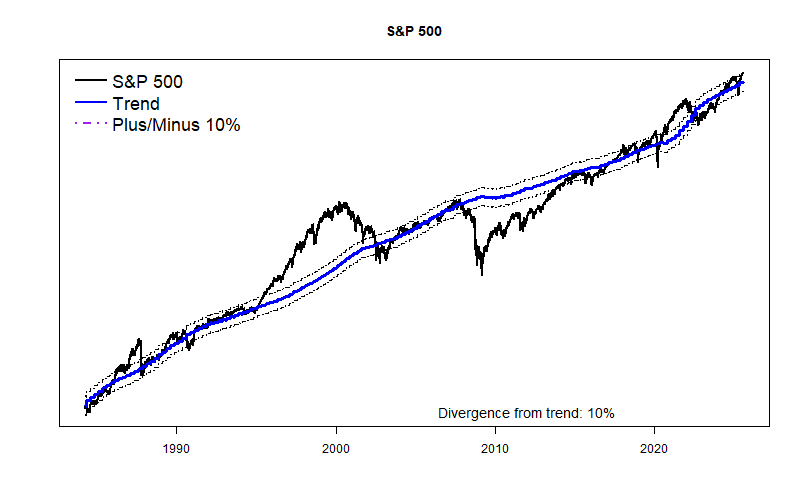

Near term stock market forecasts from my most detailed current models are basically flat (above), but for the coming half year they are “OK”. Not great, just OK. My older models running since 2007 say about the same thing with a 4% gain expected for the U.S. stock market. Meh. As shown in the following graphs, the S&P 500 is running about 10% above its long term GDP-based trend line (a little worrisome) and an equal-weighted version of the same stocks is running about 6% below its long term average. Translation: the market is still dominated by high-tech high-flyers, but the broader market of everyday companies has been mildly weakening for some time.

What worries me at the moment is that my family has started to ask me if the stock market is going to crash. That is never a good sign; usually they pay no attention to this blog or any of my other stock market stuff. If they ask, it means they are actually worried. And if they are worried it probably means a lot of others are scared as well. If a lot of people get scared, then most anything can happen. Rapidly.

The best part about Donald Trump’s sweeping economic program is that very little of it has actually occurred. All those cutbacks in government programs? While painful to many individuals, most do not kick in until October, and even then they are mere pocket change in the overall economy. All the Medicaid cuts? Don’t actually hit until 2027. And the huge tariff increases? They were supposed to begin today, August 1, but then we learn they won’t be implemented until August 8. Or, until…. There has been so much word-garbage spewed by the Trump world that most of the financial world has turned a deaf ear and has returned to following the actual economic data numbers.

For now, the actual economic data are not very exciting. GDP is growing; how fast is a question because of freakish shifts in foreign trade and business inventories, but GDP is definitely growing and is already as high as the Congressional Budget Office sees as possible without over-heating. Money supply and interest rates are normal-ish. Unemployment at 4.2% is still low. Home building is in the dumps and unfortunately is likely to stay that way for the foreseeable future. Inflation has only ticked up a bit. The U.S. Dollar (DXY) rose a rapid 10% last autumn as Trump was elected — and then fell even more after his inauguration. The almighty Dollar is still falling.

But, the overall economy is basically pretty good. So what is the concern about a stock market crash?

Increasing financial instability Big money, the accounts holding billions and trillions, normally moves investments around very slowly. Big money, like an aircraft carrier, is well accustomed to the countless small ups and downs of the economic seas. But, big money accounts cannot accept even the smallest chance of a total wipe-out. So, when there is even a hint of financial panic big money stampedes to the exits bringing about a financial and stock market crash. It will probably start in the long term bond markets. I see two ways that the Trump administration has assured a financial crash; just a question of which? and when?

World Markets In 1997-1998 the world experienced a series of national financial collapses that largely stemmed from increasing U.S. long term interest rates. In one country after another (Russia, Indonesia, Malaysia, Singapore, Thailand, Argentina, etc.) economic collapse was sudden. It even got a name tag: “Asian Contagion”.

No one knows, of course, what the Trump tariffs will actually end up. It seems the President himself likes to be surprised by what he does. TACO? But, certainly the potential exists for nations with frail economies to begin a cascade of national economic collapses. With the U.S. on an isolationist course, a clear potential exists for massive financial failure contagion. This sort of crash would be horrible, but does not appear to be on the immediate horizon.

U.S. Debt As I have written for months, the U.S. federal deficit at near 7% of GDP is unsustainable. It cannot continue forever, but no one knows when trust in the “full faith and credit” of the U.S. will break. Trump’s ‘one big beautiful bill’ further increases the deficit. Deceit (with delays in Medicaid reduction and only partial accounting for new tax cuts) continues to hide the full scale of the new deficit spending, something like $500B per year. Eventually, probably already, big money will “sell USA”. It would be best if that occurs with a slow further decline of the Dollar and gradual increases in long term interest rates. But, that is usually not how these things go.

In answer to my family’s question about a stock market crash my response is that none of my fancy stock market models see a crash as likely in the next half year. But, my models really aren’t very good at spotting truly crazy behavior. Sorry.