My stock market forecasting tools are still blessed by not being able to read the daily newspaper. My hometown Washington, DC is essentially under martial law with gun-toting National Guard troops patrolling the streets reacting to a trumped-up ’emergency’ that does not exist, but my stock market performance models (except for September) remain reasonably positive. The forecasting models, with an excellent long term track record, indicate that a wide swath of U.S. economic data is basically benign and so the U.S. stock market will probably perform fairly well over the next 6 months. The September exception is that the S&P 500 (^GSPC on the chart) looks like it has gotten ahead of itself. Both my 18 year-old models with about a dozen economic variables and my current data-intensive models reach similar conclusions.

The macroeconomic data remains positive. Unemployment is still just 4.2%; money supply is growing at a 4% annual rate; inflation, only a bit higher than the Federal Reserve wants, is 2.7%; and corporate profits as of last quarter are growing mildly. Leading economic indicators generally are modestly positive with very low probabilities of a near-term recession.

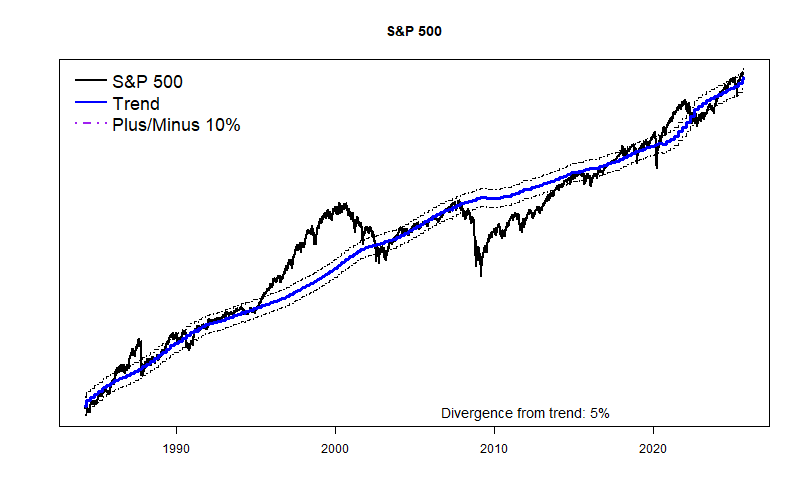

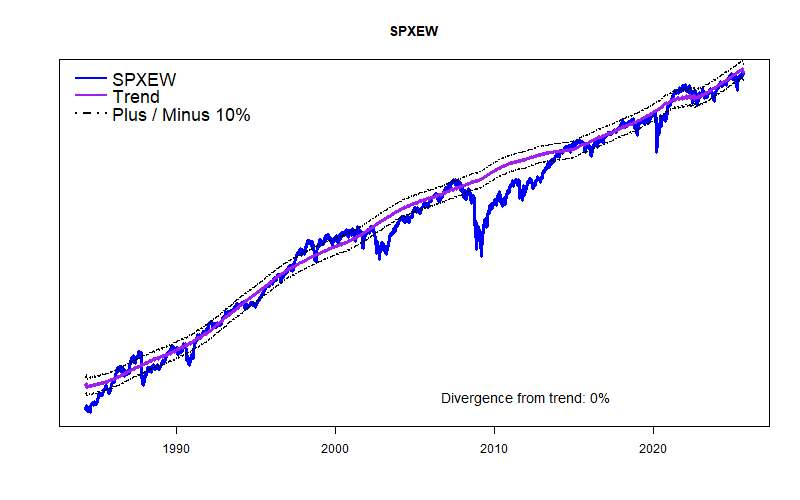

The stock market division between highflyers like Nvidia versus the rest of the world decreased last month. As the graphs below show, the S&P 500 (NVDA accounts for 8% of the index) is now just 5% above its long term GDP-based trend line, and the equal weight version of the same stocks (SPXEW) is now exactly at the long term trend line.

I have a hunch that September will show stock market indecision, but volatility could easily shoot up toward the end of the month and into October. First, the question of the basic legality of the Trump tariffs will wind its way through the courts, eventually through the Supreme Court. Second, there is a significant chance of a U.S. government shutdown at the end of September since the FY2026 budget will probably need some measure of Democrat approval. And third, there is increasing concern over Trump’s health. (The helicopter flight path from the White House to Walter Reed Medical Center goes directly over my house.) I find a bit of comfort with the thought that the stock market, having weathered so much back and forth uncertainty in the Trump second term’s first months, may have been inoculated from instant major responses to potential new calamities. Wishful thinking no doubt.