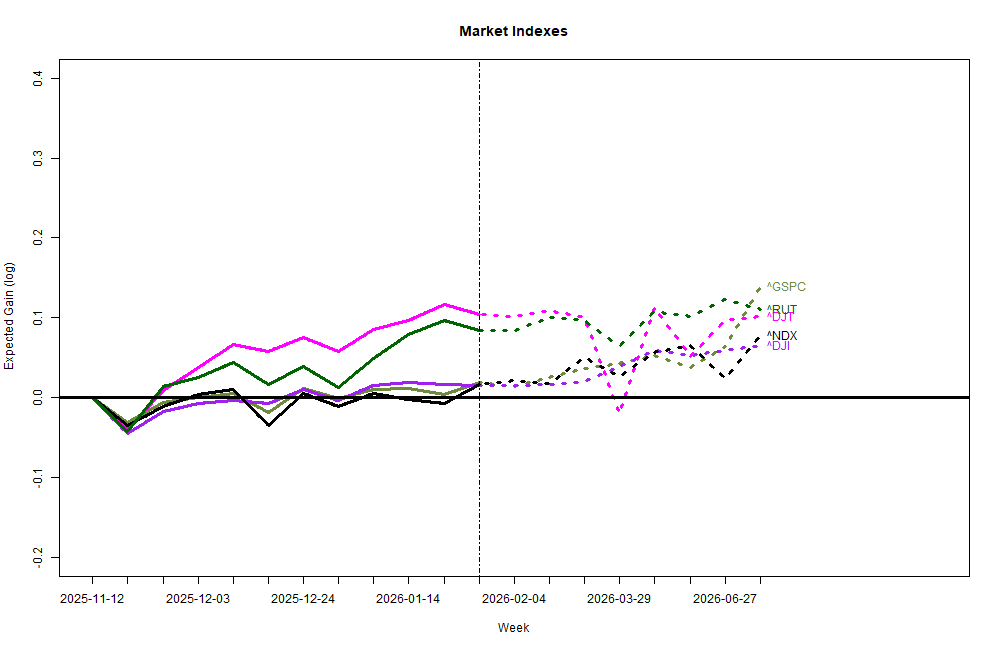

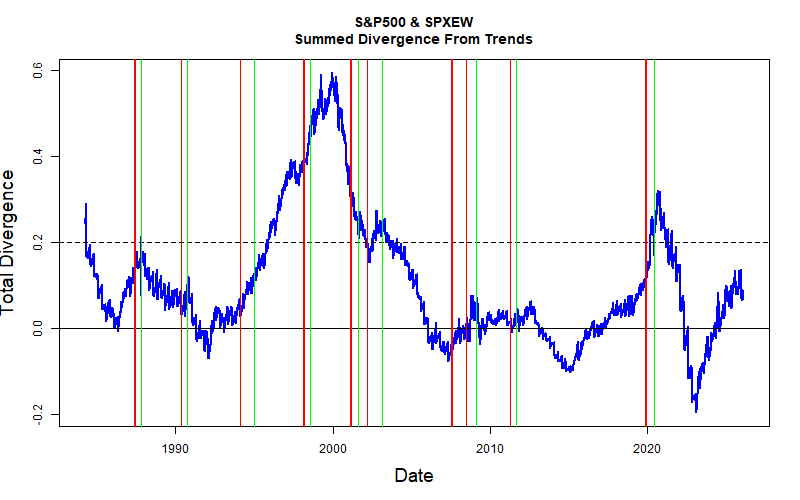

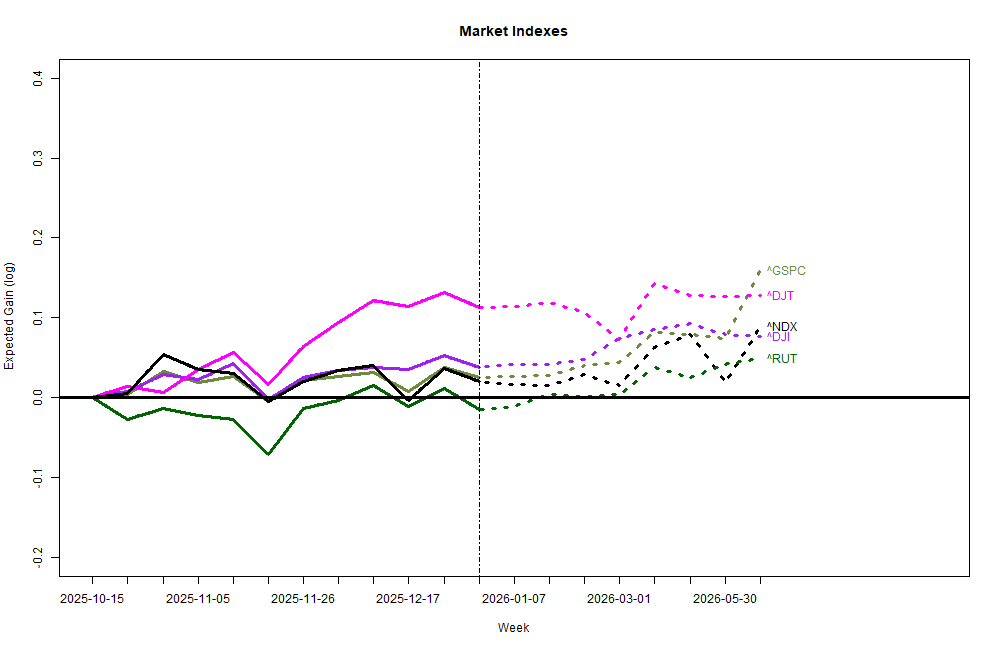

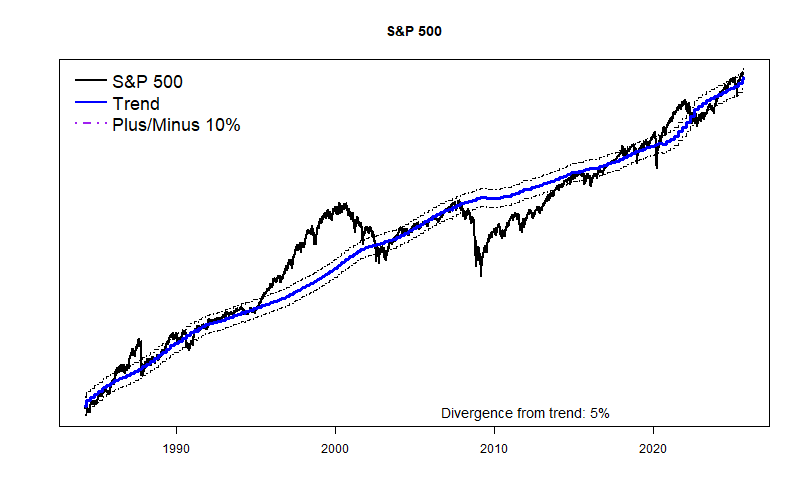

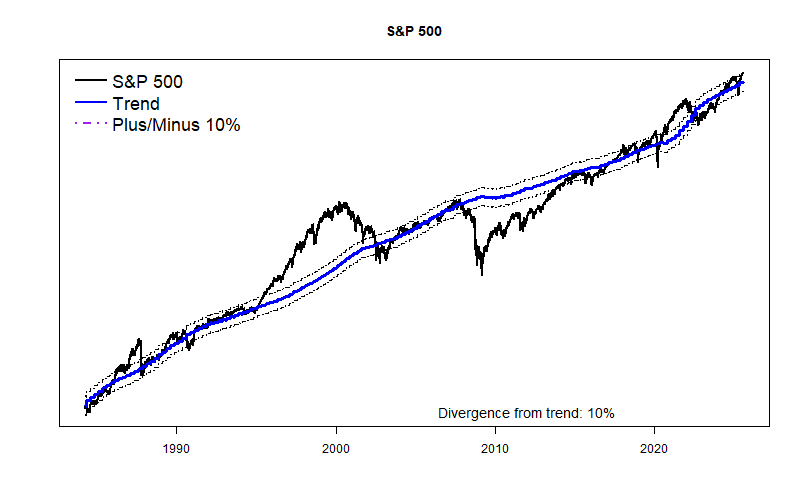

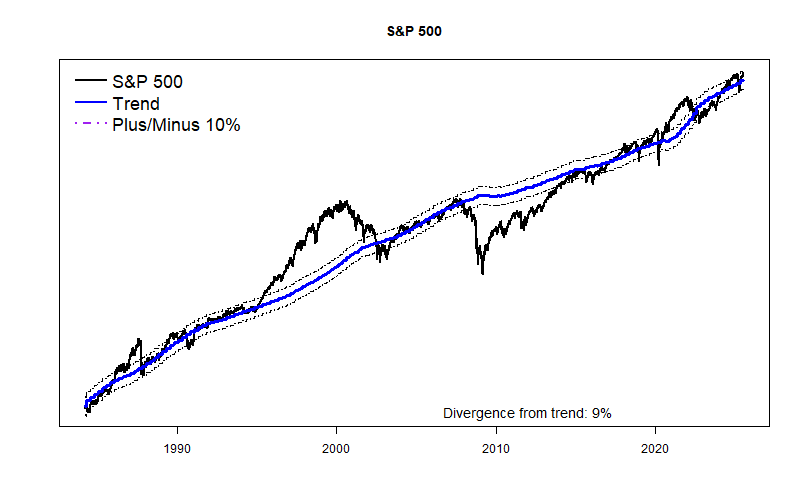

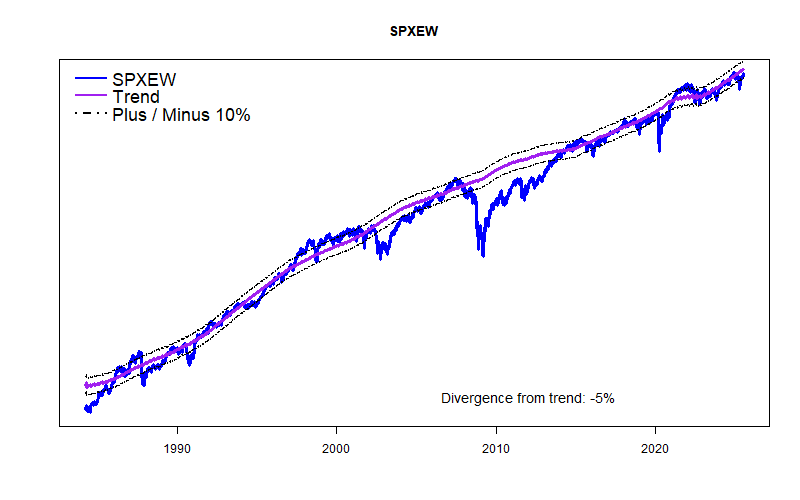

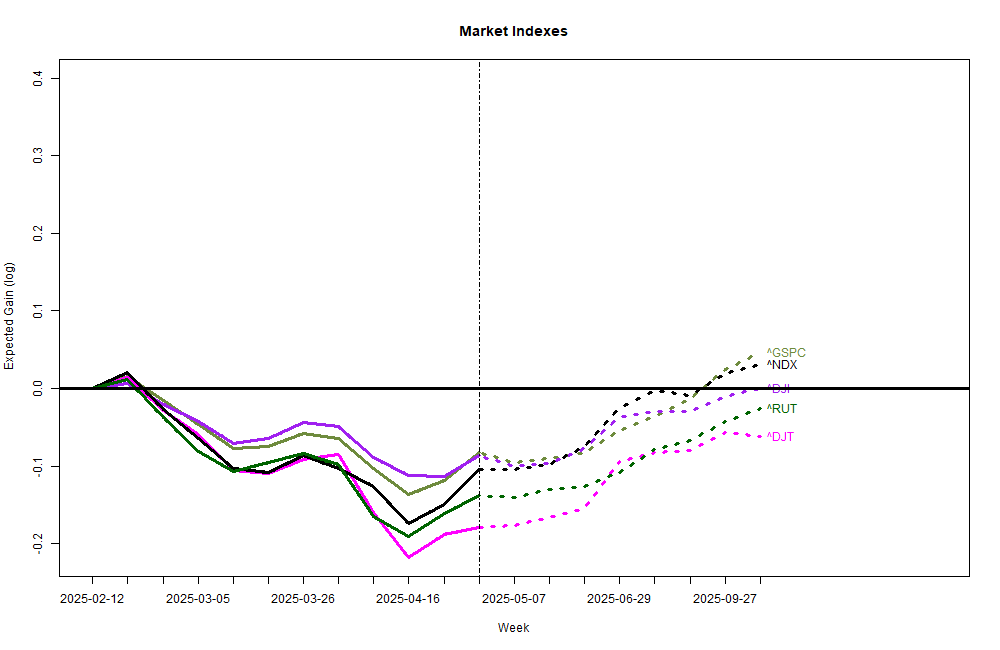

The US stock market will likely be in free-fall for a few weeks until Congress passes the final version of the FY 2026 federal budget. No bottom in sight. But, short sellers should pay attention: instantly after the budget bill gets signed the stock market could launch an amazing boom and bubble. For geezers who might still retain a few memories, this probably will be similar to the 1998 stock market crash: sharp, deep, V-shaped, with a fast rebound. Don’t blame me; I’m just the highly fallable messenger.

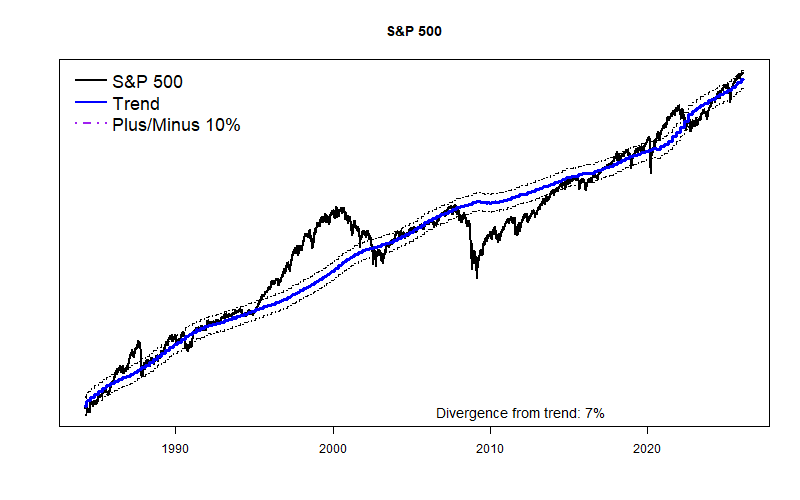

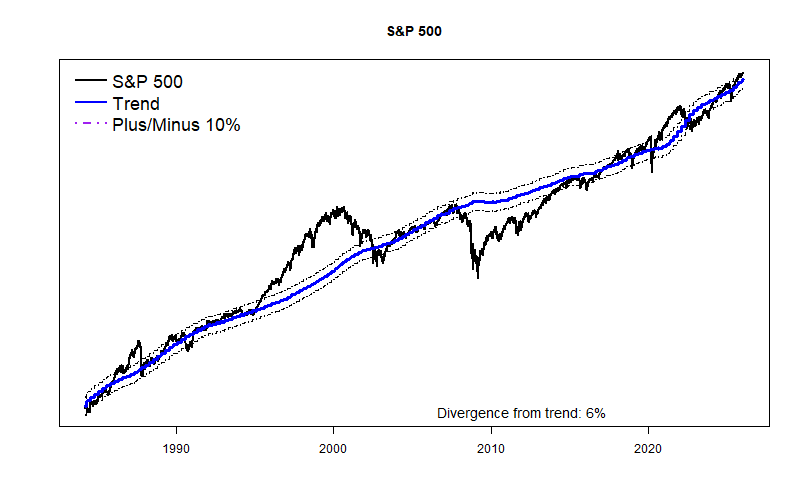

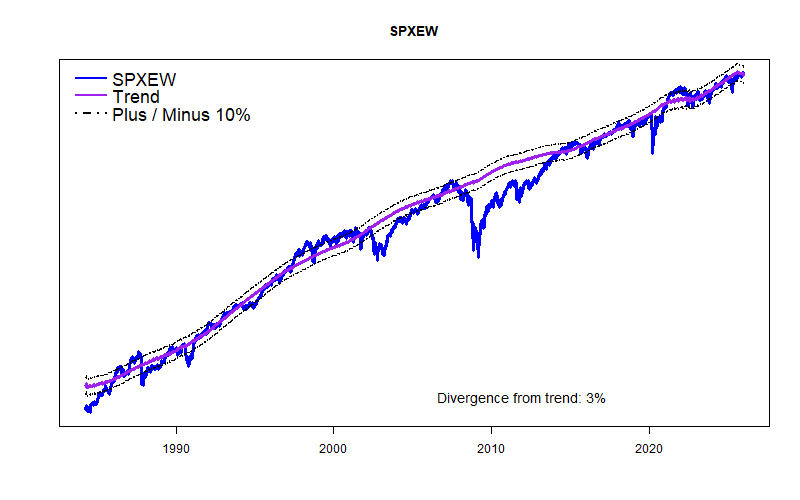

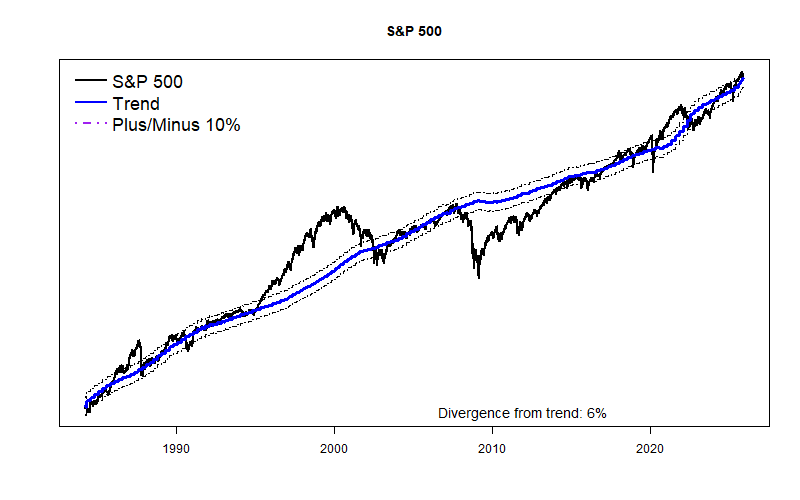

Last Thursday and Friday stock market sent a clear message on Trump’s kind and gentle tariff announcement by immediately staging the worst 2-day market collapse ever. Ever. Prior to the announcement, stock prices were still elevated as they have been for many months, so there was plenty of room to fall. Even now, there still is plenty of room below.

Unless the President relents and eases the tariffs, the market faces only more bad news or worse, faces continuing unknowns about how the tariffs will actually affect the economy or how other nations will counter the tariffs, or further escalate the trade war. We have yet to learn, for instance, how the European Union plans to react to the tariffs. (I personally expect a major hit to US services in Europe where we are actually running a massive trade surplus. There go The Magnificent Seven.) A zero response from Europe is unlikely. Neither have we seen how much consumer prices will actually rise, how much business production will drop, or how much unemployment rises due to decreased economic activity. Multiple globs of bad news will probably keep falling down in coming days and weeks. We won’t see the actual drops in US corporate profits for months and months.

Any potential good news of US industrial redevelopment is months or years away. What’s at stake is that the US economy could quickly be in a significant recession. Fear alone is enough to cut demand enough to create a recession. It doesn’t take much, just a 2% to 3% cut in what people buy. The World economy is also in jeopardy. With a sudden recession stock prices can quickly fall a further 30% to 70%. An extended recession or depression could be worse still. All unknown now.

Many have wondered why, other than sheer incompetence, Trump chose to pull together and implement an instant slap-dash set of simplistic and drastic tariffs. Tariffs aren’t a new thing. Queen Elizabeth I used them to protect wool knitters. Throughout the past several hundred years tariffs have almost always come out of extensive lengthy negotiations and have been implemented with lag times to permit adjustment by the economy. Often a threat of tariffs has been enough to change things. What’s different this time? The answer is simple: He needed to have the massive taxes in-place now! They had to be gigantic and they had to be actual, not just in discussion. The bigger the better. Might make sense to go higher still. (see below)

Reconciliation budget Trump and his maga crew desperately want to extend the expiring tax cuts they enacted in 2017, and they want to add in roughly $1.5 trillion is new tax cuts. This can only be achieved via the appropriation budget for FY 2026, which along with an expansion of a massive deficit approval must be passed in the fairly near future. But, to get their way without input from Democrats, they need to use a congressional approval process called “reconciliation”. The final bill must pass both houses of Congress, and because of a Senate rule, it must not increase the long-term US budget deficit. “Arcane”, is a word typically used to describe the reconciliation process meaning mysterious, secret, confusing, or convoluted. Flim-flam scam, Kabuki theater, and “Lets’ just pretend” might also be used.

Here is how it needs to go.

Both houses of Congress have now passed resolutions that outline their versions of a new FY 2026 budget. The outlines are similar, but they contain few details. Crucially, these budgets will only balance via major cuts to federal spending programs and if truly massive tariffs are in place to make up for the revenue lost by the many tax cuts. The higher the expected revenue from tariffs, and the more spending can claimed to be cut, the more tax cuts can slide on through. For the legislation to gain approval from the Congressional Budget Office, the tariffs must be either in-place or fully defined in the legislation. Importantly, if the tariffs are contained in legislation two bad things would occur. First, the representatives would get blamed for imposing huge new taxes. Second, the tariffs would be much harder to remove later. Trump’s Executive Order saved then from catching any blame.

Filling in the details of the budget legislation is what is going to take a few weeks. Getting agreement on all the budget cuts that need to be made is going to be a problem. In particular, approximately $800 billion is health care is scoped for elimination. Also, many of the federal programs that have been scrapped actually are very important for various people. These will be a difficult pills for many Republican representatives to swallow. So, there may be additional show-downs and delays. Uncertainty will exist. “Brinksmanship” is a word that is often used to describe these negotiations.

The key, however, is that without the draconian tariffs and spending cuts in place, the reconciliation budget and its glorious tax cuts cannot pass. The tariffs must remain in-place for the next few weeks. Trump must pretend, at least, that the tariffs are real continuing policy.

Once the budget has been signed into law, the “Let’s pretend” theater can end. Instantly. Trump will be free to drop tariffs to the extent reality demands or that his whim and “instinct” feels is right. That is the moment that can also bring massive “emergency” spending, and could bring about a major “short squeeze” in the stock market.

But, until the budget gets passed, I don’t see anything but really bad news for the US stock market.

I hope I am wrong.