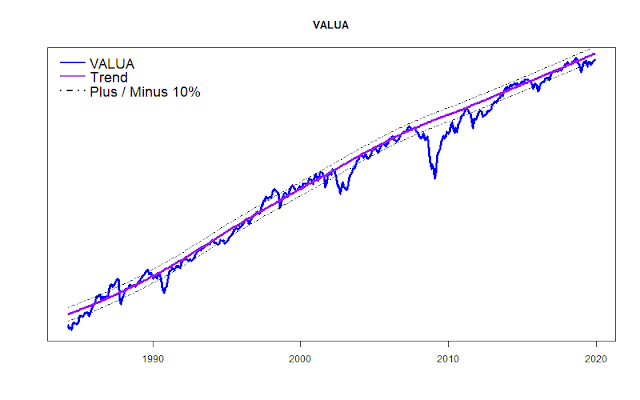

The epidemic came upon us suddenly — a huge and horrible Black Swan. Most of the data sources that form my models do not reflect the catastrophic changes that I believe will be slamming the world. I will continue to post the monthly forecasts from my models since producing a public real time record of these forecasts has been the purpose of this blog from the start. I might as well be honest about just how wrong these forecasts turn out to be. Eventually, I trust the data I use will start to reflect our new realities.

It was probably a mistake, but a while ago I started posting about what I am doing with my own money. My intent has not been to advise others, but just to be honest in indicating how strongly I believe in the econometric models. Now I am just logging the fact that I do not believe the rosy forecasts that are currently coming from the models.

Two weeks ago I wrote that I had closed my positively leveraged positions and went to approximately 70% invested. I am now almost entirely out of the stock market and have some short positions.

My personal stock market opinions are often quite wrong — that’s why I created my objective models. But, for what they are worth, here are my thoughts.

In my personal opinion this market downturn is far from over.

There is a hope that the virus contagion will all blow over as the northern hemisphere warms up in summer. As of today, many closings of schools, places of assembly, and other activities are being announced as temporary closures of two weeks or so. Many people believe that fears of pandemic are totally overblown. It would be a wonderful miracle if the virus onslaught suddenly disappeared. I personally doubt that will be the case.

The current world strategy has come to be called “social distancing”, or “flattening the curve” — curtailing countless human activities in order to slow the spread of the disease with a simple objective: keep the number of infections below the point where hospitals are unable to treat the vast flow of critically ill patients. Many people may still die, but at least deaths will not surge because there is not enough room in hospitals. Clearly the hope is also to buy time needed to find better means of treatment and eventually to find a vaccine.

The social distancing strategy, however, has a very high and still largely unknown economic cost.

In very crude and inaccurate math, each week of lost employment leads to a drop of gross domestic product in the order of 2%. For a person to not work for a week they lose about 2 percent of their yearly output (1 week of about 50 yearly work weeks.) Someone pays for that lost output, either the employee, their employer, the customer, or the firm’s investors. So, for the national economy a week of lost work for everyone is roughly a 2% drop in gross domestic product. A couple of weeks of lost national work output probably would put us into recession. I cannot even fathom what several months of lost output could mean.

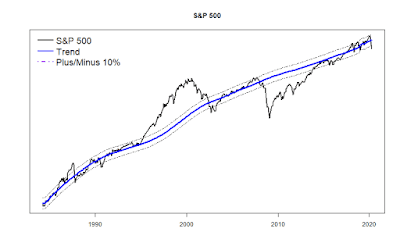

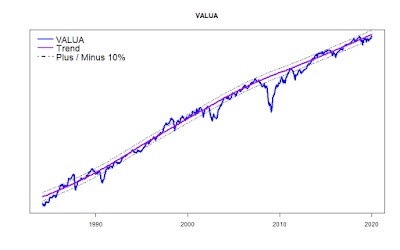

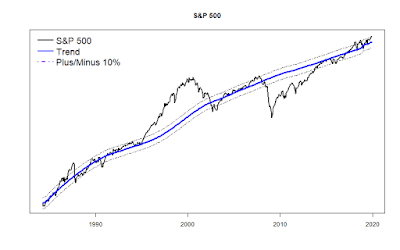

The Great Recession of 2008 produced a GDP loss of 5.1%. The S&P 500 dropped about 50% as a result. Hopefully I am quite wrong, but in my fears the coming recession and bear market have the potential to be much worse. After Friday’s wishful thinking historic price surge, the S&P 500 is now down about 20% from it’s February high point. Just barely still in a Bear Market.

Certainly emergency measures by government will soften the economic blow for many people — more paid time off, unemployment, eased foreclosure rules, etc. But, there will still be countless people and businesses who will receive crushing blows that government aid will not touch. My local friendly restaurant already survives on a small profit margin — government aid isn’t going to replace all of the lost customers for months and months. The same story is becoming true for much of the economy. The nation is now facing major industries such as air transit, retail, restaurants, entertainment and tourism shut down indefinitely. The direct effects are likely huge. The ripple effects will be like tsunami’s!

When businesses and individuals go broke, new government programs and forms of assistance, no doubt, will provide some with loans and other forms of assistance. But, we are still going to be faced with a large number of bankruptcies, foreclosures and bad loans. Financial contagion could become a reality. Political unrest in other parts of the world would not be a surprise. We aren’t there yet, true disaster has not hit. At the moment it is like we are all just taking a few weeks off after some kind of giant snow storm. But to me, the writing is now on the wall.

I do not feel that the worst has passed for the U.S. stock market.

Stay healthy!