June thru November 2023 stock market forecast:

Value Line Arithmetic Average VALUA +4% (near average)

Dow Jones Industrial Average ^DJI +1% (A bit weak)

S&P 500 Index ^GSPC +3%

NASDAQ 100 NDX +8% (Stronger than average)

Russell 2000 ^RUT -3% (Distinctly weak)

Next 3 Months: First part of summer still looks blah.

Probability of at least breaking even: 89% (Good, somewhat above average. )

New Forecasts My forecasting models now cover over 600 stocks, ETFs, and market indexes. As an Alpha test, I will begin posting forecasts for additional major U.S. stock market indexes.

I have been posting 6-month stock market forecasts for the Value Line Arithmetic Average for about 15 years giving me considerable confidence. These additional index forecasts, however, deserve skepticism. They stem from the same 40-year historical economic database, so I expect them to prove useful. There is much overlap among the stocks in these indexes, so it would not be a good sign if they differ too much. Time will tell. No surprise, the tech stocks of the NASDAQ 100 (NDX) are projected to keep climbing faster than the other indexes.

Deficit/Budget Deal Extends Ststus Quo Congressional Republicans and the Biden administrration have compromised over the federal deficit and spending. Both sides claim hard fought victory while actually changing next to nothing. The Federal Reserve will continue to modestly clamp down on the real economy while federal spending will remain highly stimulative. To me it is as it the Fed is steadily applying the brakes while the Treasury is still pumping the gas. It is not the best of all worlds, but it should continue to hold back inflation while (hopefully) not crashing either the economy or the stock market. Couldda been worse I guess.

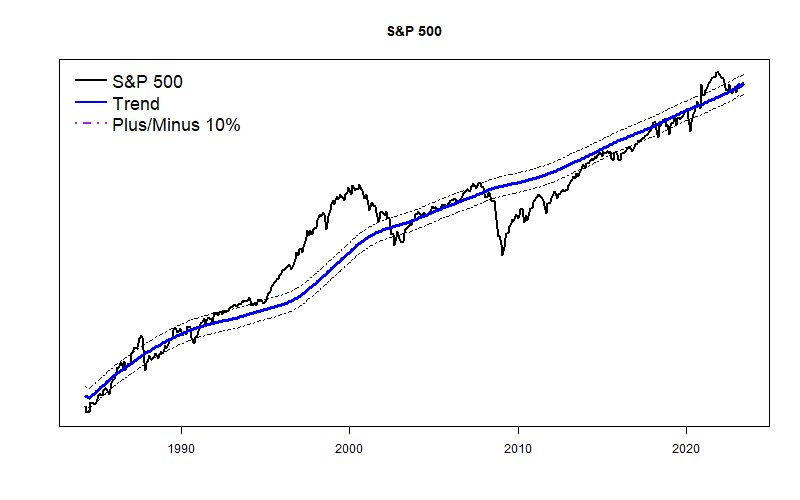

Is the Broad Market Fading? The S&P 500 Index has stayed right at its long-term trend for months, but the Value Line Arithmetic Average has been wallowing about 10% below what I calculate to be the long-term trend. Coupled with the weak forecast for the the Dow and Russell 2000 Index, this is starting to be something to worry about. Tech stocks continue to soar, but the real economy has been feeling the impact of the Fed’s higher interest rates: corporate profits have fallen a bit; producer prices are down; building permits are lower; and the Philadelphia Federal Reserve Survey of Professional Economists remains unusually concerned about recession.