This is not a pep talk for the US stock market for the first half of 2026. My older forecasting tools (with a two-decade track record) see the stock market as likely to have average gains — up 7.5% for an equal-weight version of the S&P 500 index. The probabilities of loss in both 1-month and 6-month time frames are somewhat above average. But, my newer data-hungry models (shown above) see the market as basically flat for a couple of months. In particular, the forecasts generally are showing some worry for tech stocks and the NASDAQ Composite. My personal guess is that people starting to get scared about lofty tech stock pricing will try stall the tax man by holding off selling until New Year’s. I bet we see some profit taking in January.

My forecasting is limping a bit because a few of the economic data series I rely on were not updated because of the Government shutdown. Several of the data sets are still not up to date. Looks like getting up to speed is going to take them a few more weeks. Fortunately the country does not appear near an economic crisis. The country’s soul is in greater danger.

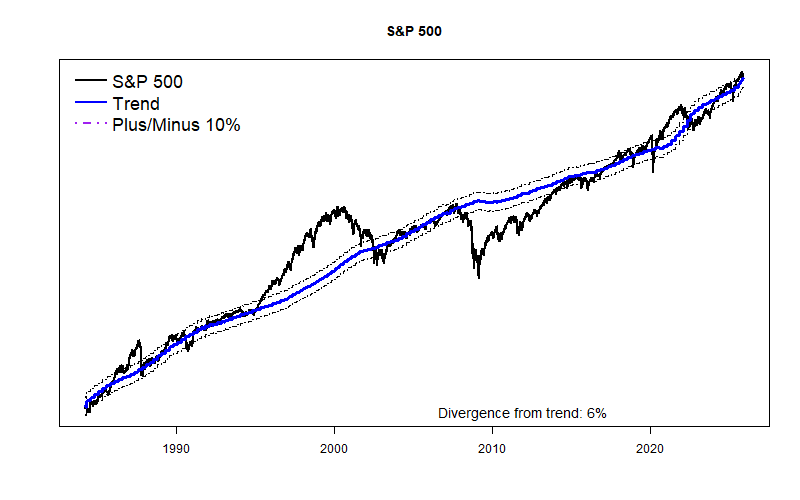

As has been the case all year, the S&P 500 is mildly above my long-term GDP-based trend line, and the equal-weight version of the S&P is slightly below trend. The flying stocks of the Magnificent Seven megastocks are still trying to hang on, but the everyday stocks that fill out the market are starting to show some damage from tariff induced rising costs and economic uncertainty. The economy is starting to show strain.