TED will tell you day by day if the world economic system is in severe crisis. TED is really worried today.

A week ago, TED said the world economy was scared, but not yet in full panic mode. TED, the world bankers’ fear gauge, was at 0.15% in mid-February and 0.57% last week. Then everything hit the fan. It now appears to be about 0.90%, a major warning signal.

The TED rate, or TED spread, is the difference between the interest rate of a 30-day U.S. Treasury Bill and the 3-month LIBOR, the rate charged to borrow U.S. dollars overseas among major banks. Here is a link for the current 1-month LIBOR. (The data on the FRED charts that I link below are one week out of date. Right now, that one-week time lag matters.)

In normal economic times the 3-month U.S. Treasury is just about the world’s safest and most liquid asset, and therefore the lowest interest rate in the financial world. LIBOR (London Interbank Offered Rate) is generally the next best thing, a slight premium usually about 1/4 percent above the 3-month Treasury Bill. The TED rate is simply the difference between these two major short term interest rates. When TED is high, it means that major world bankers don’t trust each other, even for short term loans.

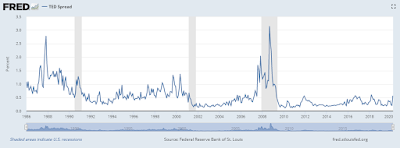

The world’s major bankers, like stock market speculators, are a nervous lot. Things fluctuate daily A 5-year view of the TED spread (below) shows lots of volatility, even in good times. Most recently TED shows a sharp spike. Undeniably, bankers are getting scared about worldwide recession and possibly financial market breakdowns. The TED premium, even a week ago, was three times as high as it was in mid-February. Now it is 6 times the February level. (link)

But, it’s all relative. In a 30-year view, the current TED spread is worrisome but not catastrophic. (link Gray areas show recessions.) The message is clear: the world’s central bankers have good reason to be pulling out all the stops to try to keep the world financial system from collapsing. There is a lot of doubt that all major players in the game are going to survive intact.

Lest anyone actually feel cheerful, looking at the long term plot of LIBOR shows that the world interest rates have been falling for about a year, behaving like a major recession was on its way. (link) And that was long before the novel coronavirus hit the world. Ulp.