Emotionally, I keep wanting to issue a big controversial stock market forecast, but the numbers just won’t let me. The forecast for the next month is essentially flat, and the estimates in the months that follow are bland. There is no end of scary/exciting news in politics and we have seen distinctly higher volatility on Wall Street. My forecasts don’t care much. As far as they are concerned, the Immaculate Disinflation is still on-track. Higher interest rates are slowly damping down the economy, squeezing out inflation. Unemployment has inched up, but the current 4.1% unemployment rate is none-the-less historically quite good. Large cap stock profits are still fine overall. Financial liquidity (M2) is pretty stable. GDP remains a bit higher than the best long-term models expected. Main street is still pretending that workers are going to come back and fill the near-empty downtown office buildings. It is all like watching paint dry.

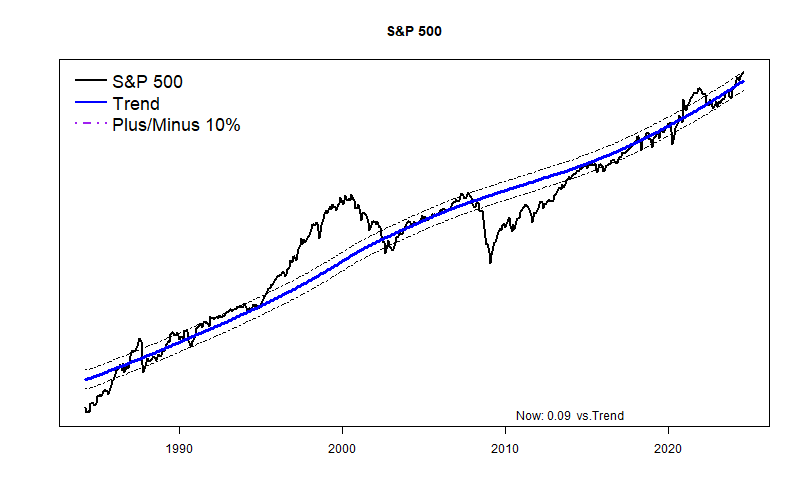

The markets are playing along with the snooze-worthy scenario. The S&P 500 remains 9% above my long-term trend line. (No big deal.) The equal-weight Value Line Arithmetic Index is now a glorious 2% above its long-term trend, much improved from being a few points below trend. Be still, my heart!

If World War III doesn’t kick off in the meantime, my personal bet is that we will witness stock market fireworks in the late winter or early spring when a new Congress and new U.S. President will have no choice but to pretend to deal with the exploding Federal Deficit. (Scary picture at the end of this post. Well, I find it scary at least. The deficit truly is falling off a dangerous cliff.) They will try heartily to do absolutely nothing, but eventually will have to enact a tweak or two. In the process, the stock market will envision huge “what-if” gyrations if my guess is right.