(No new forecast just words.)

The “Everything Bubble” is starting to pop. Worldwide. It will take tiime, not be painless, and probably will include a stock panic of some sort.

First, there was The Great Recession Around the world, countries fought the economic collapse of the 2007-2010 “Great Recession” with massive economic stimulation, mainly in the form of historically low interest rates –near zero — and massive quantitative easing. There were also umprecedented government spending increases and tax cuts, but central bank actions were the prime movers.

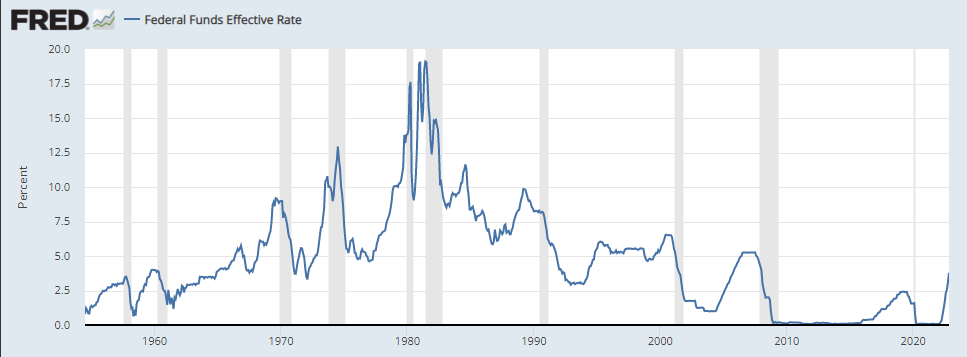

Low interest rates are a stimulus technique for the ages. But, the near zero short term loan rates adopted during the Great Recession had never occurred before. Bank “Reserve Requirements” set by the Federal Reserve to promote responsible lending were eliminated as well.

Quantitative easing was a new addition to traditional government stimulus programs. Collapse of ‘subprime’ home finance loans in the housing speculation collapse of 2007 made trillions of dollars of supposedly safe bonds — mainly on the U.S. — either worthless or questionable. In the U.S. the Federal Reserve simply bought up all the bad debt. There was no other realistic option. As a result, Federal reserve holdings suddenly rose from around $900 billion dollars (not chump change) to $2.5 trillion in 2010, and to keep the ball rolling, Fed kept buying junk bonds until assets leveled off at $4.5 trillion in 2016.

Total U.S. Gross Domestic Product is now $23 trillion. So, all of a sudden, the Fed was holding highly questionable long term debt worth about a quarter of the U.S. economy annual output.

Ben Bernanke, chairman of the Federal Reserve at that time and a student of The Great Depression, fully supported the concept of dropping helicopter money — doing whatever was necessary — during extreme economic emergencies. To deal with the Great Recession both the Federal Reserve and the U.S. Congress, Republicans and all, shut their mouths, held their noses, bit their toungs, and, in short order, did what ever they had to do to get past an economic calamity that easily could have been worse than the Great Depression. They did what they did because there was no other option. Things were that bad.

By 2017 the Federal Reserve decided that it could start to reduce the stimulation of near-zero lending rates and to slowly, very slowly, start selling off the $4.5 trillion in long term bonds it had been forced to purchase. They probably waited too long — the Everything Bubble had started to inflate.

Then came the Covid Pandemic Within a couple of months beginning in December, 2019 the novel corona virus opened a worldwide pandemic. Much was unknown, but it became apparent that covid, with a mortality rate of about 2%, was a different beast than the annual influenza with its mortality rate of about 0.05%. Flu is th #9 killer in America. but it was, and remains, a joke compared to the early versions of the corona virus. Even today, covid has a mortality rate of nearly 1%. Total U.S. losses to covid are well above the total number of American soldiers lost to all U,S, wars from the Revolution to today.

In the first and second quarter of 2020, the U.S., and the rest of the world, suffered an econonomic collapse more sudden and severe than any ever before. Grocery stores were near empty of many staples from toilet paper to laundry bleach. Whole economic sectors like retail, tourism, airlines, instantly were not just suffering, but totally bankrupt. Airlines. for example, are highly leveraged businesses; compared to profits, their overhead expenditures are huge. With no prospects of flying again for months the airlines were immediately bankrupt. First, the airlines would collapse, then the firms that lent money to the airlines, then the owners and firms that lent money to them. Then…. It was a classic domino chain event.

Much like 2007. central banks and governments around the world pulled out all the stops, dropping interest rates — in a few cases even below zero — and dropped trillions of dollars in helecopter money unlike anything ever seen before. The Republican Trump administration was suddenly sending out checks for thousands of dollars to just about everyone. No strings attached. Trillions of dollars in spending programs. Helicopter money pure and simple. As shutdowns and cutbacks from covid continued, the new Democratic Biden administration kept the money flowing.

And thankfully, all that money falling from the sky did its job. Vaccines were developed. The new strains of the original virus were both weaker and more contageous. People changed how they interacted. People could get back to work. We survived.

We survived, but as in fighting all wars, there was a heavy debt that must be paid.

The Federal Reserve now owns roughly $9.5 trillion, half a year of U.S. GDP.

The “Everything Bubble” collapses. With interest rates incredibly low — unlike ever before in history — buying demand went up. But for things in limited supply (oil, housing, gold, labor, whatever) prices rose according. So, very suddenly, nearly everything was in bubble mode. Just like the Dot.Com Bubble, mere imaginary figments like crypto currencies and non-fungible tokens suddenly became prized assets. Real assets like stocks and housing spiraled in price as well. For a while an awful lot of people around the world got to feel like very smart investors. That is never a good sign.

Inflation is starting to fall because of tighter money supply, higher short and long-term interest rates, and easing of pandemic and Ukraine spurred shortages. As required by its charter, the Federal Reserve is using the few, but powerful tools it has to tamp down inflation, hopefully without destroying employment. Inflation had shot up to roughly 9% annually (now down to 7.1%). The Fed target is an ongoing inflation rate of roughly 2%, but the Fed would throw a staff party if it even got near 3%. The process has far to go. It took roughly two years for inflation to jump so it may well take two more years for it to decline and stabilize.

(Sticky Price Consumer Price Index. Click graph to expand)

Short-term interest rates sharply up nearly 4%. This is already as much of an interest rate increase as the Fed typically has used in the past to damp down the economy, but it has never raised rates so fast. Another point up or so seems likely but in smaller increments.

Effective Federal Funds Rate, Click on image to expand.

Higher Long Term Interest Rates Mortgage rates have generally been falling since the highs of 1980, and then sank to unprecedented levels during the pandemic. Only recently have long term rates started to shoot up again.

30 Year Fixed Mortgage Rates. Click to enlarge.

Expect a slow motion train wreck. Though cooling, inflation remains near 7%. The Federal Reserve will not turn around until inflation nears the target or the economy goes in to a crisis. Knowing that interest rate changes have a time lag of about a year, the Federal Reserve will typically raise rates and then pause further action until the economy’s reaction becomes clear. But, the fed still expects a couple more interest rate increases before pausing this time..

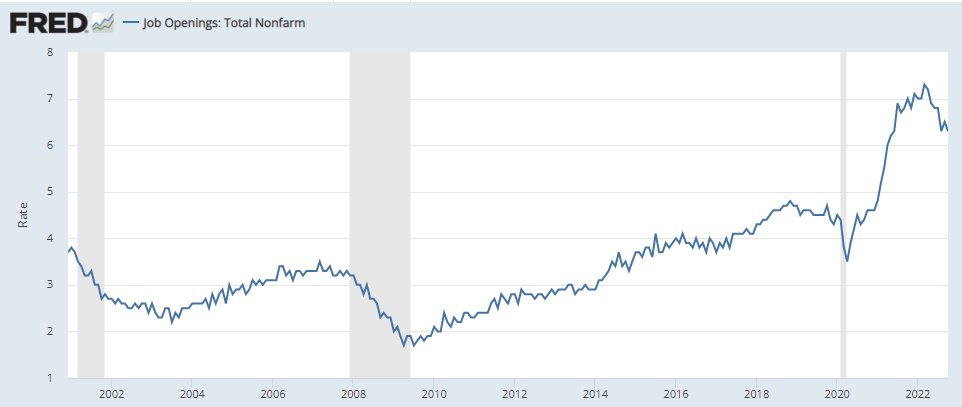

In its most positive view, the Federal Reserve expects Real GDP growth of just 0.5% in 2023 — very near a recession. My back-of-the-envelope calculation is that, though the Case-Shiller U.S. National House Price Index has fallen a few percent, house prices still needs to drop 10% to 15% more. Job Openings have fallen a bit, but remain incredibly strong — for now. Unemployment, still rock bottom at 3.7%, will probably double.

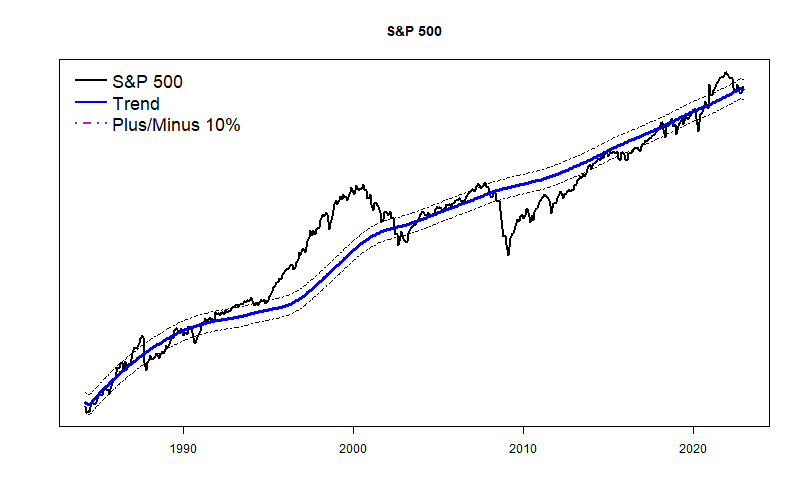

Finally, corporate profits are still well above a solidly established long term trend. Profits margins will shrink and profits down. Price/earnings levels that seemed realistic through the pandemic years will start to look frothy.

In the words of Warren Buffet: “Only when the tide goes out do you discover who’s been swimming naked.”

One bit of good news is that it does not appear that the stock market requires a major contraction. My long-term trend line for the S&P 500 says that the market had been in a small bubble over the past couple of years, but the tough times of 2022 brought the market back to near the long term trend. In the Dot-Com era, prices were ridiculously above the long term trend and sadly years of major downturn and over-correction were required. This time, the market situation is much more like 1987 or 2007 — in those situations the stock market was near trend and other sectors — principally real estate — required major correction.

Though the U.S. economy is strong and the Federal Reserve is doing exactly what it is supposed to do, the next year will be difficult and filled with worry. Periods like this are ripe for stock market panic. Every time the Federal Reserve has campaigned against inflation a stock market crash has occurred.

My next post will look at likely triggers for stock market panic and discuss whether my models are likely to forecast correctly any market crack up. I have my doubts.