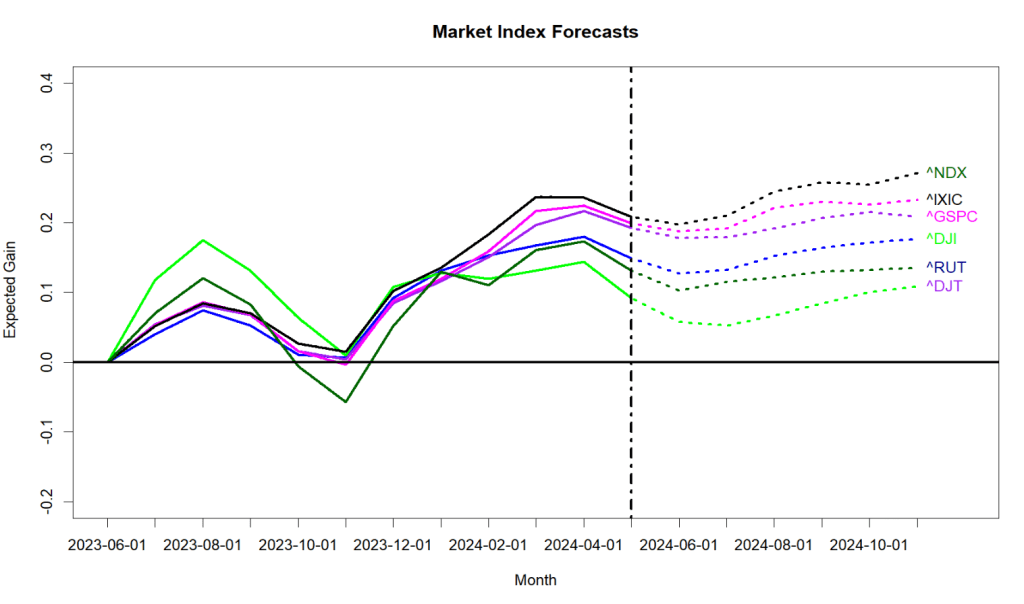

Last month these forecasts expected “the primary market indexes to pause and then retrace a bit”. Well, they did, but I grant that they went down more than a tiny bit. Anyway, the current forecasts expect the downward trend to continue for the next month or two. Nothing really major, but highly likely the market will drop some more. (Why? The equations say to blame the 1/2% increase in the 10-year Treasury rate.)

Last month the forecast for the S&P 500 was less than 1/2 of one percent positive. (Sub-Meh) But, it was POSITIVE, and for the last several months the market has been behaving above expectations. Now the tide has shifted and all the major indexes have projected 1-month losses of -1% to -3%. Does not look horribly bad, but the immediate expectation is now negative, and for the broader market the 6 month forecast is negative. The old adage “Sell in May…” looks like a winner this year.

I have a new graph to unveil. Of the 600+ large-cap stocks I follow, I keep score of the number that have strong positive 1-month forecasts versus the number with strong negative 1-month forecasts. This next graph shows the “bouncing-ball” output. The blue line is the net positive/negative score and the red line plots what actually happened to the S&P 500 for these months. (Ignore the last red month, it hasn’t happened yet.) Anyway, the net forecast is for a negative period that plays out something like last October-November.

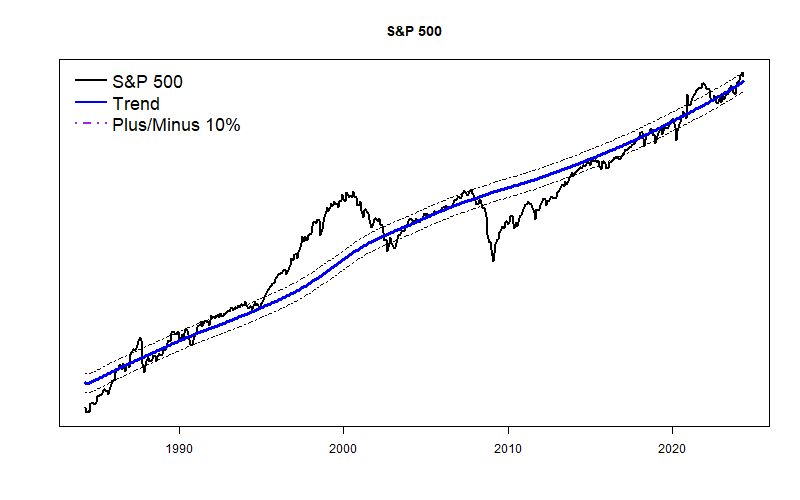

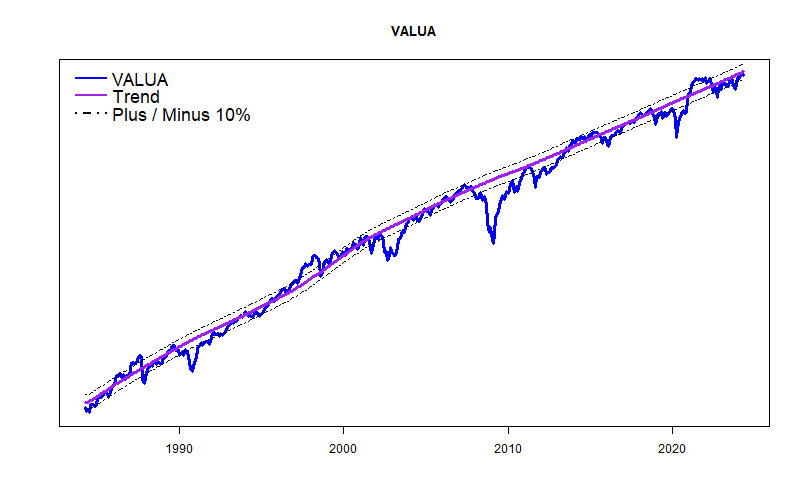

Otherwise, nothing is seriously wrong with the stock market. The S&P 500 is bouncing along its normal boundary, busily deciding if it wants to begin a new and wonderful “AI Bubble”. (My hunch is that it will.) The more staid VALUE LINE Arithmetic Average is right at its long term trend line.