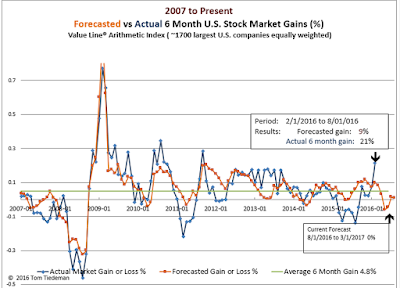

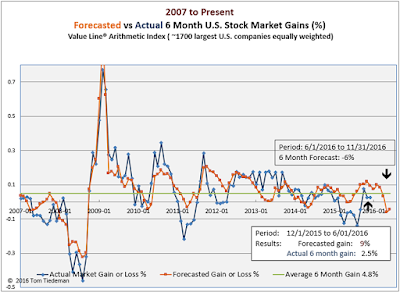

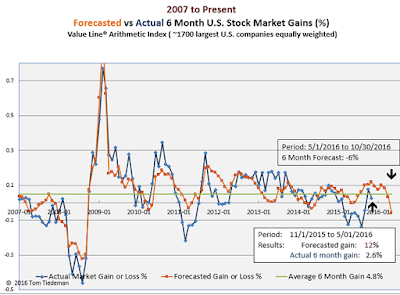

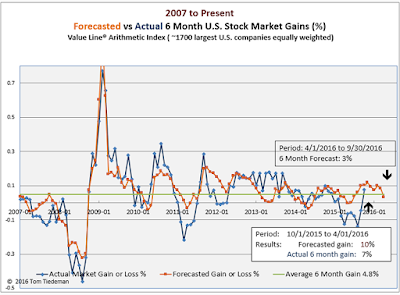

Each month since October, 2007 I have posted predictions for the U.S. stock market for the coming six months. That’s 9 years of forecasts, so I think it’s about time for a reckoning. Are my forecasts for U.S. stock market gains worth anything? Or are my predictions just plain bogus?

The excellent news is that my break even models have performed quite well . The models are just as valid now as when I started using them in 2007. The models are far from perfect, but they generally foretell major stock market moves.

This blog post focuses on my forecasts of the probability that the U.S. stock market will at least break even over the next 6 months. In another post I will review the separate models I use to estimate how large gains or losses will be.

Were Break Even Forecasts Basically Useful?

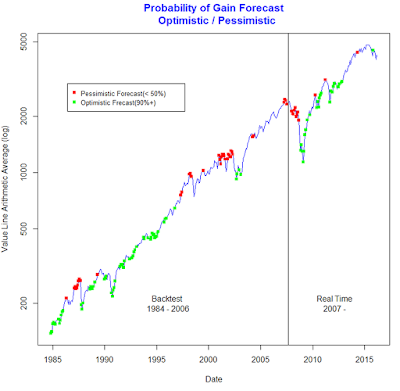

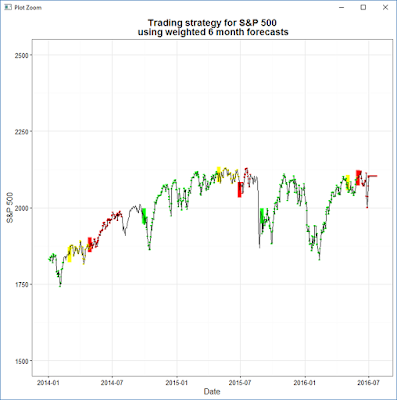

The chart below shows the growth of the Value Line Arithmetic Average (VALUA) from 1984 through 2016 Q1. This index tracks the roughly 1700 large U.S. companies that are followed by the highly respected Value Line Investment Survey. Unlike measures such as the S&P 500 Index, or the NASDAQ Composite Index, VALUA gives equal weight to each stock. No stock is more important to the index that any other. The distinction is important — VALUA ends up being much less volatile and speculative than the other market indexes.That makes VALUA much more predictable than other indexes.

For the entire period from 1984 through 2016 Q1 VALUA has risen during 73% of all the 6-month periods, making 0.73 the average probability of VALUA rising in any half year period.

I have superimposed a series of green dots to show the dates when my forecasting model concluded optimistically that the probability of the market going up was 90% or better. Likewise a series of red dots mark where my forecasts of the market at least breaking even were 50% or less. (The rest of the time the forecasts were middling — neither very optimistic or pessimistic.)

Overall, the pessimistic forecasts (red) do tend to come before significant market corrections, rather than coming after the market has already collapsed. For the forecasts made in real time from 2007 on, all of the pessimistic forecasts were valid. All but one were timed exceedingly well. The remaining recent pessimistic forecast did foretell a market break, but the break came months later than expected.

Optimistic forecasts (90% or better chance of a market rise) were much more common in both real time and historical data. Generally, the optimistic forecast points do appear to lead favorable market periods. It is clear, however, that optimistic forecasts are frequently premature — even though the market future has improved, the stock market may still be in the process of crashing.

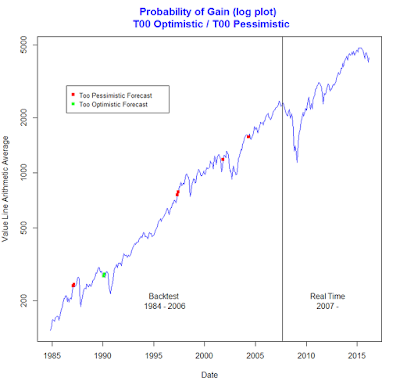

What About Break Even Forecasts That Were Terribly Wrong?

Fortunately, there were relatively few points when the probability of gain forecasts were really bad. Eyeballing the chart above, it is reasonable to conclude that every few years, the model makes a really bad market call. In most cases, even though the market rose after a very pessimistic forecast, it appears that the pessimistic forecast was just issued too early — the market did indeed tumble, but months after the model expected the market to break.

To my surprise there were no instances of really bad forecasts during my real-time testing from 2007 on. I have no doubt that at some times in the future the model will again make some really bad market calls. The accumulated experience, however, encourages me to think that really poor stock market calls will not happen more frequently than every few years.

basic

Has There Been Any Basic Change in the Factors that Move the Stock Market?

The general goal of modelling the stock market is to find consistent relationships for a small number of factors that reasonable might be expected to affect the market going forward. The stock market responds almost instantly to countless sorts of news but no model can be reasonably be developed that will reflect all of those factors. So, the real problem is finding just a small number of important factors that consistently affect the general direction of the market going forward.

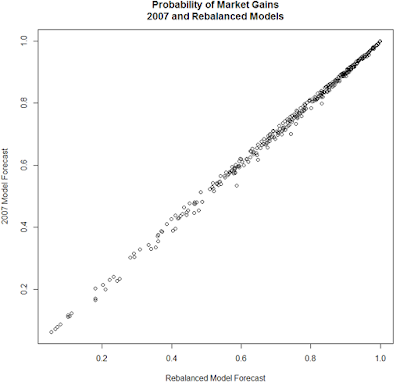

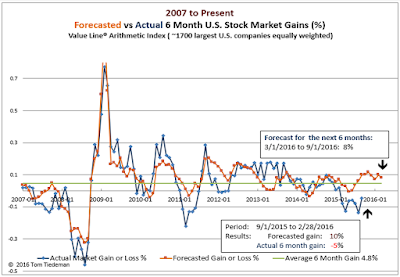

In 2007 the stock market forecasting models I came up with tracked the past performance of the market pretty well. The question now is whether the model needs to be changed to reflect new sorts of factors that may have developed over the past decade? Maybe the basic nature of the stock market has changed enough so that an entirely new sort of model needs to be used going forward? Maybe some of the old factors that seemed to be relevant really aren’t?

Good news. The same factors that seemed important based on data from 1984 to 2007 appear to be behaving in almost exactly the same way since then. There really hasn’t been a large shift in the basic factors that affect stock prices.

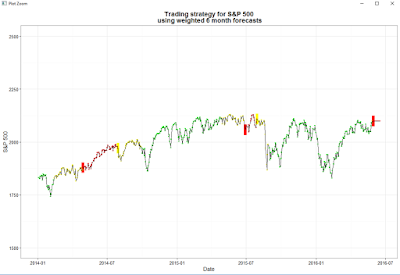

The plot below compares the forecasts for the probability of stock market gains based on my old 2007 model and based on the same model that has been re-balanced to reflect all the new data since 2007. The changes to the model that should be made are very minor: the new forecasts for probability of breaking even match the old forecasts 99.8%. There is almost no change.