Since roughly 1980 , in fits and starts, long term interest rates fell. That period is over. Rising — not falling — long term interest rates will be major economic and investing news for decades. Cross your fingers that the transition is very, very slow and smooth. But, of course, it won’t be.

In performing a ‘tweak’ of my forecasting models it has become clear that I need to adjust the way that rising long term interest rates are factored in. This is not just the common ups and downs of rates that accompany the business cycle. The concern here is a relentless long term (secular) escalation in interest rates. This post tries to offer an overview.

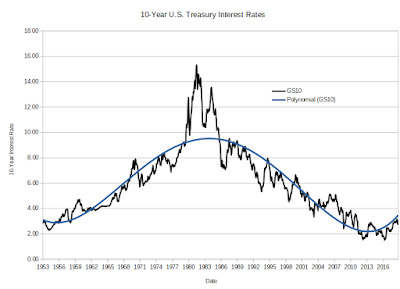

The chart below shows interest rates for 10-year U.S. Treasury issues since 1953. The blue curve shows a smoothed interpretation of the data. With many ups and downs along the way, Treasury yields rose to astronomical heights near 1980 and since then rates have fallen. Rates did not fall fast or steadily, but they did fall.

Rising and then declining inflation has been a big part of the story. For any loan to be profitable the interest rate charged needs to include a “real” rate of return that is somewhat above the prevailing inflation rate. In 1980 inflation rose as high as 14% while today it is closer to 1.5%. So, much of the decline in interest rates is the result of declining inflation.

But, declining inflation is not the entire story. Real (inflation adjusted) interest rates fell as well.

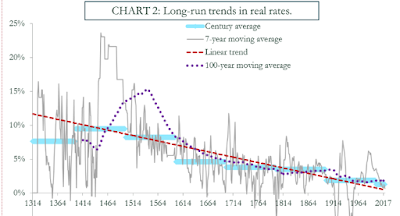

The next graph puts the current interest rate situation in perspective — a 700 year perspective!

In November, 2017 Paul Schmelzing wrote about real interest rate variations since 1311 in a blog sponsored by the Bank of England. His chart (below) shows the 700 year story of inflation-adjusted interest rates.

As he points out, cycles in interest rates are the norm, not the exception. And the overall trend for hundreds of years has been slowly declining real interest rates. An economic calamity (like the Black Plague!) could send real interest rates either sky high, or negative, for a relatively brief period of time. But, over the span of history the overall rate trend has been down. Near zero rates as we have seen over the past decade, however, are about as low as they can go.

Reason and history suggest that the still-low rates that we have are highly unusual. Real interest rates can stay fairly low, but they are not likely to stay this low forever. From here, rates can stay roughly level, or they can go up. The four decade period of declining rates we have experienced has drawn to a close.

The Federal Reserve has made very clear that they want to fully back out of the ‘extraordinary’ measures needed to break out of the Great Recession. They want to see somewhat higher inflation, somewhat higher interest rates, and they want to reduce the $4.5 trillion in long term bonds they hold in their portfolio.

But, actually breaking out of the low interest rate regime is going to be exceptionally difficult.

First, any move to increase rates or reduce the Fed portfolio will depress the economy. That’s Econ 101. So, at best these moves will be unpopular. President Trump, for example, has said: “… I’m not blaming anybody, but I’m just telling you I think that the Fed is way off-base with what they’re doing.”

The crucial ‘spread’ between long term and short term interest rates is already vanishingly small. It would not take much of a rate increase to bring on a recession.

Second, about half of the Fed’s portfolio consists of long term property mortgages. Dumping those holdings will raise mortgage rates in particular. But, the real estate market and residential construction are already hurting.

Rising long term interest rates have raised the real cost of buying a home. Already, real estate agents blame a slack market on people not wanting to give up their great long term mortgages in order to trade homes. The Trump tax cuts also hurt the housing market. Both the cuts in itemized deductions for state and local taxes and the increase in the standard deduction mean that far fewer people will receive actual benefit from a home mortgage deduction. With less benefit from the mortgage tax deduction, the perceived desirability of owning a home goes down. Most recent U.S. recessions have been led by decline in the housing sector. And, a decline appears well underway. The most recent comments I have seen indicate that the Fed will be backing off in cutting their portfolio.

Third, interest rates are still so low that proportionate changes in rates are critical. When rates are high, say, 10% a single percentage point of rate change is relatively unimportant — just ten percent. But, when rates are near, say, 4%, a percent increase in rates amounts to a whopping 25% increase in borrowing costs. It is especially difficult to raise very low interest rates without causing major economic disruption.

And finally, the Federal Reserve does not want to drive the economy into recession. Even though unemployment is at historically low levels, natural inflation has not grown much. The Fed does not see a clear need to take froth out of the economy. They certainly don’t want to head back anywhere near the Great Recession.

I don’t know what the Federal Reserve is going to do next. But, I will guess a couple of things that might be on the wish list.

My guess is that the Federal Reserve would really like to see some major deficit spending. Tax cuts won’t be much help — most tax cut money goes to the wealthy who invest, not spend much of their additional money. The Federal Government really needs to start spending lots of freshly printed dollars to heat up the economy. A huge infrastructure program would do the trick, especially since it can be dialed up or down to keep inflation under control. A significant increase in inflation would give the Fed some cover to slowly raise interest rates.

I’d also bet that the Fed wants investors to stay a bit scared — not really scared so that the markets would crash, but scared enough so that a major price bubble does not develop. In fact, I bet you can expect periodic grumbles and growls form the Fed that effectively keep bubbles in check.

Expect continued fairly high volatility.