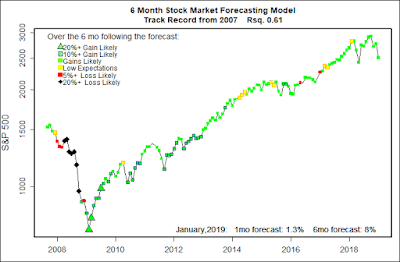

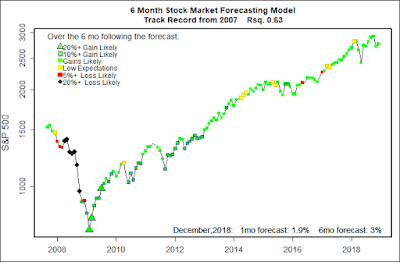

(This post does not contain a new market forecast.)

In brief: The stock market is tied to the economy, but the link is not all that direct.

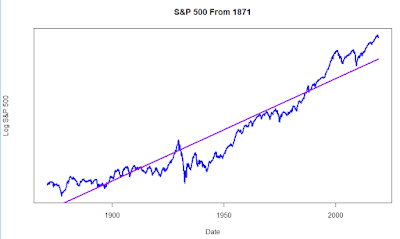

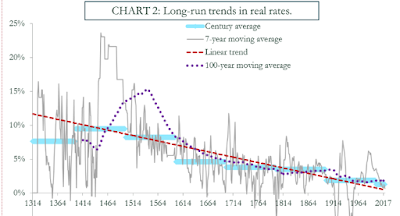

Part 1 of this Trend Line series argued that the U.S. stock market — despite all of it’s booms and busts — has grown at a surprisingly steady percentage rate (exponential growth) rather than by a steady or random number of points each year (linear growth). It even looks like that growth rate has been going up a bit, somewhat consistently, over the long haul, making long term market growth ‘increasingly-increasing’.

The S&P 500 data I presented in Part 1 began in 1871, but researchers have shown this same sort of increasingly-increasing growth has occurred for human economies from the dawn of civilization.

The economy dominates stock market performance. Sort of.

The U.S. government didn’t collect much economic data until the Great Depression, and only really became serious about it during WWII. The first publicly available GDP data is from 1947. So, the focus here will be on the stock market since that time.

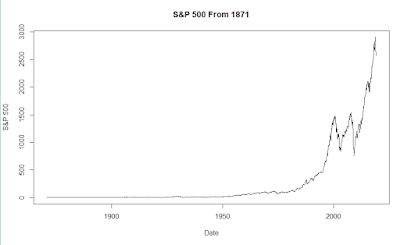

In the post-1949 graph of the S&P 500 below, the Y axis is linear. Just like the 1871- graph in Part 1, it shows the characteristic upward swoosh. Again, the immediate appearance of the graph is that the market was flat for years and years, then suddenly shot up. And there were those two crazy bubbles of the DotCom episode and Great Recession.

Plotting the same S&P500 data with the Y-axis showing percentage growth (logarithmic) smooths the line out, making it more linear. Also, volatility of the early years comes into perspective — volatility in percentage terms has not increased dramatically in recent years. Overall, the stock market has experienced a roughly steady rate of growth.

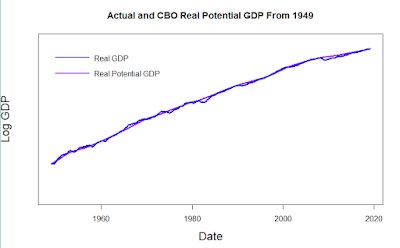

To factor economic performance into the new market trend line, I am turning to the combined talents of scores of the top U.S. and world economists — living and dead — including several Nobel Prize winners. The best data I have found to track and forecast the economy is the Real Potential Gross Domestic Product created and maintained by the Congressional Budget Office. “Real” in the name means that inflation has been factored out of the data. Interestingly, the S&P 500 matches an inflation-adjusted Real GDP better than unadjusted data. “Potential” means that the CBO Real Potential GDP comes from an elaborate model designed to mimic the U.S. economy running near it’s full potential. During an economic boom the economy may run somewhat above potential, but only for a few years at most. Likewise during a recession GDP may drop as much as 10% below potential, but tends to recover over several years.

The CBO Real Potential GDP adds a lot of power to my market trend line. First, it is the best known model there is, and for good reason. The CBO model is the tool used to evaluate the 10 year economic impact of all proposed congressional legislation. In the hope of making their proposed legislation score better, every congress member, and every interest group tries to get the CBO model tweaked. For that reason the CBO model is fully documented, transparent and heavily peer reviewed. It is unaffected by politics.

In the professional world of young top-notch economists the Federal Reserve and the Congressional Budget Office are the top credentials you would want on your resume. Just writing a paper that suggests a small adjustment to the model is a major kudo for an economist.

As shown in the graph below, it tracks the actual GDP numbers amazingly well. But, even if it was not very accurate, it is the economic model that economic forecasters are most likely to trust, creating a self-fulfilling prophecy effect on the stock market.

Importantly, the CBO Real Potential GDP projects economic performance quarter by quarter for a full 10 years. Actual GDP data, by contrast is always a quarter to half a year out of date. Economic trends that are most probable in the coming decade have already been factored into the model.

Finally, the difference between actual Real GDP and Potential Real GDP is a solid and objective measure of how well the actual economy is living up to it’s long term potential.

Adding Real Potential GDP and Interest Rates to the trend line

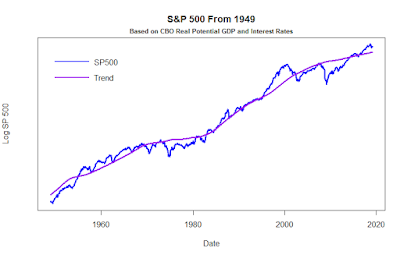

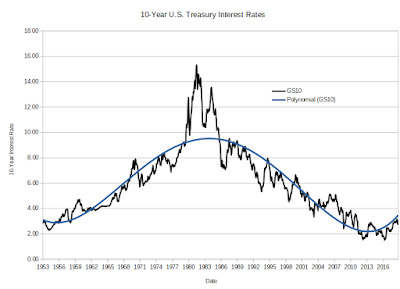

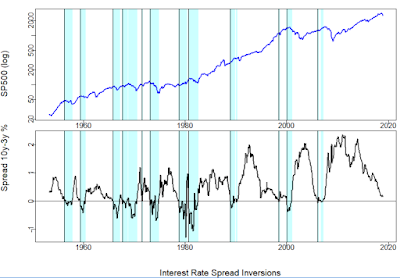

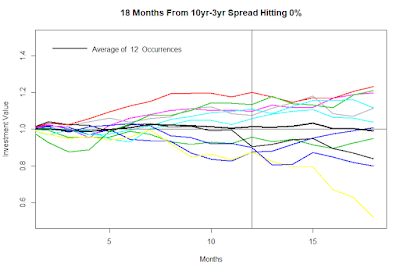

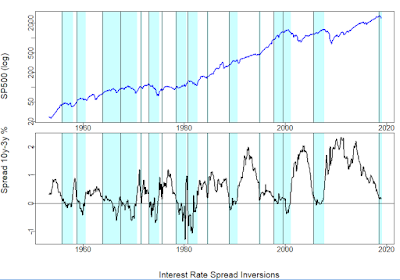

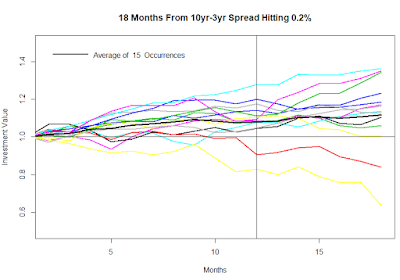

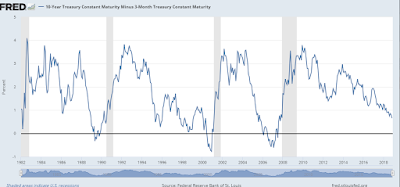

I have added one more piece of information to the trend line model — Interest Rates. We know from long experience that interest rates and especially changes to interest rates have a major impact on business profitability and the stock market. The CBO GDP model includes interest rates as direct economic factors. But, the effects of interest rates on the stock market are somewhat different. Especially since we appear to be heading into a period of rising interest rates, it is important that the trend line reflect changing rates.

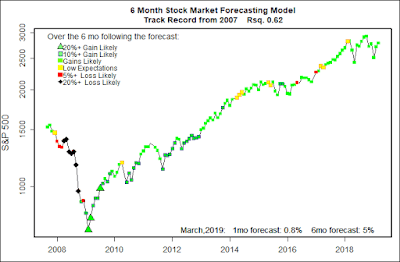

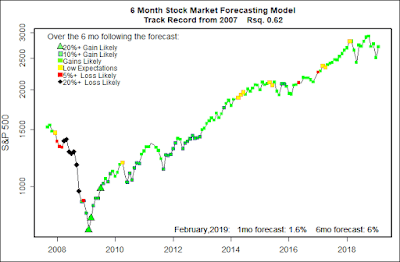

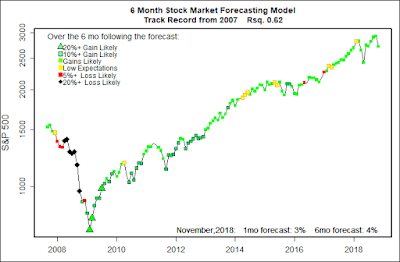

Adding the CBO Real Potential GDP and data on prevailing interest rates to the existing exponential trend line produces the trend line for the S&P 500 shown below. The trend line, now based on objective economic data, appears to conform to past market performance pretty well.

But, this is not the final trend line I will be using. There are a few more steps that I’ll cover in my next post.