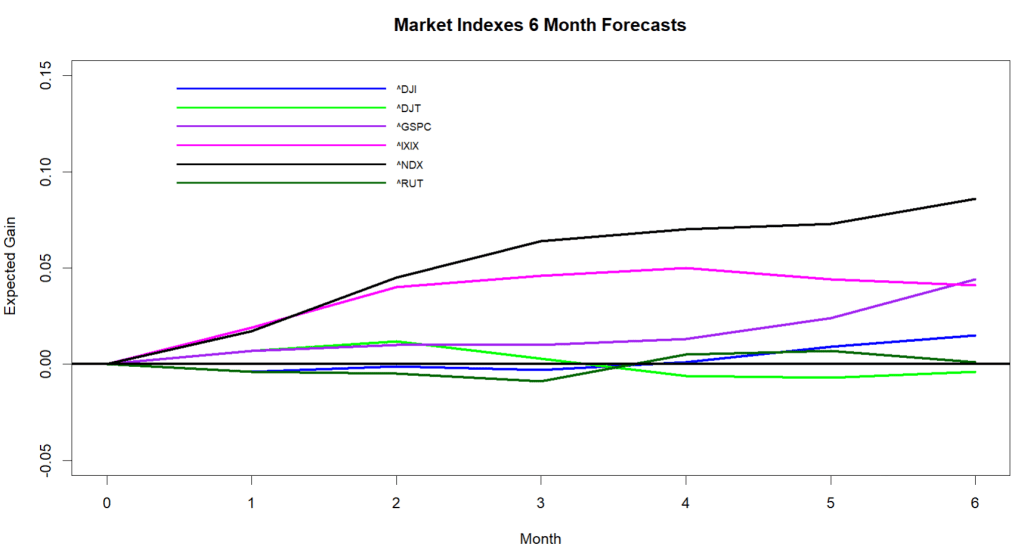

The overall forecast for the U.S. stock market for the first half of 2024 is positive, especially for high-flying tech stocks. The overall forecast shows technology stocks continuing to outpace the broader market. But, there are some caveats. Smaller corporations in the Russell 2000 look weak for the next 3 months and the Dow Jones Industrials also appear to be mildly weak.

January, however, will probably lead to temporary setbacks for tech stocks. Even though the 1-month forecasts for the NASDAQ and the NASDAQ 100 are both positive, the 1-month forecasts for leveraged inverse ETFs for these indexes are very strong. The models for these inverse ETFs indicate that the runups over November and December were just too strong, and a short-term pull-back is likely.

A real-world factor could also hurt January gains: temporary funding for the U.S. government will run out in two stages in January and early February. A path to compromise is not clear. Concern will likely grow during the month and a market disruption could easily occur.

Looking beyond January, the stock market and economy appear hardy: inflation is down, employment is high, corporate profits are strong, and the market is near its long-term trend line. Politics is the wild card, and a big chunk of one party seems intent on throwing a wrench in the works. I doubt the market will appreciate a government shutdown, and I doubt that the prospect of electing an insurrectionist dictator will calm the investment world.