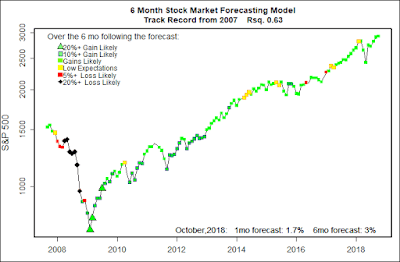

The forecasting model says:

October: +1.7% (Above average)

Next 6 Months: 3% (slightly below average)

Probability of at least breaking even: Above average

This month’s run of the econometric stock market forecasting model has about the same expectations as last month — slightly below average That stands to reason as the economy remains strong, but the market is highly priced by most historic valuation measures. There is no clear force immediately moving to push stock prices either up or down. Overall, corporate profits should continue to rise as the impacts of this year’s U.S. corporate tax cuts become more and more evident.

Results that I routinely post come from a mix of forecasting models and are based on the projections that have proven to be most accurate for the past decade or so of real-time testing. They point to a 3% stock market gain over the coming half year. That is a bit below the long term average for 6 month stock market returns. One month market expectations are decidedly strong at 1.7%. Likewise the probability that the next half year will at least break even is unusually strong.

That said, for two reasons I wouldn’t put too much store in this month’s one month prediction. First, the variants of my model that I run are unusually divergent this time. Both the 6-month and 1-month model flavors run from strongly positive to mildly negative. There is always some variation among my models, but not usually this much. Whatever the reason, the models’ variation is not enough to cause any real change in the forecast. The second reason to downplay this month’s predictions is the coming U.S. mid-term congressional elections. Politics are not factored into my models, but they certainly impact the stock market. Whatever the election outcome, it is almost certain that there will be more surprise twists and turns to come, and after the first week of November about half the U.S. population will be happy and half will be quite depressed. Depressed people tend to sell stocks. Your guess on the outcome is as good as mine, Let us pray.