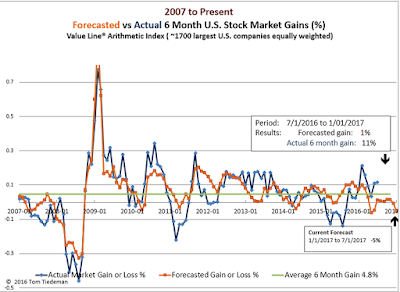

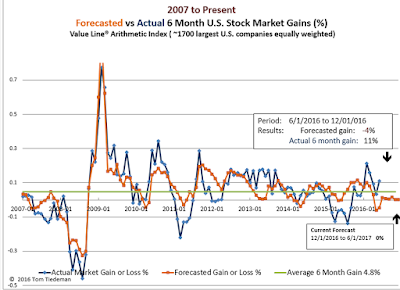

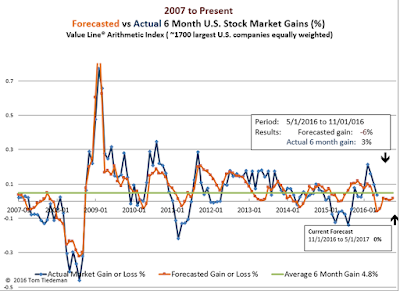

Each month since 2007 I have posted the 6-month predictions for the U.S. stock market generated by my econometric forecasting model. That amounts to 116 monthly forecasts that I can now evaluate. How well did my model perform?

There are several ways to judge performance. Cumulative return on investment, however, ends up being the best measure of success or failure. Based on cumulative returns, following my models would have produced about three times the return of a Buy-and-Hold strategy.

Not that Buy-and-Hold is a bad idea. If you followed a Buy-and-Hold strategy from 2007 through July, 2016, simply holding an S&P 500 index fund, your holdings would have grown 51% plus dividends. Pretty good for a portfolio set on autopilot. Especially considering that shortly after the test period started the stock market crashed horribly and took years to fully recover. You still would have come out OK.

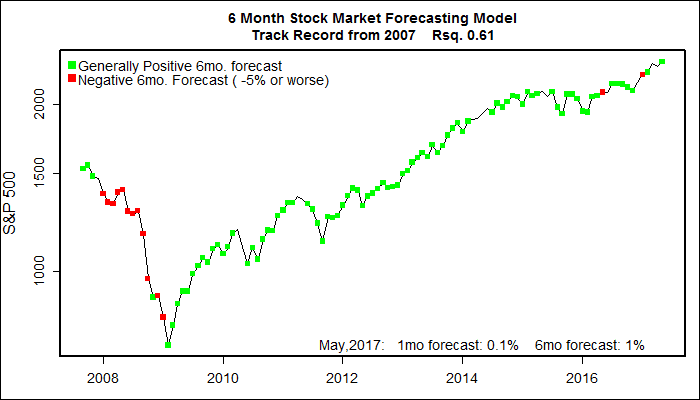

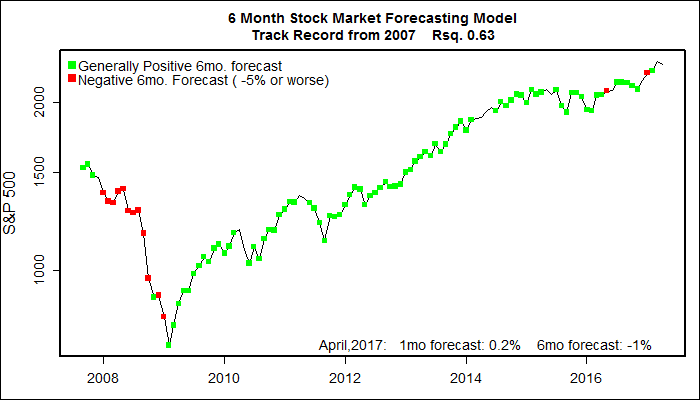

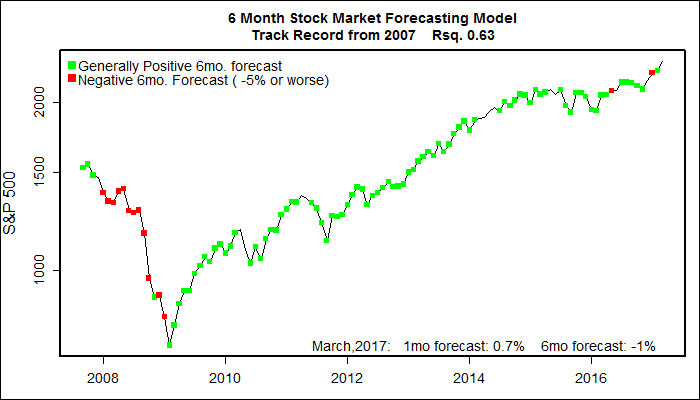

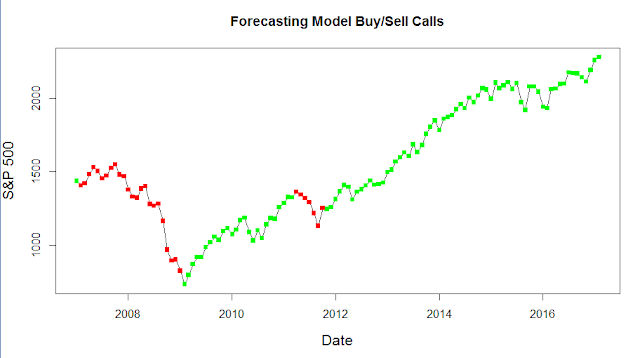

Acting upon the 6-month forecasts from my model would have been somewhat better than just following a Buy-and-Hold strategy. (i.e. Buy when the six-month forecast was positive and sell when the 6 month forecast turned negative.) But, while the 6-month forecasts were surprisingly accurate, they really didn’t say much about what the market was likely to do in the month immediately following a forecast. In the end, they didn’t do very well at picking the best buy and sell points. For example, my model was generating fantastically positive 6-month performance forecasts while the stock market was still crashing down in 2008-2009. The market did, indeed, climb over the following 6 months, very nearly as expected. But, in the meantime the stock market was still falling like a rock. Buying when the 6-month forecasts first turn positive or first turn down ends up not being such a good idea.

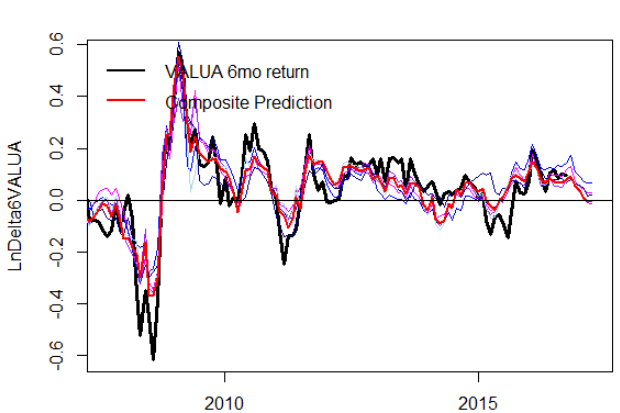

A while ago I learned that I could apply different weights to several of my 6-month forecasts from previous months to give a better decision on buy and sell points.

An investment in the SP 500 index that followed the forecasts generated by the weighted predictions from my model would have largely missed the market crash of 2007-2009 and would have gained 169% — over three times the return from a Buy-and-Hold strategy.

An important caveat is on order. The calculation above does not consider dividends. Dividends would have been somewhat less for the trading strategy since the strategy would have taken you out of the market for over a year. Also, the net gain would be significantly less for the trading approach for stocks held in a taxable brokerage account due to taxes levied on profits from sales of stocks.

That said, being able to dodge a major market crash can significantly beat a Buy-and-Hold strategy — especially in a tax-favored account such as an IRA. It looks like my forecasting model is doing what it is supposed to do.