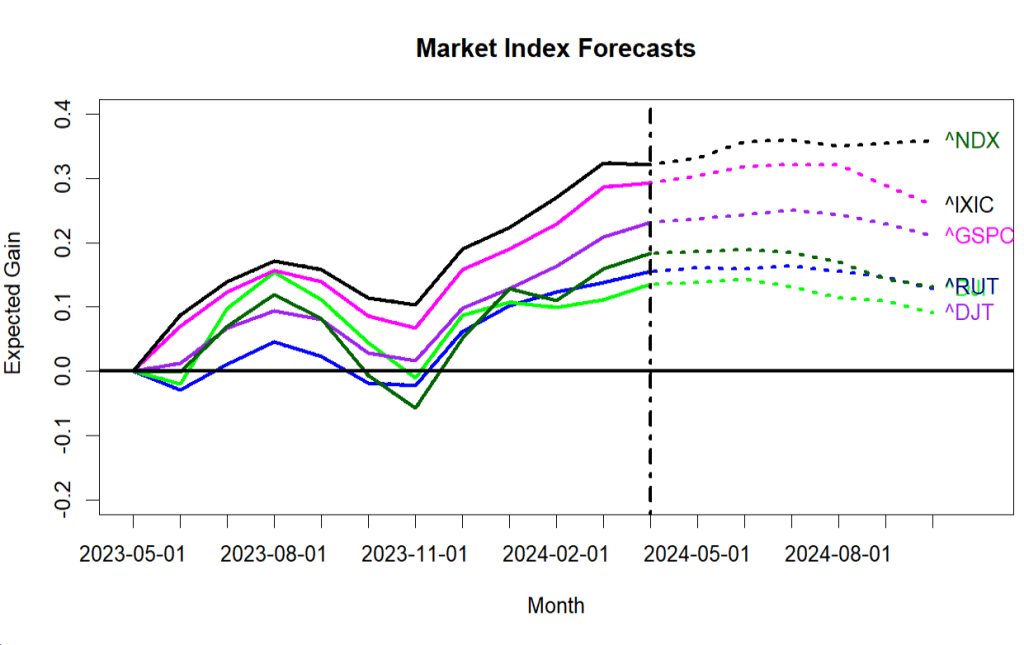

The U.S. stock market has performed spectacularly well since October, so not surprisingly, my short term market forecasts expect the primary market indexes to pause and then retrace a bit. The NASDAQ 100 is projected to have a gain of about 1% this month, while the other indexes are expected to gain a mere 1/2 percent or less.

Changes in the economy are the prime drivers of these models, and not much change is expected soon. Unemployment is low and job creation is high. Corporate profits remain strong. Inflation is relatively tame and not rising. Interest rates are elevated, but compared to everything over the past half century, they are not all that bad. Gross Domestic Product numbers are right at the level of the “full employment” Real Potential GDP model of the Congressional Budget office — that is wonderful, but it does not leave much room for near-term improvement. While the threat of recession had been quite high just a few months ago, none of the data sources I tap now see much chance of recession in the next few months. And, quite thankfully the Republicans in Congress seem less eager to crash the Federal Government budget. At least for now.

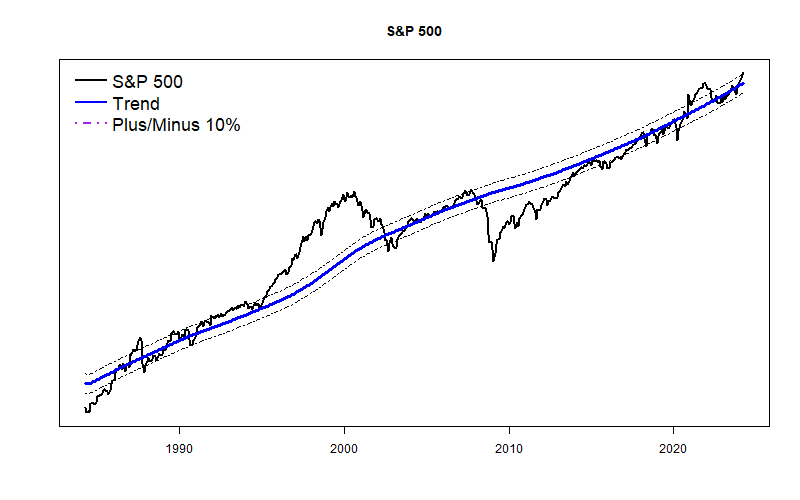

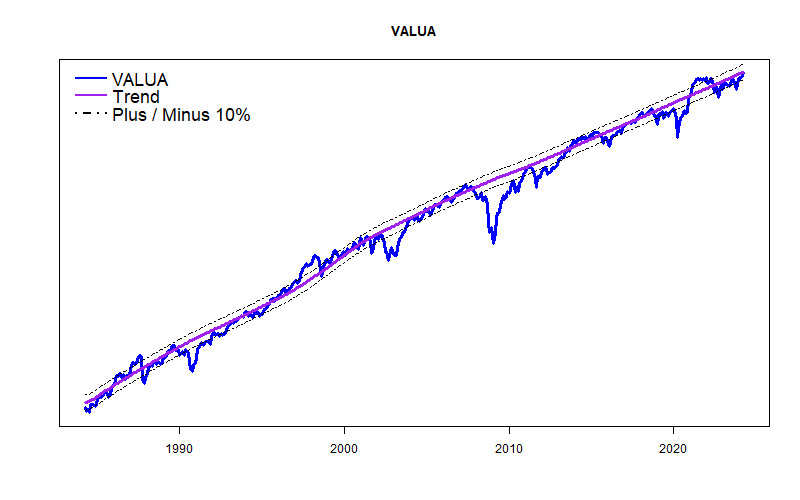

The charts above show the S&P 500 currently a bit high compared to its long-term trend line, and the equal-weight Value Line Arithmetic Average is almost exactly at trend.