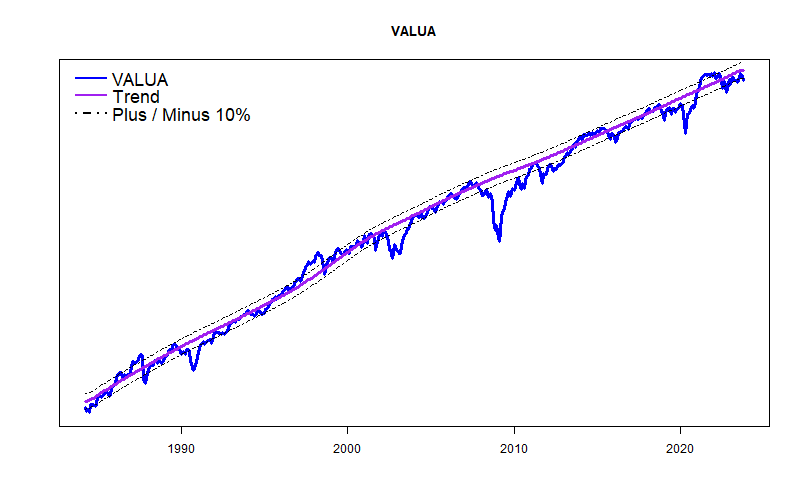

Value Line Arithmetic Average VALUA +4% (Normal)

Dow Jones Industrial Average ^DJI +0.04

S&P 500 Index ^GSPC +0.05

NASDAQ Composite ^IXIC +0.04

NASDAQ 100 NDX +4%

Russell 2000 ^RUT 0.01

Next 3 Months: VALUA looks fine, other indexes weak for the next couple of months

VALUA Probability of at least breaking even in 6 months: 95% (86% to 98% — better than average)

ETFs Alpha Test posted HERE

September was a weak month for the stock market; about what these forecasts had forecasted. The predictive models are divided at the moment, but overall they expect some continued weakness during October. The market then should become generally positive, a bit better than average.

The stock market usually stages its big moves when it has strayed far from its long-term trend. Frothy prices bring a downdraft and a panic crash quickly turns into a recovery. As shown in the graph below, both the ValueLine Arithmetic Average and the S&P 500 are very near their long-term trend lines. Unless something drastic happens in the world, a major stock market move is unlikely. Looks to me like the Federal Reserve has indeed achieved a soft landing.