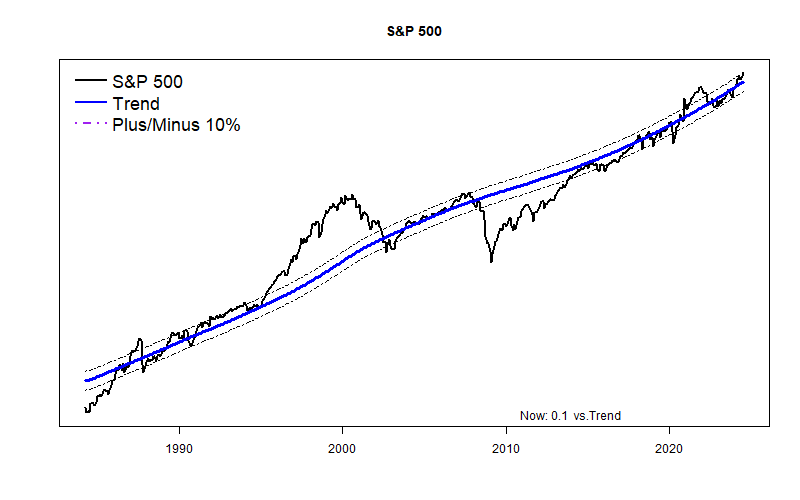

Since November, the stock market has been performing somewhat better than these models have been forecasting. So, I wouldn’t be surprised if that positive over-achievement continues for a few more months, leading to fairly mild market gains overall. But, even my pessimistic models do not foresee anything really bad happening. The bad news should happen in 2025.

As I have written for months, the overall economy is performing well — actually it is performing slightly too well and that is the problem. The Federal Reserve feels forced to fight inflation by intentionally holding back the economy via high interest rates.

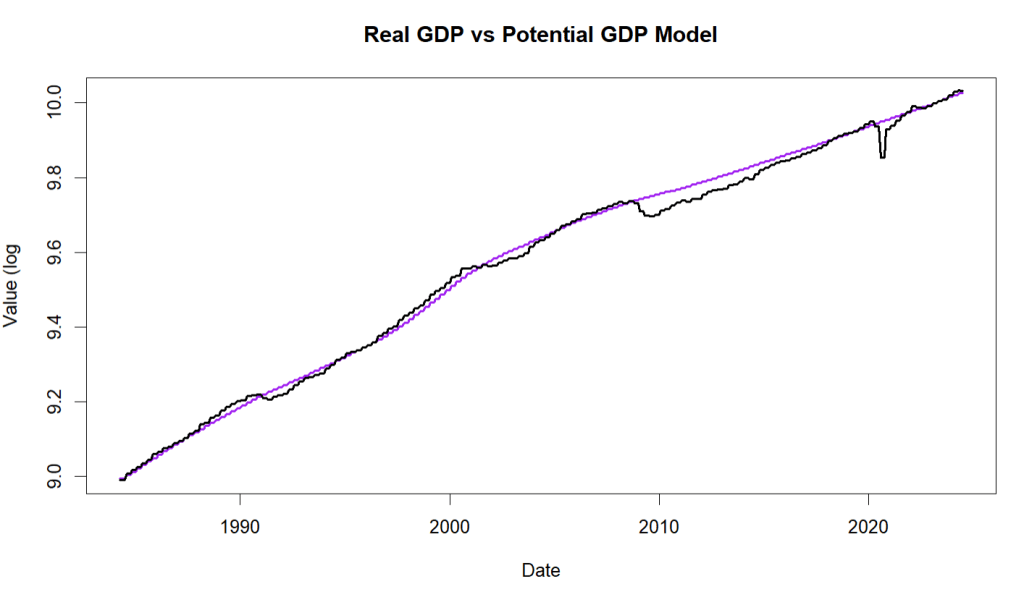

Actual Gross Domestic Product is running a bit higher than the long-term Real Potential GDP model run by the Congressional Budget Office. (See chart.) That is my personal definition of the famous “Wall of Worry”. Right now it much easier for the economy to quickly get worse than for the economy to sharply get much better. Looking at the graph, for years the actual GDP may run near or even slightly ahead of the GDP model. But, actual GDP seldom spurts high above the model, and typically the Wall of Worry period ends in some level of collapse.

The economy remains spurred by high Federal deficit spending, and simultaneously constrained by high interest rates — pressing simultaneously on the gas pedal and the brake. This may suddenly change next spring, but it will not change in the next few months.

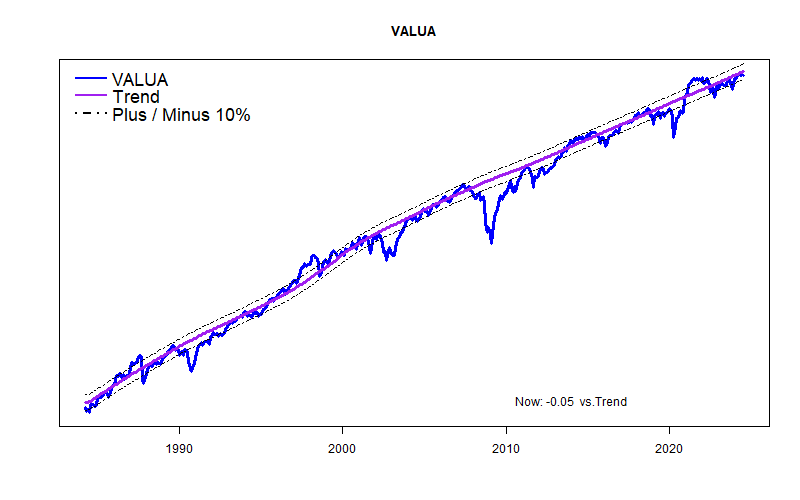

The split continues to increase between a small number of high flying AI and tech stocks like Nvidia, versus the broader market reflected by the equal-weighted Value Line Arithmetic Average. At the moment the S&P 500 is 10% above my trend line and the Value Line Average is 5% below trend. All my models expect more of the same to come.

These models still have not learned how to read the news, so they are blessedly blind to the political world. Typically in the past, major movements in spending or interest rates lead to major lasting stock market movements. Political news, however, tends to produce sudden and sharp temporary stock price moves. Let’s hope that remains the case. (But, that is ‘hope’ speaking, not statistical experience.)