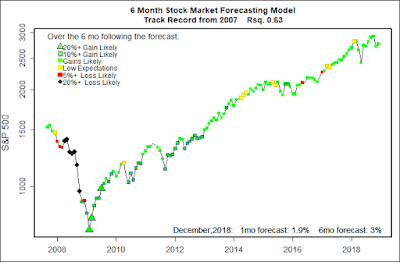

The forecasting model says:

December: +1.9% (Way above average)

Next 6 Months: 3% (Somewhat below average)

Probability of at least breaking even: Well above average

Appropriately for the end of the year, I have both good and bad news to share.

The bad news: The stock market is going to crash and we are all going to die. Sorry.

The good news: At least according to my statistical models, neither event is likely to occur in the near future. Finish digesting your turkey, I hope it was wonderful. Stay warm as winter comes on. Try to be nice to at least one person who is worse off than you. If you own any stocks at all there are billions of people in the world who are much worse off than you. Be glad that the stock market is unsettled — volatility in the stock market is a very healthy thing.

(Click on image to enlarge.)

We are in the later stages of an historically long bull market — the crash of the Great Recession was bad enough to guarantee that the current bull market would set records. Things were so bad, they could only get better! Importantly, the Great Recession was bad enough so that a world-wide consensus developed that central banks needed to apply long term stimulus in the form of historically low interest rates. It worked! For a couple of years now the U.S. Federal Reserve has been raising interest rates back toward more normal levels. The speed at which the Fed has been increasing rates has been unusually slow and steady, and the Fed has been unusually forthcoming in stating that slow and steady was exactly what they were aiming for. Other major central banks have been lagging — they are not so sure that everything is fine yet.

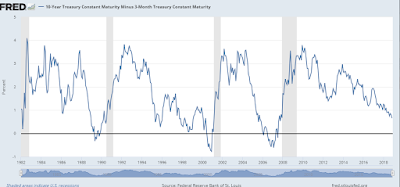

Big financial organizations make their money by borrowing short term money at very low interest rates (e.g. your savings account that returns almost no interest) and then lending that same money out at significantly higher rates (e.g. mortgages, commercial loans, and credit cards). As long as short term interest rates are lower than long term rates, the game goes on. But, when short term rates and long term rates collide, the whole economy shuts down.

The chart below shows the spread (the difference) between 10 year interest rates and 3 month interest rates in the U.S. When the spread goes to zero or even turns negative, a recession surely follows with a time lag of 6 months to a year. Same story for the stock market which reacts to bad news faster than the economy.

As shown, for years the Federal Reserve has been raising interest rates (and reducing the spread) at an unusually slow and steady pace. When the Fed finally decides to slow down the economy, it will engineer a much more rapid tightening.

But, that’s not yet. The model does not see a major market deterioration occurring in the next half year. Doesn’t mean the market won’t crash tomorrow, just means that it probably won’t crash in the near future.

Historically, the Fed brings the hammer down during the final year of a presidential term. (That’s just by coincidence, of course. :o) That would mean in about a year from now.

Enjoy the season and be nice to others!