Forecast October 2024 thru March 2025: Climbing the Wall of Worry continues. My oldest and most accurate long term models are skeptical about the market, and have been negative for months. These econometric models can never forget the plunging prices of past stock market crashes. That’s their job. They are supposed to worry.

This time might be ‘slightly’ different. I won’t be surprised if the models are overly cautious for several more months, and the market keeps gaining.

The U.S. stock market is climbing a “Wall of Worry“, a classic stock market expression that applies at about this time during every business cycle. Stock valuations have been rising for several years and now are high by nearly all measures. But, prices keep rising anyway. ‘Everyone’ knows the market is overdue for a tumble, but ‘nobody’ wants to miss out on the relentless gains that stocks keep washing in. Eventually ‘all’ markets do falter, and most speculators are completely surprised. My most recent and detailed models say the end may not be imminent, At least, not for the next few months.

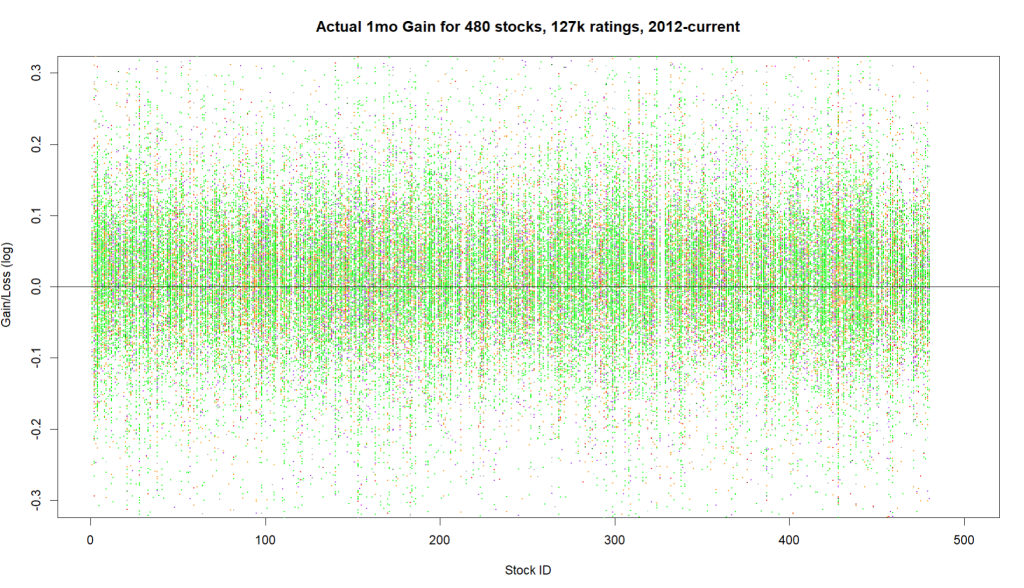

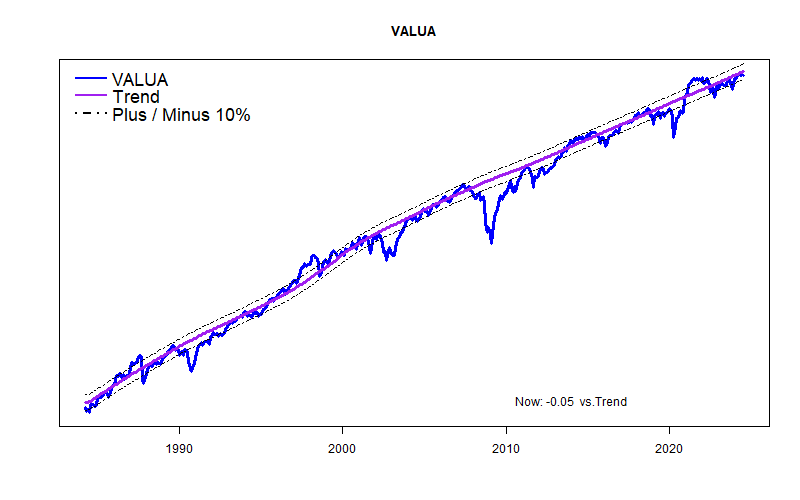

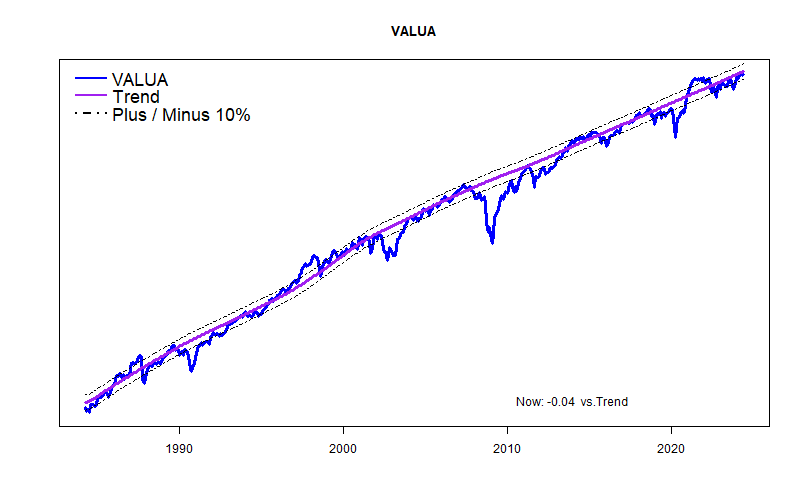

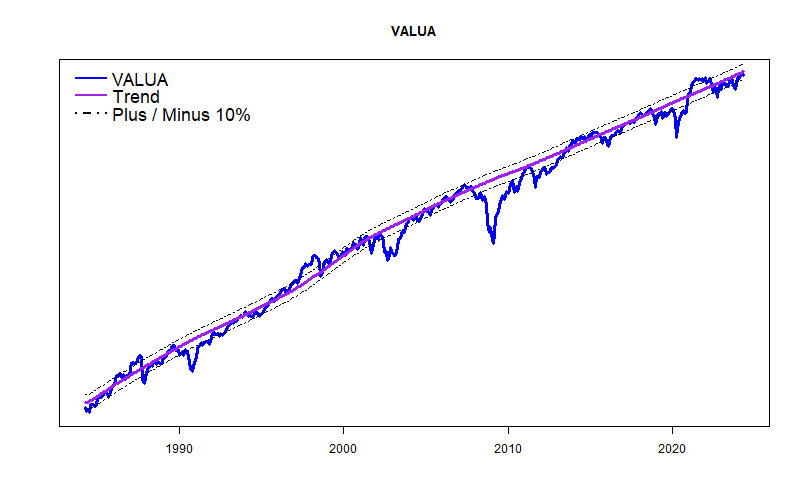

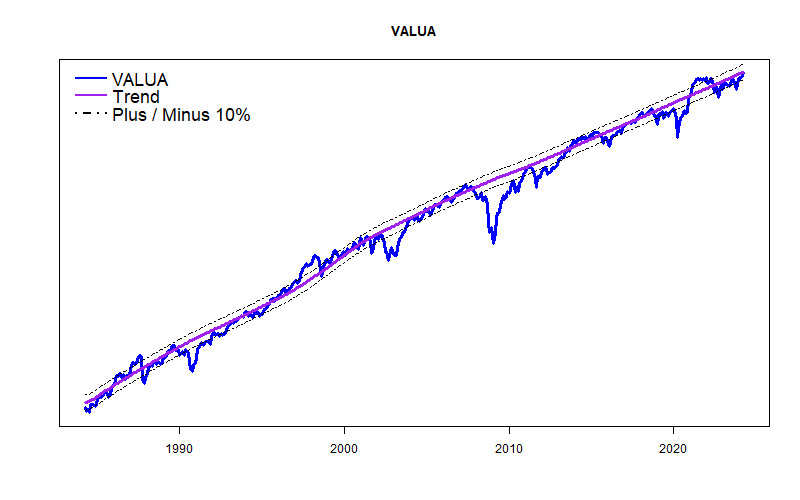

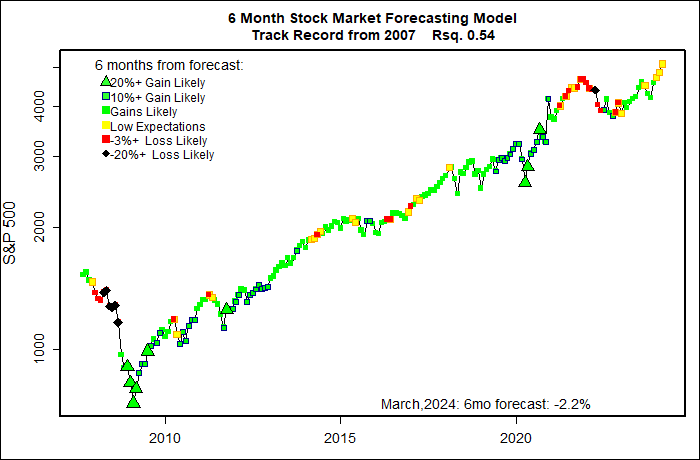

At the request of one of my few readers, I am bringing back my oldest and ugliest chart to illustrate. My wife calls it ‘garish’ and she is never wrong.

The graph below displays all of my actual 6-month market forecasts going back to 2007. The shape of the graph is the S&P 500 plotted on a logarithmic scale. Each dot is color-coded with the dot color indicating the approximate forecast value for the coming 6 months. (So, ideally a big market drop should follow a black diamond, and a strong market rise should follow a big green triangle.)

The message here is that the negative (red) forecasts of the past several months paint the wall of worry, just like they did through the pandemic mini-bubble. Eventually, they will probably prove to be approximately correct. At some point not too far away the market will probably be cheaper than is is today.

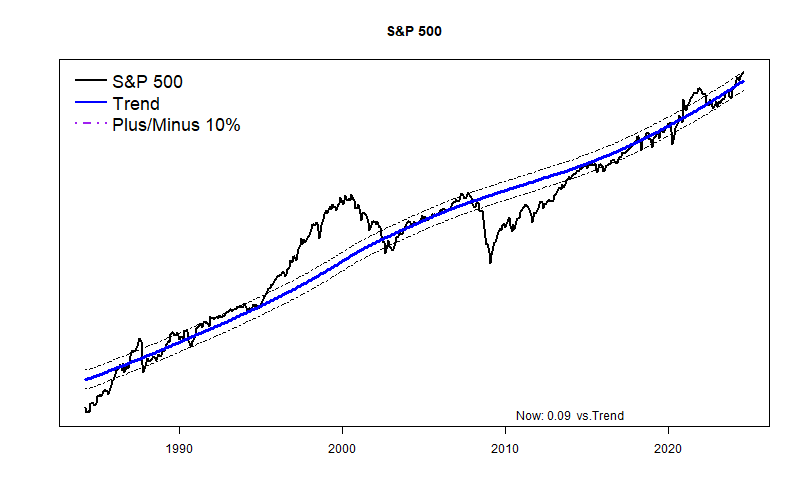

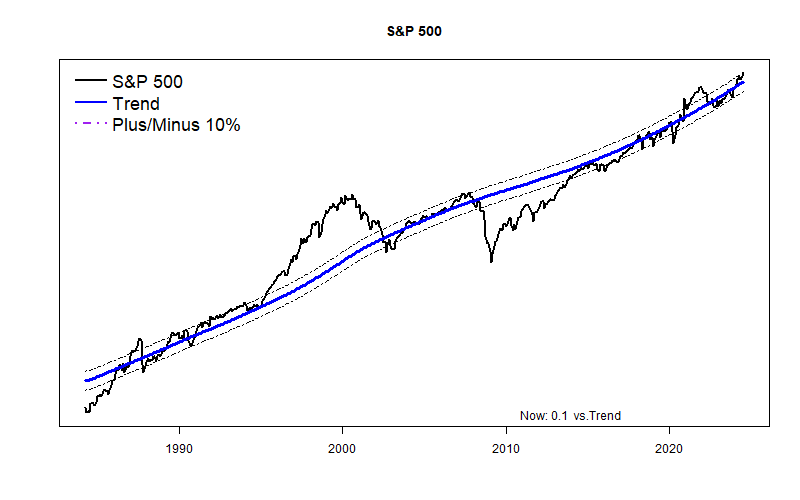

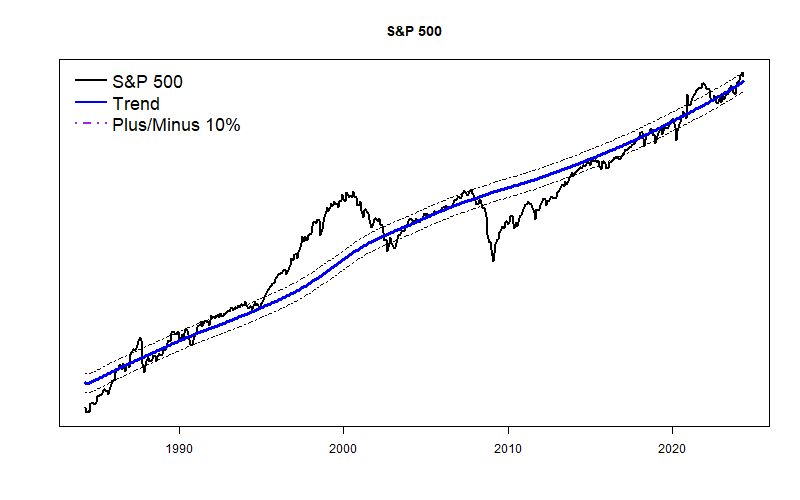

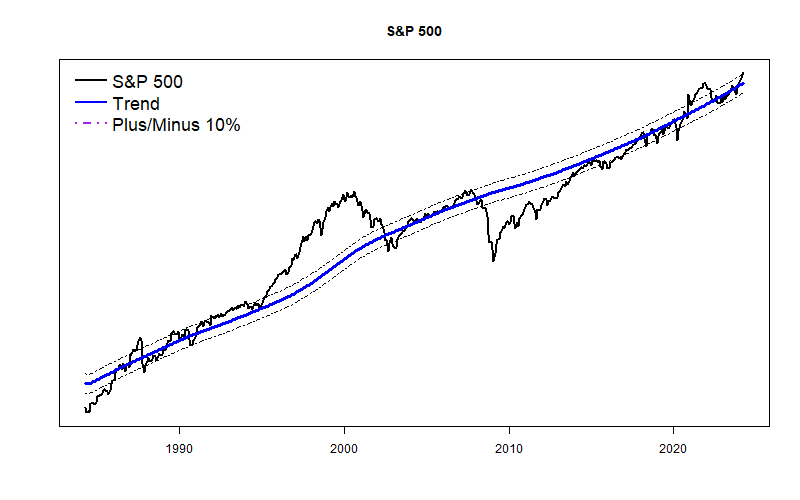

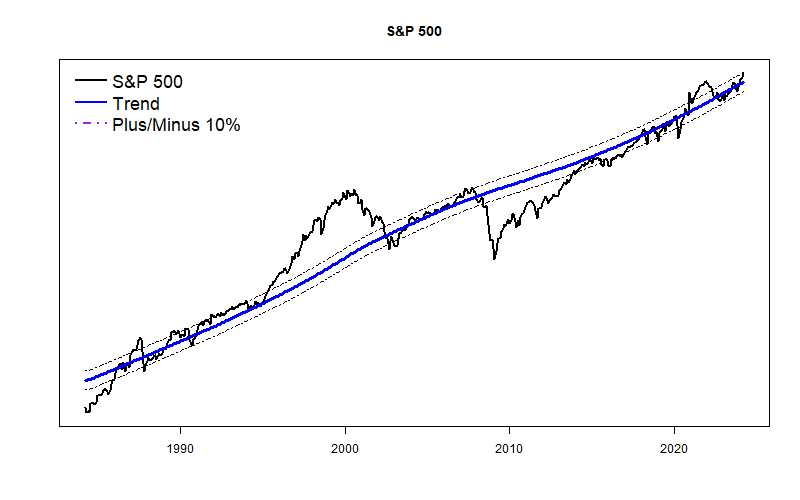

The plot (below) of a long-term model of the S&P 500 shows what certainly looks like the start of a new market bubble. Since at least 1871, the growth of U.S. GDP and the U.S. stock market have corresponded quite closely. That is no surprise: GDP tries to estimate the total volume of goods and services, while the S&P corresponds to a big chunk of that same economic output. The trend line here plots the current (and future) path of the S&P 500 based on the ongoing relationship between Real Potential GDP and long term interest rates. It is far from a perfect model, but it shows a growing divergence: a new bubble? (This model shows the S&P 10% above trend, another model says 14% above trend.)

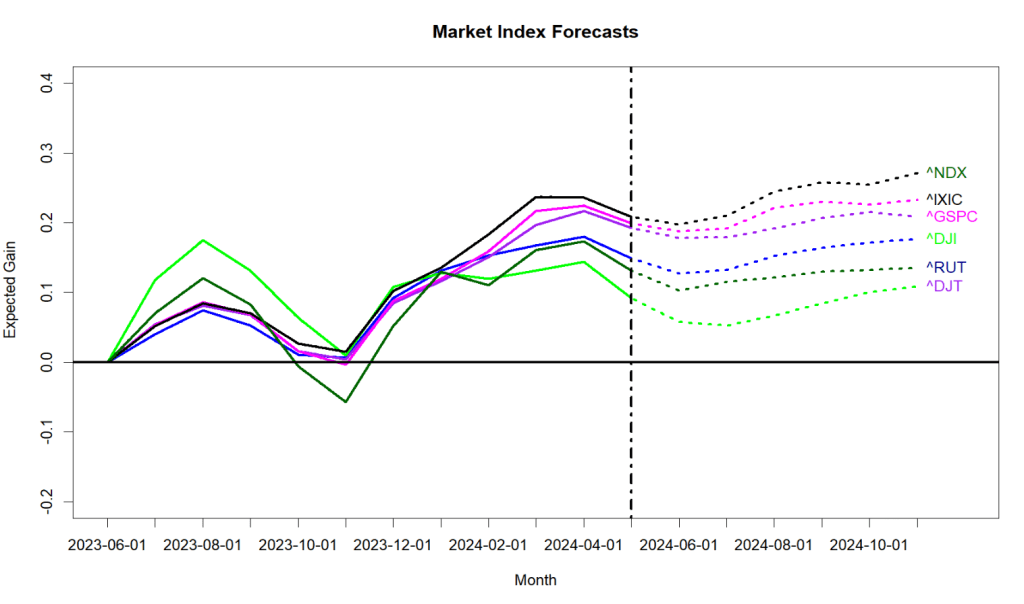

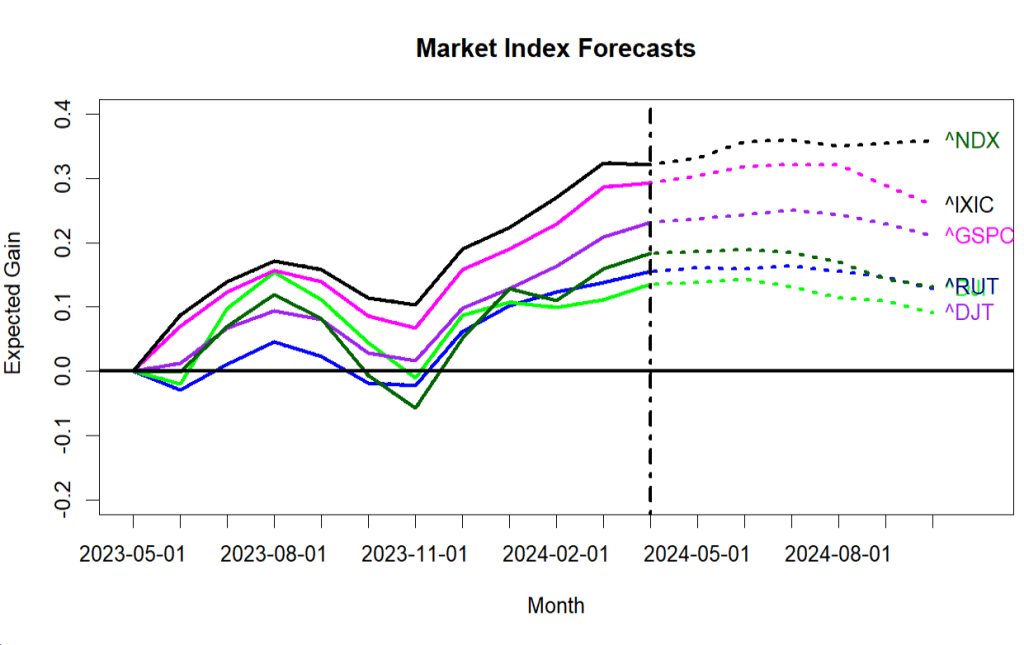

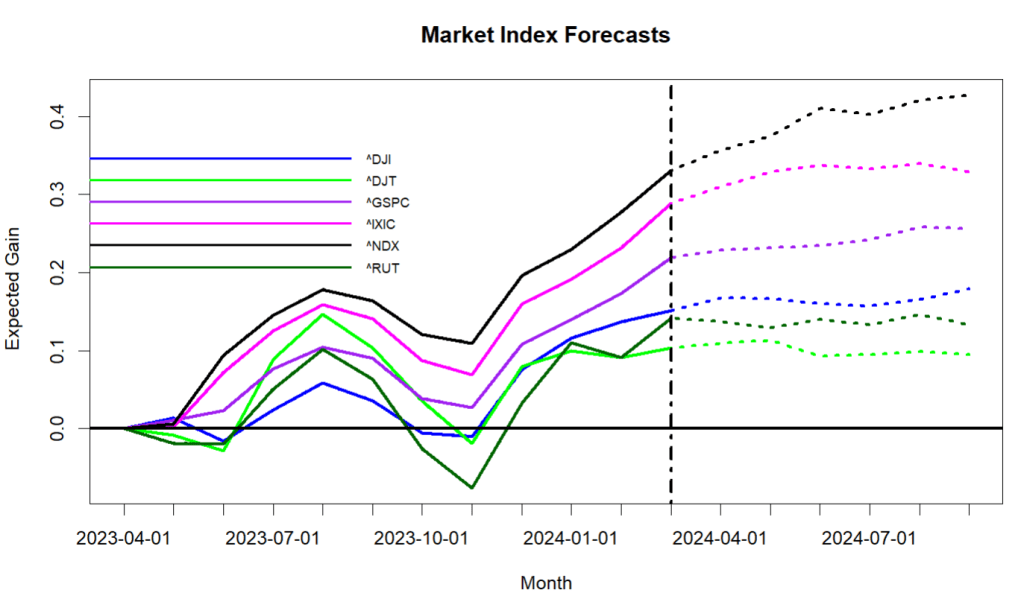

Here is a somewhat more positive look at a series of market index forecasts. The forecasts span from 1-week through 6-months. The models that produce these plots are based on gobs more data than my original models and are not quite as ‘fixated’ on the market crashes of the past. For good or ill, they are more trusting of current economic data.

If the Orange Octogenarian does something exceptionally bizarre in the next month, then all bets are off.