The statistical stock market forecasting models say:

May thru October 2023: +7.8% (above average)

Next 3 Months: Positive but weak. Both positive and negative alternative forecasts.

Probability of at least breaking even: 92% (Range from 80% to 95% . Strong. )

The U.S. stock market forecast continues to brighten, and prospects are now distinctly above average. There probably will be gains over the next couple of months, but they are expected to be mild. In the later part of the summer, the models show some real strength. My concern is mainly focused on Republicans in the House of Representatives. They say they want a fight over the federal deficit, which will probably happen sometime over the summer. If the fight threatens government operation or the credibility of U.S. Treasury debt a sharp and probably temporary stock plummet would occur — I can’t predict that possibility. If they significantly reduce Government spending without a proportionate tax increase, the stock market will decline next fall or earlier. Federal spending is still stimulative (i.e. unusually high). If that economic joy-juice is taken away the stock market will certainly soften.

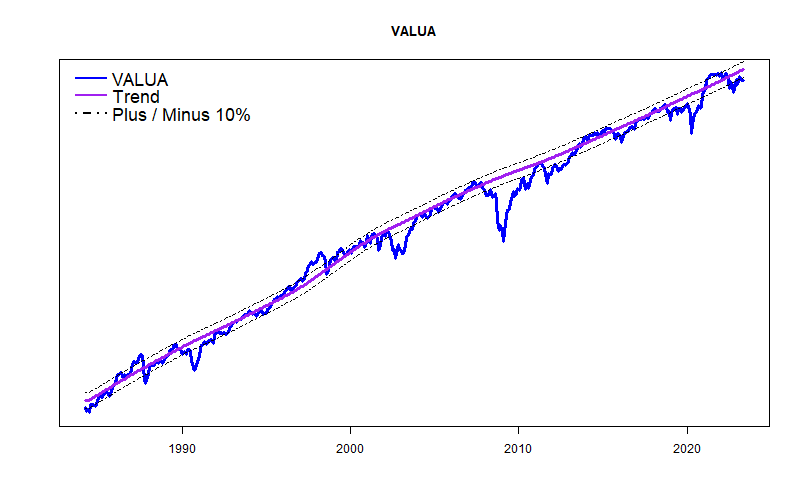

It is important to appreciate where we are starting from. Both long-term market trend graphs (below) show that the market is at or below trend. No bubble needs bursting (as opposed to cryptocurrency scams). Continued higher interest rates and less government spending potentially will dampen the market indefinitely.