(For the next year or so I will report on two sets of market forecasts. I will keep up my monthly forecasting models which I have documented for about 17 years. I will also be reporting monthly on newer market forecasting models that create forecasts on a daily basis. These newer models, however, have only about a year of forward-testing. I apologize in advance to both of my readers for confused reporting on the two sets of analyses.)

My original forecasting equations originating in 2007 are somewhat negative for the US stock market for the first half of 2025. My newer, much more data-intensive forecasts are mildly positive for the next 6 months. The difference isn’t huge, but it is real.

The stock market has been making new highs, climbing the Wall of Worry, and is historically overpriced. In the near term, stocks have plenty of room to fall down, but little chance of quickly falling up. Given those caveats, my forecasts for the near future are mildly positive.

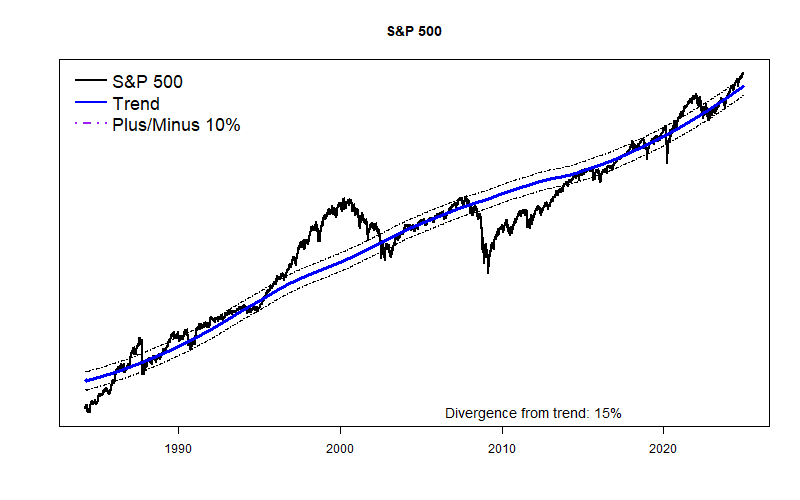

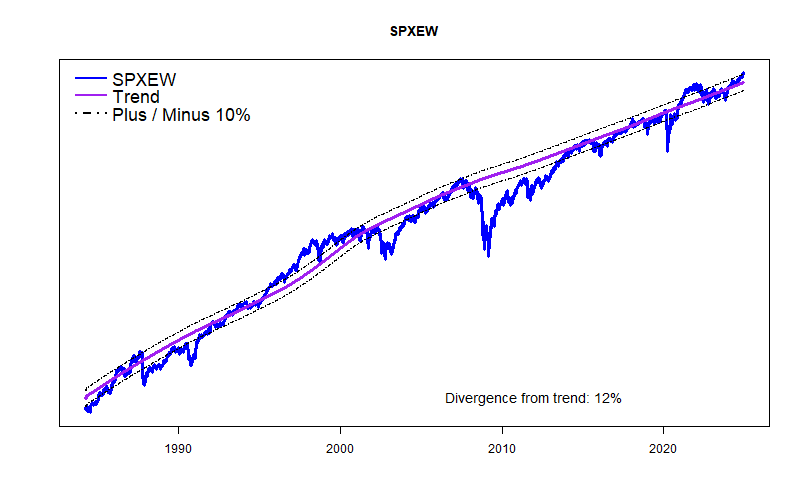

My long term trend models for the US stock market keep showing a developing price bubble. The S&P 500 is 15% above trend and the equal-weighted version of the S&P is 12% above trend. This bubble will probably keep growing. The bubble is still minor in comparison to the Dot-Com Bubble before 2000.

The Federal Reserve has begun to reduce short term rates, but the high level of short-term rates compared to long-term interest rates is still a very real negative factor in finance. Banks can’t make money lending money for long terms if they need to pay very much for short-term funds. They are painfully squeezed and have only been saved through Federal Reserve intervention.

On the other hand, truly massive Federal deficit spending — currently 6.11 percent of GDP — is dominating the economic situation. For comparison purposes, the total economic contribution of ALL FARMING to GDP is less than 1% of GDP ( 0.7%). Including all agriculture, food, and related industries takes the share up to just 5.6% of GDP. So, the US current deficit of greater than the economic impact of all the food we consume — all the food, supermarkets, restaurants, warehouses, even the Taco Bells! That is an incredibly high level of splurge spending that has only occurred during major national emergencies. It is not sustainable.

This spring the new administration and the new Congress will begin to deal with the deficit situation. It will either get better or get worse. (If you think the deficit will improve significantly, I’d like you to consider buying a nice bridge I recently obtained in Brooklyn.) Recent increases in long-term interest rates show that Big Money expects the deficit to get worse. In that case the stock market’s developing Bubble will expand. The math is pretty simple.