The statistical forecasting model says:

Next 6 Months: +10% (Flavors of the model vary from 0 to +20%)

Probability of at least breaking even: 78% (Flavors vary from 40% to 99%)

It is very hard to forecast a volatile thing like the stock market even in a good year. We haven’t gone through a ‘good’ year; it was a horrible year on so many levels and in so many ways. When the primary adjective you hear in most news stories about just about any subject is the word “unprecedented” making a forecast about anything is hard.. Everything about 2020 seems to have been “unprecedented”. I am sick of that damn word. How about, “unpresidented”?

It is now a full year since the pandemic hit the U.S. like a giant sledge hammer. The world economy was knocked unconscious and was put on intensive financial life support through massive government financial intervention. Simultaneously, several of the respected data series that support my models were either discontinued, disappeared from publication, or became otherwise suspect.

The net effect of all of the pandemic-caused economic disruption was that several components of my economic forecasting models were essentially blown apart.

However, the major (the most powerful and statistically reliable) components of my forecasting models came though the storm surprisingly well, and I have finally finished with a series of repairs and work-arounds. It remains to be seen how well my modified forecasting models behave, but I am fairly confident that they will report “what usually happens” as financial and economic changes occur.

Bubble in progress

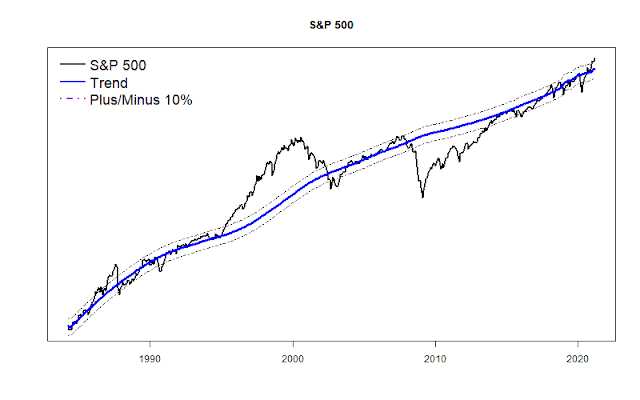

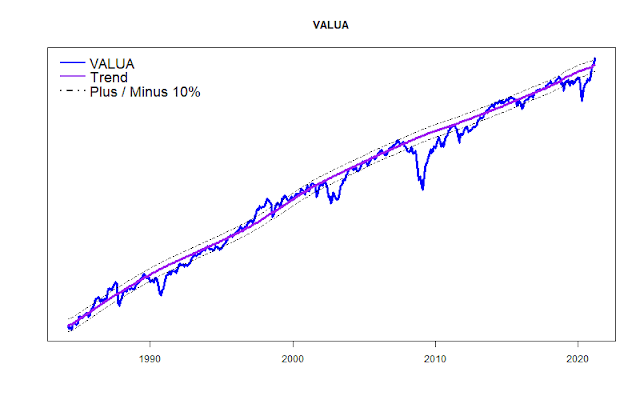

The long term trend graphs for both the Standard & Poor’s 500 and the Value Line Arithmetic Index are both about 10% above normal. If you scan the graphs below it is clear that markets seldom stay this far above trend for long. The glaring exception, of course, was the DotCom Bubble of 1998-2001. I think that sort of market bubble is happening again.

Some flavors of my models are already fretting about the frothy market and are turning more and more negative. However, given the $1.9 trillion recovery package that has been signed into law (about 10% of GDP) and also given the dovish stance of the Federal Reserve, I highly doubt that the stock market will crack any time soon. To me it appears that we are in the early stages of a major stock market bubble.