What the forecasting model says:

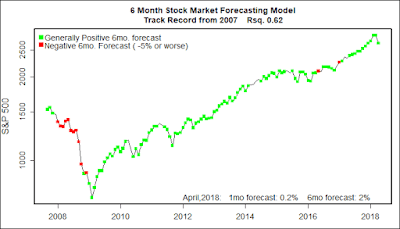

One Month Stock Market Forecast April, 2018: 0.2% gain ( below average)

6 Month Stock Market Forecast April thru September, 2018: 2% (below aerage)

Probability of at least breaking even: 0.37 to 0.91(OK, but down from last month)

What am I doing? Staying fully invested, relieved by the March correction.

March was a tough month for U.S. stocks. Both of my readers may hate me, but I think the retrenchment was a good thing. Over the past year stock market performance had gotten ahead of fundamentals and volatility had been unusually low. Too many investors had become over confident. It was time for the market to “revert to the mean” as the statisticians say.

My predictive models are pointing to a somewhat weak, but probably not declining market for the next month and through the next six months.

Why? IMHO

After a likely bounce back from the March correction, large stock price gains are not probable over the next half year. The economy has nearly fully recovered from the Great Recession and the easy economic gains have been won. It’s like the situation of someone recovering from injuries from a bad traffic accident. At first they can make great healing progress. But, when they are back to normal they simply can’t enhance their health at the same rate.

Second, while there is little room for easy gains, there is little likelihood that a significant economic setback will hit in the near future. Leading economic indicators and several models used by economists give very low odds of a recession in the next half year. The massive tax cuts and spending increases passed by Congress will boost the economy for the short term. (So what if nearly every economist on the planet thinks these measures to be counter productive and horribly timed. In the short term they certainly will provide a kind of “sugar high” for the economy and the market.) The tax cuts and spending increases total approximately twice as much in joy juice as the Obama emergency stimulus package that kicked in at the depth of the recession.

On the negative side many investors appear to be deeply worried about Trump starting a world-wide trade war. As far as I can see, there has been much more talk than action on tariffs. I have great faith that any U.S. economic interest groups that feel hurt by any changes will rise up in holy wrath and force the U.S. government to reverse course. Besides that, in the next 6 months any economic impacts of new tariffs are unlikely to show up in economic data.

Third, historically during the summer months and early fall the stock market has typically been weaker than during the colder half of the year. It is not a huge effect, and it is often wrong, but the maxim of “Sell in May and go away” has been shown to have some validity in a range of economic markets for at least the last 300 years.

Fourth, the battle over the mid-term election for Congress is just starting to heat up and will reach fever pitch by late September. There is not much doubt that twists and turns will lead to greater stock market volatility. By the end of the process approximately half of the U.S. population will be very worried and upset. That is not the setting for a major stock market advance. Maybe after the election ?????

So, I expect a bouncy market ride through the next half year with little net change at the end of the period. It is probably best to avoid discomfort by paying less attention to market gyrations over the next half year.