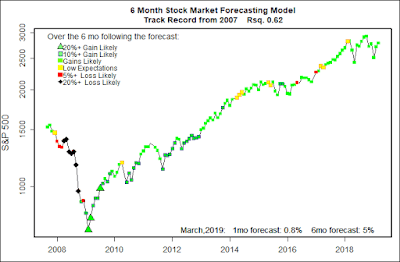

The statistical forecasting model says:

March, 2019: +0.8% (A bit above average)

Next 6 Months: +5% (Slightly above average)

Probability of at least breaking even: Not clear.

What am I doing? Fully invested.

I wouldn’t pay much attention to this month’s forecast. My prediction models do pretty well at forecasting major stock market moves. But, when the market is not enduring some sort of major earthquake the ‘noise’ of near-random market activity is greater than any sort of ‘signal’ that overall economics are sending to investors. That’s where things are now.

My stock market forecasting models remain generally favorable — not enthusiastic, but they continue to give the market the benefit of the doubt.

The models that forecast the probability of at least breaking even over the coming half-year and not in agreement. They range from highly positive to even odds. At least they are not highly negative.

Interest rate questions are definitely affecting my models and they appear to be driving investors into a nervous breakdown. The spread (difference) between short and long term rates is very tight, and it will probably stay tight for quite some time. The stock market can probably hold on as long as the governors of the Federal Reserve maintain their “patient” attitude toward rate increases.

March thru August, 2019 — Expect continuing volatility

Leave a reply

(Click on image to enlarge)