Two days before the US presidential election, the forecasts for all the major market indexes are dead flat for at least the next month. For the S&P500 I now have 2 independent 1 month models. One expects 0.1% rise and the other 0.5% rise in the next month. (i.e. diddly squat) . My forecasts still cannot read the newspaper, so they do not have any idea of any crazy stuff that may happen.

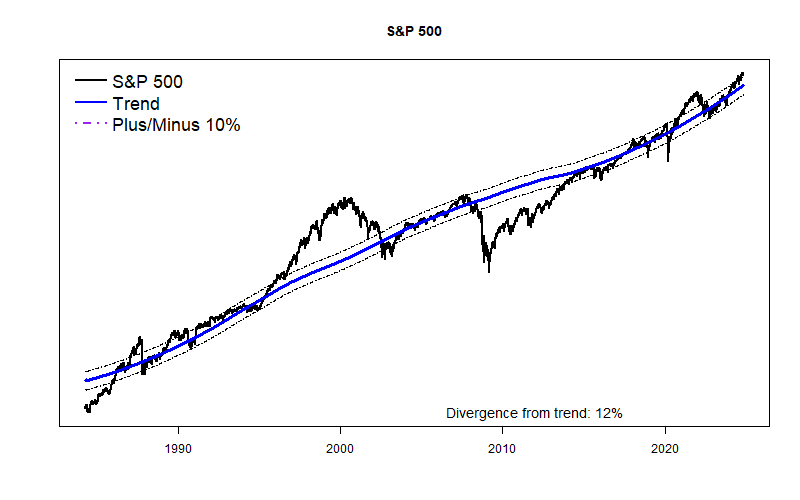

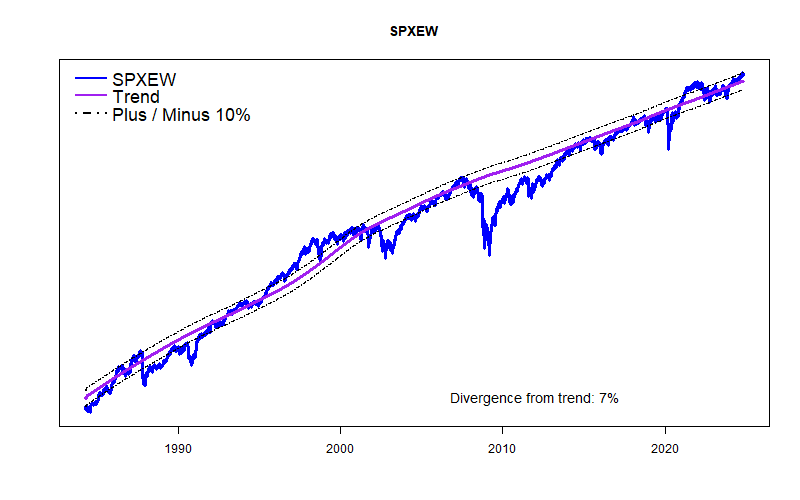

As in the last several months, the stock market is priced to perfection — many forms of valuation see the stock market as overpriced. My GDP-based trend line sees the S&P 500 as 12% over valued, and an equal-weighted version of the same stock prices sees the market as 7% overvalued.

This situation of walking a Wall of Worry is likely to persist as long as interest rates do not rise again, and as long as US federal deficit spending remains at the unsustainable level of 6.11% of GDP. If congressional fireworks over deficit reduction do not occur next spring, we will almost certainly be in the midst of a true pricing bubble. Be careful what you wish for.