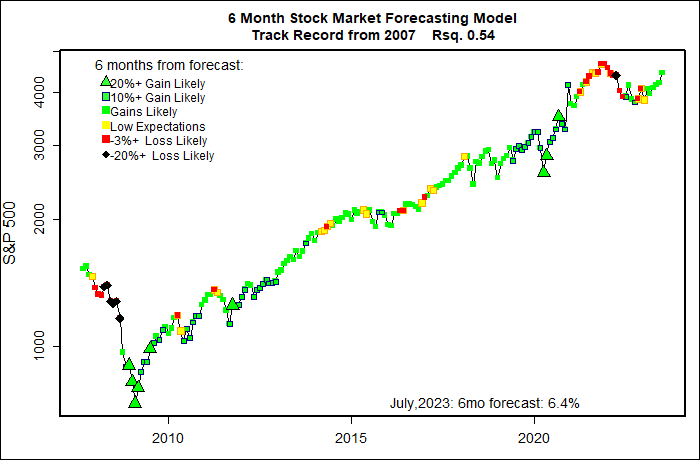

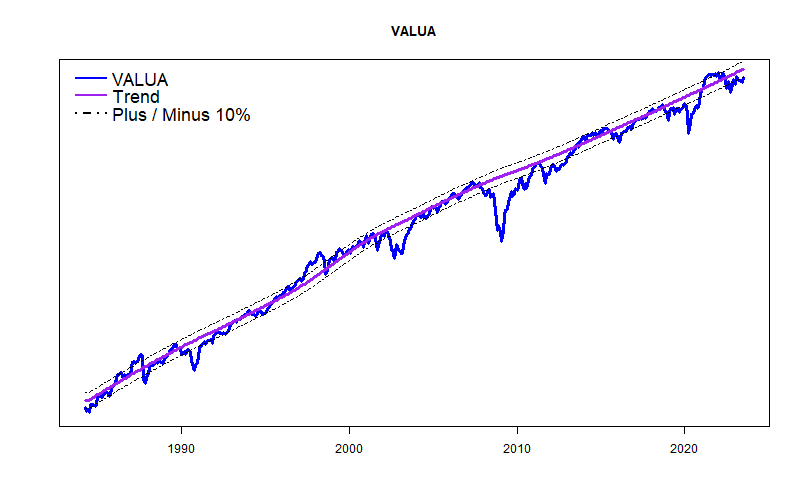

Value Line Arithmetic Average VALUA +6.4% (Above average)

Dow Jones Industrial Average ^DJI +6% (-0.08 to +0.11)

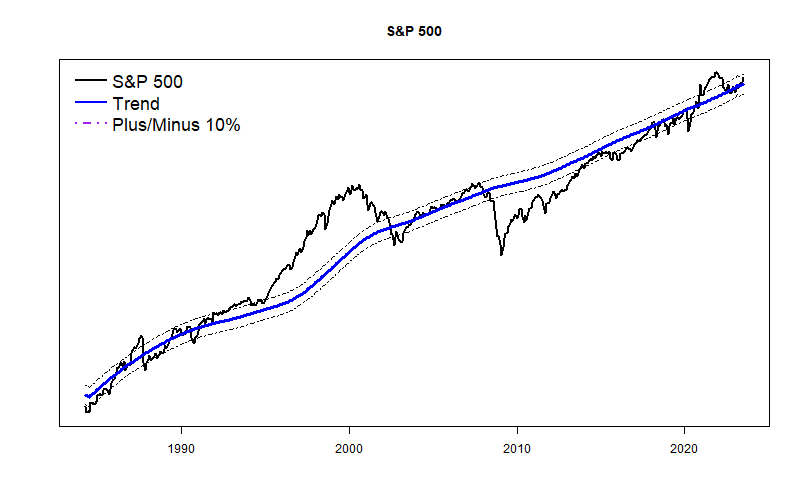

S&P 500 Index ^GSPC +6% (+0.01 to +0.13)

NASDAQ Composite ^IXIC +8% (-0.02 to +0.37)

NASDAQ 100 NDX +7% (-0.03 to 0.23)

Russell 2000 ^RUT +4% (-0.01 to +0.09)

Next 3 Months: First part of summer still looks mildly negative, but then so did June.

Probability of at least breaking even: 80% (72% to 97% )

The stock market clearly enjoys the mild economic tightening of the Federal Reserve Bank combined with continuing economic stimulation from Federal Government deficit spending. For several months the market has exceeded the forecasts from my models and it seems likely that will continue.

June market performance was excellent, but that causes my one-month market forecast to expect a balancing drop of a percent or two — not a big deal. If the market decides to turn negative, the worst 3-month loss my forecasts expect would be just about 6%.

Posting ETF forecasts will need to wait another month or so to allow for more testing and validation.